President Biden’s bold 2024 budget proposal puts him squarely on the side of working Americans in their ongoing struggle for retirement and health security. The new White House budget would keep the Medicare Part A trust fund solvent until 2050. That should reassure Americans concerned about projections that the trust fund will become depleted by 2028 absent any kind of pre-emptive action. This is the kind of action the American people want to see.

The President’s budget proposal arrives amid a contentious debate on Capitol Hill about the future of Social Security and Medicare, with Republicans promising not to cut benefits for today’s seniors while floating multiple proposals that threaten benefits for tomorrow’s retirees — including raising eligibility ages, means testing, and privatization.

“While the conservatives’ approach is to ‘cut, cut, cut!’ earned benefits for future generations of retirees, President Biden’s budget would fortify Medicare for the future by asking the wealthy to pay their fair share. Instead of ‘kicking the can down the road’ as some previous administrations and Congresses have done, the President’s budget confronts the trust fund shortfall head on — without burdening beneficiaries. In a society with massive wealth inequality, the wealthy can afford to pay a little more. Future seniors cannot afford benefit cuts.” – Max Richtman, President & CEO, National Committee to Preserve Social Security and Medicare

The President’s budget would increase the Medicare tax rate on earned and unearned income above $400,000 from 3.8 percent to 5 percent, in keeping with his pledge not to raise taxes on anyone earning less than $400K per year. The budget also would eliminate loopholes so that everyone earning over $400,000 per year would have to pay those taxes.

On the Social Security side, the budget offers no concrete plan for shoring up the system’s finances — but does say that “the Administration looks forward to working with the Congress to responsibly strengthen Social Security by ensuring that high-income individuals pay their fair share.” We have endorsed Senator Bernie Sanders’ Social Security Expansion Act and Rep. John Larson’s Social Security 2100 act, which extend the solvency of the program’s trust fund while expanding benefits by raising revenues (including adjusting the payroll wage cap so that high earners contribute their fair share).

The budget provides additional funding for the beleaguered Social Security Administration (SSA) to bolster the agency’s customer service capabilities. SSA’s customer service has suffered because of a decade of budget cuts and the strain that the pandemic put on the agency. The White House requests a 10% increase for SSA’s operating budget over 2023 enacted levels, totaling about $15.5 billion altogether.

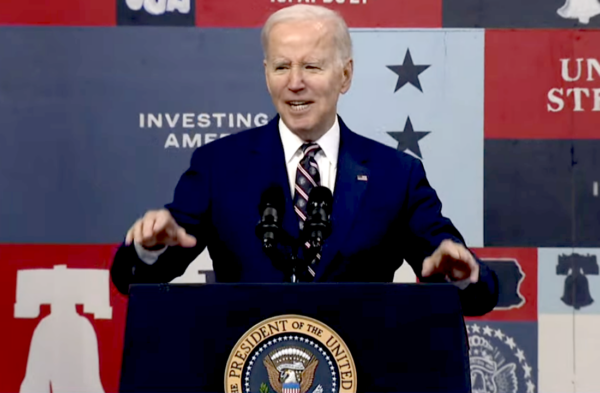

President Biden unveiled his 2024 budget in Philadelphia on Thursday, March 9, 2023

The White House budget also seeks to rein-in privatized Medicare Advantage (MA) plans. Some MA insurance providers have been maximizing profits while over-billing taxpayers and short-changing patients. The administration is imposing new regulations that will crack down on MA insurers gaming the system. One of the new regulations requires greater transparency in Medicare Advantage ads — the kind featuring celebrities like Joe Namath and William Shatner — that lure seniors into buying MA plans without important distinctions and disclaimers.

“We have been saying for years that the playing field between MA and original Medicare is tilted in favor of the privatized plans. The administration’s regulations finally will begin to level that playing field. MA plans are problematic for older and sicker beneficiaries. Thanks to the Biden regulations, seniors will be better informed about MA vs. original Medicare before making a choice that can be hard to reverse later.” – Max Richtman

In addition to these reforms, the Biden administration has proposed a rule that would prohibit some forms of prior authorization — and would clarify that MA plans must cover basic benefits to the extent they are covered in traditional Medicare.

The National Committee also lauds the President’s proposed enhancements to the prescription drug pricing reforms enacted last year in the Inflation Reduction Act. The President proposes to save $200 billion by making more drugs eligible for Medicare price negotiation with Big Pharma — and to accelerate the start dates for the new prices.

Finally, the budget invests $150 billion over 10 years to improve and expand Medicaid home and community-based services (HCBS). We have been advocating to boost HCBS funding so that seniors have more options for affordable care in their own homes and communities — a safer and healthier option than nursing homes.