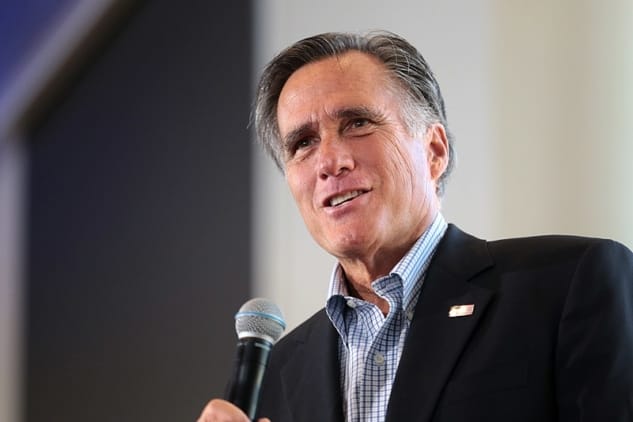

photo by George Skidmore/Wikimedia Commons

The TRUST Act is back again. Senator Mitt Romney (R-UT) reintroduced his bill on April 15th, after it went nowhere in the 116th Congress. The TRUST Act purports to protect federal trust funds, including Social Security and Medicare’s. But it would actually open the door to cutting both programs. The reintroduced TRUST Act is cosponsored by Republican members of the House and Senate and a handful of Democrats.

We urge them to reconsider their position — and to oppose the TRUST Act. Democrats must reject Republican attempts to undermine our nation’s most successful social insurance programs — crucial legacies of the New Deal and Great Society. Today’s workers and tomorrow’s retirees expect nothing less. – Former Senator Tom Harkin and NCPSSM president Max Ricthman, The Hill, 3/4/21

The bill would establish ‘Rescue Committees’ in Congress to draft legislation affecting the Social Security and Medicare – and fast track it for floor votes without going through the normal deliberative process. For example, members would not be able to offer amendments to legislation that comes out of the ‘Rescue Committees.’ “It leaves the skeleton of the legislative process in place, but nowhere along the line can you make changes or improvements,” explains Maria Freese, a Social Security and retirement expert at NCPSSM.

Given that fiscal hawks in Congress want to cut Americans’ earned benefits under the guise of protecting or “reforming” Social Security and Medicare, the TRUST Act is dangerous. It would open the door to slash both programs. Today’s seniors rely on their earned benefits to stay healthy and stay out of poverty. Research indicates that tomorrow’s retirees will rely on these programs even more. The last thing American workers need is to have their future benefits threatened. If anything, they should be expanded.

While it’s true that the Social Security and Medicare Part A trust funds will become depleted in 2035 and 2026 respectively if Congress takes no action, there are commonsense solutions that do not involve cutting benefits. But, too often, “entitlement reformers” use the canard that “no one in Washington has the courage” to address Social Security and Medicare’s financial challenges, which simply is not true. Representative John Larson introduced the Social Security 2100 Act, which would extend the life of the trust fund, partly by asking the wealthy to begin contributing their fair share of Social Security payroll taxes. Other members of Congress have offered their own solutions that do not ask future seniors to withstand benefit cuts.

“We agree that it’s important to address solvency,” said Dan Adcock, director of government relations and policy at the National Committee to Preserve Social Security & Medicare. “We also think it’s equally important to address benefit adequacy, because of the struggle that the middle class and working class have these days in saving for retirement.” – Dan Adcock, NCPSSM Director of Government Relations and Policy

In fact, the TRUST Act does not require its “rescue committees” to consider the adequacy of current benefits — or the human impact of potential cuts. Retirees would be relegated to the status of figures on a balance sheet. This is not an acceptable outcome for our parents, grandparents, and friends who depend on their earned benefits.