Let the Drug Pricing Games Begin!

Under pressure from the White House, Big Pharma has been touting “discounts” via Direct to Consumer (DTC) websites. Meanwhile, the Trump administration promises to unveil its own prescription website, immodestly named TrumpRx, in 2026. Prescription drug prices obviously are still too high, though President Biden’s Inflation Reduction Act (IRA) of 2022 was beginning to make headway in bringing them down. Unlike Biden’s IRA, these latest gestures by Big Pharma and the Trump Administration should be viewed with a healthy dose of skepticism.

Last month, drugmaker AstraZeneca launched a new direct-to-consumer (DTC) website to sell three popular drugs to customers with no insurance at lower-than-list prices – Farxiga, Flumist and AirSpura. Shortly afterwards, the CEO of Pfizer appeared at a White House event to announce that company would make certain drugs available to Medicaid beneficiaries at lower-than-list prices.

It is unlikely that ‘discounts’ offered by Big Pharma and “TrumpRx” website are actually a good deal for consumers . As Yahoo!News reports, some experts have characterized TrumpRx as a “gimmick” that “is not going to help the average person, particularly those who purchase prescription drugs through their insurance plans.” Experts worry that the discounts on TrumpRx won’t offset the Trump tariffs on drugs, which will raise consumers’ prices, not lower them.

Health care advocates also are skeptical of Big Pharma’s own Direct to Consumer sites. A case in point is AstraZeneca’s announcement that the diabetes drug, Farxiga, will be sold for $182 per month on its AstraZeneca Direct website. But for Medicare beneficiaries, the price of Farxiga is already much lower, averaging $39 per month, thanks to the Inflation Reduction Act.

For those who don’t have insurance (or who have skimpy insurance) it’s unclear whether the industry’s Direct to Consumer websites will be genuinely helpful. Workers living paycheck-to-paycheck still may not be able to afford hundreds of dollars or more per month for any single prescription. People with employer-sponsored drug coverage will need to determine whether purchases from a pharmaceutical DTC website — or from “TrumpRx” — actually count toward annual deductibles and out-of-pocket spending maximums.

The diabetes medication Farxiga is $182/mo. on AstraZeneca’s ‘discount site,’ but it’s only $39/mo. for Medicare Part D beneficiaries, thanks to Biden’s Inflation Reduction Act

Biden’s Inflation Reduction Act contained well-considered measures that were beginning to work (See the $39 per month for Farxiga). For the first time, the IRA empowered Medicare to negotiate prices with Big Pharma. It also included penalties for manufacturers that raise prices above the inflation — and a $2,000 cap on out-of-pocket costs for patients in Medicare Part D.

This is a far better approach than Trump’s efforts to coax drug companies into lowering prices by threatening tariffs. During both of his terms in office, Trump’s actions on prescription drug pricing have always seemed more performative than serious. There also is a certain smoke-and-mirror synergy between Trump and Big Pharma. Drugmakers can conjure any list price (or retail price) for their products in the U.S. market, making the concept of a ‘discount’ somewhat sketchy. Manufacturers promising to offer 50% discounts next year could simply double their prices on January 1, rendering the discount meaningless.

Biden’s Inflation Reduction Act resulted in real cost savings for seniors

What Trump would posit as progress on drug pricing reform may, in reality, represent backsliding. Trump’s Unfair, Ugly Bill diluted the Inflation Reduction Act’s drug negotiation powers — giving the government less leverage over Big Pharma. Meanwhile, it is unclear how robustly the administration will implement the next round of prescription drug price negotiations. All told, none of the latest news is reassuring for seniors or anyone else who depends on life-saving medications — but struggles to afford them. It remains to be seen whether TrumpRx will truly save anyone money, or whether it will join Trump Sneakers, Trump Steaks, and Trump University in ignobility.

*****************************************************

Check out our “You Earned This” podcast, with the latest insights on Medicare, Prescription Drug Pricing, Caregiving and more! Listen here.

Trump Shutdown Could Snag Social Security, Medicare

In normal times, a government shutdown — while unfortunate — would not be cause for immediate alarm for people on Social Security and Medicare. But these are not normal times. The Trump administration has made the shutdown more perilous for the most vulnerable Americans because of its campaign to undermine the delivery of both programs — not to mention the President’s recent threat to cut benefits.

While benefits will continue to be paid during the shutdown, Americans’ ability to access their benefits could be compromised. Anyone trying to verify benefits, report changes in circumstances, or obtain replacement Medicare cards may have to wait until the shutdown is over. But that may not be all.

