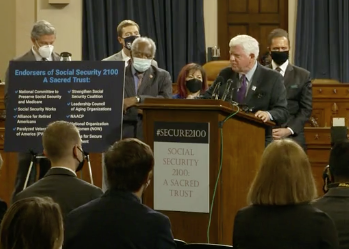

Rep. John Larson (D-CT) introduced landmark legislation today to expand and strengthen Social Security, with leading members of the seniors’ advocacy community present – including NCPSSM president and CEO Max Richtman. In introducing his Social Security 2100: A Sacred Trust bill, Rep. Larson said that benefits must be boosted and Social Security financially fortified:

“Every day, hard-working Americans contribute to this great program that has never missed a payment and stands as a hallmark to what good governance is about. This bill is what the American people need and richly deserve. Now is the time for us to act.” – Rep. John Larson, 10/26/21

Congressman Larson unveiled the bill in the committee room of the House Ways and Means Social Security subcommittee, which he chairs. Speakers at the event noted that it is the same room where Social Security and Medicare legislation was hammered out in the 1930’s and 1960’s. Rep. Larson pointed out that Social Security benefits have not been enhanced during the past fifty years, and that many seniors are teetering on the edge of poverty — unable to make ends meet under the current benefit structure.

The bill has nearly 200 cosponsors and the enthusiastic backing of the advocacy community. The National Committee to Preserve Social Security and Medicare has championed the program’s expansion for many years, working closely with Rep. Larson’s office.

“To those who claim that no one in Washington has the courage to address Social Security’s challenges, or that the only solution is to cut benefits for future generations, Congressman Larson’s bill is a stunning refutation. For years, seniors and their advocates have demanded these improvements. Rep. Larson has admirably led the charge on Capitol Hill, and with this bill, he has delivered.” – Max Richtman, NCPSSM president and CEO, 10/26/21

Larson’s fellow subcommittee members and other cosponsors of the bill praised the new bill – and Rep. Larson’s leadership on this issue:

“Social Security is one of our nation’s greatest success stories. It stands as a monument to decency and dignity, and is the birthright of every American worker. We have a sacred responsibility to assure its preservation. No one knows that better than John Larson.” – Rep. Bill Pascrell (D-NJ), 10/26/21

The Sacred Trust legislation would boost benefits for everyone on Social Security and provide extra increases to vulnerable groups, such as widows, widowers, and low-wage workers. Rep. Lynda Sanchez, a cosponsor of the bill, said these increases will benefit communities of color, whose lifetime earnings are lower and who typically depend on Social Security for all or most of their income. This bill, she said, “would reach down into these communities and help them live out their older years in dignity.”

Rep. Alexandria Ocasio-Cortez said, “Social Security helped my family through” when her father died of cancer. Rep. Conor Lamb (center) emphasized the program’s importance to veterans.

Rep. Conor Lamb (D-PA) spoke of Social Security’s importance to disabled veterans, while Rep. Alexandria Ocasio Cortez (D-NY) reminded Millennials that they, too, benefit from the social insurance that the program provides all adults and children in the event of a loss of a spouse or family breadwinner – or when a worker becomes disabled.

“When I was a kid, my dad passed away of cancer. My mother was a domestic worker. Social Security checks helped my family through. To have that social safety net isn’t just good for us individually; it helps us feel like we are part of a society that respects our elders and values our vulnerable.” – Rep. Alexandria Ocasio-Cortez (D-NY), 10/26/21

The Sacred Trust bill contains several provisions that seniors and their advocates have sought for years, including:

- An across-the-board benefit boost for all beneficiaries

- Adoption of a fairer, more accurate COLA formula (CPI-E)

- Improving benefits for long-serving, low-wage workers;

- Repealing the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO) that penalize many public servants;

- Providing caregiver credits for time taken out of the workforce to care for children and other dependents.

“Women especially will benefit from this legislation. Women often leave the workforce to take care of loved ones, which lowers their lifetime earnings on which Social Security benefits are based. Under this bill, there will be a credit for those who take time off of work, which will enhance their retirement benefits.” – Rep. Jan Schakowsky, (D-IL), 10/26/21

To pay for these improvements and forestall a projected shortfall in the Social Security trust fund in 2034, the Sacred Trust Act adjusts the wage cap so that earnings above $400,000 are subject to Social Security payroll taxes. This is a long-overdue correction for rising income inequality, where the percentage of wages subject to Social Security payroll taxes has shrunk over the past four decades. It also aligns with President Biden’s pledge not to raise taxes on anyone earning under $400,000 per year.

“Social Security stands as a monument to decency and dignity,” said Rep. Bill Pascrell.

Rep. Larson said that he plans to hold hearings on the Sacred Trust legislation in November, followed by a markup and floor vote in the House. The bill would need at least ten Republican votes to pass the Senate (an outcome that is far from guaranteed) and move to the President’s desk for signature. “No one understands better than President Biden that Social Security is a sacred trust between the people and their government,” said Larson.