Parents Depend on Social Security Benefits for Their Children

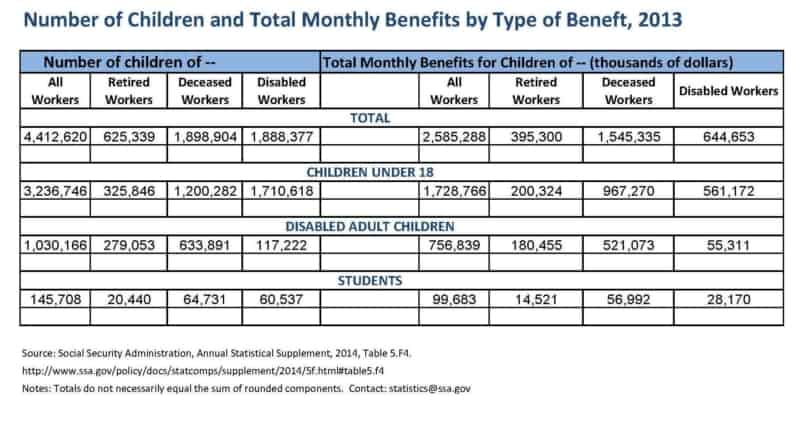

Social Security is among the nation’s largest programs serving children. About 4.4 million American children receive approximately $2.7 billion in Social Security benefits each month because at least one of their parents is disabled, retired or deceased. Although Social Security is well known as an essential source of retirement security for older Americans, there is less awareness of the critical income protection it has provided for survivors since 1939, and for the disabled since 1956. Social Security is a safety net for millions of working parents who may have no other resources to fall back on when tragedy strikes and they are no longer able to earn an income to support their family. From clothing and feeding their children to buying needed supplies, paying healthcare costs and saving for college, parents and grandparents understand that Social Security benefits are a stabilizing source of income for children ages birth to eighteen.

Many current members of Congress such as Representatives Richard Neal of Massachusetts and Paul Ryan of Wisconsin were themselves recipients of Social Security survivor benefits after losing a parent before age 18. Minnesota Senator Al Franken often tells the story of his wife, Franni, who was raised on Social Security benefits after her father died when she was just 17 months old. Children of deceased military service members depend on Social Security survivors benefits, as well as benefits from the Department of Veterans Affairs. On September 11, 2001, thousands of children lost one or both parents due to the terrorist attacks in New York, the District of Columbia and Pennsylvania. At the time the Social Security Administration (SSA) reported paying monthly benefits to 2,375 surviving children and 853 surviving spouses. In addition to monthly benefits, one-time payments were made to 1,800 members of victims’ families bringing them some financial reassurance.

Social Security is also an important source of income for communities of color. African American parents are more likely than others to become disabled or die before retirement. African American children represent 12 percent of all children in the United States under age 18, but 21 percent of all children receiving Social Security benefits. Likewise, more Hispanic and Latino children receive benefits because their parents are more likely than the population at large to receive disability benefits.

How Much Financial Support do Children Receive?

There are several factors used when SSA determines the monthly benefit amount to be paid to the children of deceased, disabled or retired workers. Eligible children of a deceased worker are entitled to benefits of up to 75 percent of that deceased parent’s benefit, and children of disabled or retired workers receive benefits of up to one-half of their parent’s benefit. In general, total monthly benefits are capped if three or more people in the family are entitled to Social Security benefits.

Today, there are 1.2 million children of deceased workers receiving an average monthly survivor benefit of $806; and 326,000 children of retired workers receiving an average monthly benefit of $615.

More than 3 million additional children benefit from Social Security, even though they do not receive it directly themselves, because they live with relatives who do. In total, almost 9 percent of all children in the United States depend on Social Security for all or part of their family income. As reflected in the 2010 census, almost 5 million children under age 18 live in households headed by a grandparent. Approximately 20 percent of these children have neither parent present in the household and the grandparents are responsible for their basic needs.

How Long Do Children Receive Benefits?

Dependent children receive benefits until they reach 18 years of age, unless they are still in high school fulltime and then can continue to receive benefits until age 19. Approximately 146,000 high school students currently receive benefits under this provision. In the past, student benefits had continued until age 22 if the child was a full-time student in college or in a vocational school. However, Congress ended post-secondary students’ benefits in 1981. Recipients of this benefit were disproportionately children of parents in lower-income or blue-collar jobs, or were African Americans.

Childhood Disability Benefits

Social Security also provides protection to disabled adult children who were disabled before reaching age 22 and who are unmarried. The childhood disability benefit is based on the work record of a parent who is deceased, or receiving retirement or disability benefits. Approximately one million disabled adult children are receiving such benefits. Today, 1.7 million children of disabled workers are receiving an average monthly benefit of $328.

Policy Recommendations

The National Committee proposes a reinstatement of benefits for children of disabled or deceased workers until age 22 when the child is attending a college or vocational school on a full-time basis. This proposal was included as part of the National Committee’s Eleanor’s Hope Initiative unveiled in the fall of 2014. With the cost of higher education at an all time high, this benefit improvement could go a long way toward helping more children access college opportunities.

Benefits for disabled adult children should be improved by allowing them to reestablish entitlement to benefits after their marriages have ended in divorce, and by computing their benefits without regard to the family maximum. When a disabled adult child qualifies on a parent’s record, benefits for the child and for other family members may be adjusted due to the family maximum. If all eligible family members live in the same household, expenses and income are usually shared. However, people with disabilities are increasingly deciding to live independently from their families, creating a difficult situation for those disabled adult children whose benefit is reduced because of the cap on the family maximum. Computing the benefit for a disabled adult child without regard to the family maximum, as is already done when calculating the benefit for a divorced spouse, will address this situation.

Providing caregiver credits would strengthen a parent’s earnings history which should also result in a higher benefit amount for themselves and their eligible children. Interrupting participation in the labor force to look after other family members, usually children and elderly parents or relatives, can result in a significant reduction in the amount of the caregiver’s Social Security benefit. This disproportionately impacts women. When calculating an individual’s Social Security benefit, caregivers should be granted imputed earnings equal to 50 percent of that year’s average wage for up to as many as five years spent providing care to family members. Enactment of this provision would strengthen the protection provided by the program for both workers and their children.

Proposals to Reduce Social Security Benefits Will Hurt Children

Proponents of reducing Social Security benefits by changing the formula for cost-of-living adjustment (COLA) increases, raising the retirement age and other benefit cut plans argue that these benefit reductions are needed in order to save Social Security for our children and grandchildren. The irony of that claim, however, is that of the 6.5 million children in families that receive Social Security, 42 percent would be considered poor if their households did not receive Social Security. In fact, Social Security currently lifts 1.3 million children out of poverty. This illustrates the value of the program to current and future generations of children. It is imperative that discussions about any changes to Social Security policies must consider the program’s importance to American families, including parents and their children.