“Hands Off” protest against Trump cuts at Social Security Security Administration last Spring

Since Trump and DOGE hijacked the Social Security Administration (SSA) last winter, they have ruthlessly slashed the agency’s workforce — at a time when staffing was already at a 50-year low. The administration also put up barriers for people trying to simply access their earned benefits. All of this was done under the guise of hunting for “waste, fraud, and abuse” — which are extremely rare at SSA.

Although some of the SSA workforce will be deemed ‘essential employees’ during the shutdown and continue working, the shrinking of staff by Trump and DOGE can only slow down already diminished customer service. Wait times on the 1-800 phone line and at overcrowded, understaffed field offices could be exacerbated by the shutdown.

“It’s perfectly understandable that beneficiaries would be concerned about additional disruptions during a shutdown. We would like to reassure the public about customer service at SSA, but we cannot honestly do that — given the administration’s blatant disregard for the needs of Social Security recipients.” – Max Richtman, President & CEO, National Committee to Preserve Social Security and Medicare

More ominously, Trump threatened to use the shutdown as an opportunity to (illegally) fire federal workers. Staffing at the Centers for Medicare and Medicaid Services (CMS) already has been brutally cut. Further firings would hobble the agency’s ability to administer the Medicare and Medicaid programs.

Worse yet, Trump claimed the power to cut benefits during the shutdown in order to punish Democrats. “We can do things during the shutdown that… are bad for them… We can do things medically and other ways, including benefits. We can cut large numbers of people.”

Cut large numbers of people? It was a word salad, for sure, but also a declaration that this President is willing to illegally cut crucial benefits — as revenge against his political opponents and their constituents.

The shutdown is disturbing on many levels. It happened because Trump and Republicans in Congress refused to simply extend subsidies to help people pay for health coverage under the Affordable Care Act. Without those subsidies, premiums could more than double — leaving millions of Americans unable to afford coverage (including many ‘near seniors’ who aren’t yet old enough for Medicare). Instead, the president who rammed through a $3 trillion tax cut mostly benefitting the rich is cynically using the shutdown as an excuse to inflict further damage on seniors, people with disabilities, and their families.

*******************************************************

A bonus gift from Trump and the Republicans: The announcement of the 2026 Social Security cost-of-living announcement (COLA) may be delayed because of the shutdown. Why? Because workers at the Bureau of Labor Statistics, which calculates the inflation rate used to determine COLAs, are deemed ‘non-essential’ employees. The COLA announcement, previously expected on October 15th, may have to be pushed back. If the shutdown drags on lone enough, this could even impact the payment of the new COLA — and hit beneficiaries right in the wallet. Thanks again, President Trump & The GOP!

Social Security Comish Would Consider Raising Retirement Age

Despite Trump’s pledge not to cut Social Security, administration officials keep letting the real agenda slip out. First, Treasury Secretary Scott Bessent hinted that privatizing Social Security was on the table. Now, Social Security Commissioner Frank Bisignano says he’s open to the idea of raising the retirement age.

In an interview on Fox Business News last week, host Maria Bartiromo asked Bisignano if he’d “consider raising the retirement age,” to which the commissioner replied, “I think everything’s being considered.”

“Bisignano said that he would need Congress’ help to officially raise the retirement age and acknowledged, ‘That will take a while,’ before adding, ‘But we have plenty of time.’” – Common Dreams, 9/19/25

Yes, it takes an act of Congress and the signature of the president to change Social Security law. But given the Trump administration’s meddling in Social Security this year — enacting arbitrary rule changes that put obstacles in the way of people simply trying to access their earned benefits — Bisignano’s statements betray an ideological bent that undermines the program.

Anyway, it’s not as if congressional Republicans haven’t proposed raising the retirement age. The current full retirement age is 67; the GOP has floated proposals to raise it as high as 70, under the cover of fixing the the projected depletion of Social Security’s trust funds in 2034. Meanwhile, Republicans have refused to consider solutions that would bring more revenue into the system, preferring benefit cuts instead. As we have pointed out many times, raising the retirement age is a lifetime benefit cut — 7% for every year the age is increased.

Conservatives argue that since ‘people are living longer,’ they can wait longer to collect full benefits. That ignores the fact that life expectancy actually is declining for some demographic groups — and that workers in physically demanding jobs simply cannot work into their late 60s.

Not all older workers can continue working into their late 60s (iStock by Getty Images)

In an episode of our podcast in 2024, Los Angeles Times columnist Michael Hiltzik called raising the retirement age “the stupidest and most dishonest fix for Social Security.” He explained further: “Not everybody spends their careers with their belly behind a desk in an air-conditioned office, and the life expectancy and the need to retire is obviously very different between office workers and members of Congress and construction workers. But (Republicans) want (a higher) retirement age — and it makes no sense.”

In the Republican world view, workers must continue to sacrifice while the rich get richer. “Republicans gave away trillions in tax cuts for the wealthy (in Trump’s Unfair, Ugly Bill),” said Senator Ed Markey (D-MA). “Now they are asking Americans to work longer. We won’t stand for it.”

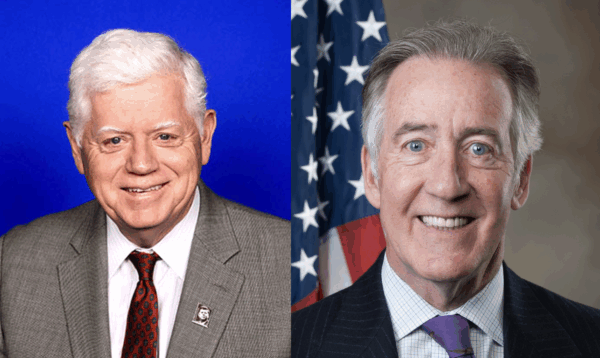

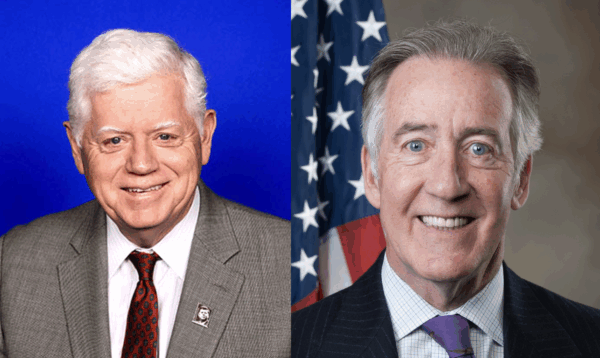

Rep. John Larson (D-CT), one of the fiercest seniors’ champions in the U.S. House, said in a statement:

“After months of denying it, the Trump Administration is finally admitting what we suspected all along. They are planning on raising the retirement age. Slowly but surely, they have all fallen in line with the Project 2025 playbook to cut benefits. Some Americans may have been born at night, but not last night.” – Rep. John Larson (D-CT)

We have long endorsed a far better idea than raising the retirement age: demanding that the wealthy begin paying their fair share into Social Security. Rep. Larson and other members of the House and Senate have introduced bills to adjust the payroll wage cap (currently set at $176,100 in annual earnings) in order to help close Social Security’s projected funding gap. Republicans talk only of cutting benefits (though they rarely call it that).

While conservatives hedge by saying that their proposals would not affect current retirees or those nearing retirement, increasing the retirement age for future seniors would be a devastating blow to Gen X, Millennials, Gen Z, and the generations behind them. Today’s younger adults will rely on Social Security even more than current seniors do — to which we say: who wants to sacrifice their children’s and grandchildren’s retirement security while Republicans strive to enrich the already wealthy?

Bisignano’s Un-Truthy Letter to the People — or “Fact-Checking the Frankster”

Getty Images

The Trump administration continues to gaslight the American people about its interference in the workings of the Social Security Administration (SSA). So it’s time for another fact-check. Trump’s DOGE squad savagely cut staff, closed field offices, and erected barriers for beneficiaries attempting to access their earned benefits — as part of a phony hunt for ‘fraud’ (which, in fact, is extremely rare).

Now, Commissioner Frank Bisignano is misleading the public by claiming that these actions have ‘improved’ customer service, when they have, in fact, made things significantly worse. On the 90th anniversary of Social Security in August, SSA posted an ‘un-truthy’ letter from Bisignano to the American people on its website.

We asked our director of government relations and policy, Dan Adcock, to knock down the false claims by Trump’s Social Security commissioner:

FALSE CLAIM #1:

“President Trump has been resolute in his promise to protect and preserve Social Security. Last month, the President delivered historic tax relief for America’s seniors when he signed the “One Big Beautiful Bill” into law. A provision in the Bill eliminated federal income taxes on Social Security for most beneficiaries, ensuring that retirees can keep more of the benefits they earned.” – Commissioner Frank Bisignano

THE FACTS:

Trump’s “Unfair, Ugly Bill” does NOT eliminate income taxes on Social Security benefits. It does provide a temporary tax break for some higher-income seniors. At the same time, Social Security’s Chief Actuary projects that the new law will advance the insolvency date of the Social Security trust funds by six months.

If Congress does not act to solve this looming crisis, the Committee for a Responsible Federal Budget estimates that the additional loss of revenue means every Social Security beneficiary will see their benefits cut by about 24 percent once the trust funds are depleted, almost five percent deeper than if the provision had not been enacted.

Under prior law, nearly one-half of seniors already did not pay any income tax, including on their Social Security benefits, which means the increased senior deduction does not provide them any benefit at all. But they will be exposed to potential across-the-board cuts if Congress does not address the now-accelerated insolvency of the Trust Funds.

FALSE CLAIM #2:

“In addition, we have updated our authentication tools for serving you online and over the phone to ensure we pay benefits only to those who are eligible for receive them.” – Commissioner Frank Bisignano

THE FACTS:

“The Social Security Administration has taken this emergency action without public consultation and with absolutely no evidence that significant fraud exists. (The actual fraud rate on SSA’s phone lines is statistically infinitesimal.) SSA has created an unsurmountable obstacle for millions of older Americans and people with disabilities who lack internet access (or competency navigating online) by requiring them to have a “Security Authentication PIN.” This PIN now will be needed to make simple transactions, such as generating a benefit verification letter, requesting a tax statement, changing an address or inquiring about the status of a claim – all of which can currently be done by phone.

Without proper internet competency or access, beneficiaries who want to conduct any of these transactions will be forced to wait on average 35 days or more to make an appointment at a SSA field office. They will be further disadvantaged by the reduction of staff at field offices, some of which have been reassigned to the SSA toll free phone service. Perhaps if the Trump administration had not recklessly slashed SSA’s workforce, it would not be forced to triage backlogs and create fictional claims of fraud.

FALSE CLAIM #3:

“To eliminate the opportunity for fraud using Social Security numbers, we added over 12.4 million individuals aged 120 and over to the Death Master File.” – Commissioner Frank Bisignano

THE FACTS:

There was little to no fraud in Social Security due to benefits being collected for deceased beneficiaries. The deceased beneficiaries identified by DOGE staff, Elon Musk and President Trump where part of a data base that is not used to make payments. Instead, the Social Security death master filed was inappropriately used by error-prone SSA political appointees to stop benefit payments to around 6,000 people and who were also prevented from conducting any financial transactions, like buying a house or car or opening a bank account. Of these 6,000 people, most were legal residents who were victims of this improper practice. They were forced to visit understaffed SSA field office to prove they were alive AND legally eligible to receive Social Security benefits.

FALSE CLAIM #4: “(Before DOGE took over, you experienced long wait times that caused frustration and reduced trust in a program we cherish. The data speaks for itself. The average speed of answer on the National 800 Number reached an all-time high of 42 minutes in November 2023; field office wait times spiked to 32 minutes in February 2024; and the disability claims backlog reached an all-time high of more than 1.25 million in June 2024.” – Commissioner Frank Bisignano

THE FACTS:

Bisignano’s data is highly misleading. The numbers have been skewed to make it appear that the Trump administration has improved customer service, which is the opposite of reality. (See CNN’s excellent reporting on this issue here.) The commissioner makes it seem as if SSA service worsened during the Biden years, when, in fact, under the leadership of former Commissioner Martin O’Malley, it got better.

During O’Malley’s tenure, average call wait times on SSA’s 1-800 number fell to under 13 minutes by the end of 2024, the Social Security Disability Insurance (SSDI) claims backlog hit a 30-year low, and SSA productivity improved by more than 6% in 2024.

On Bisignano’s watch, though, the agency has manipulated performance data to appear more rosy — or outright removed such numbers to prevent independent analysis. This statistical sleight of hand isn’t just misleading — it’s a breach of public trust. Social Security is the bedrock of retirement income and disability support for millions of Americans. Misrepresenting its operations does a disservice to the very people the SSA is supposed to serve.

We suspect that the Trump administration’s reckless actions at SSA are designed to sabotage the agency, so that their allies in the private sector can take over. Trump and DOGE are breaking SSA so it can be ‘saved’ through privatization. That may serve the interests of wealthy donors, but not the American people, who pay for SSA services as part of their payroll contributions to the Social Security program.

********************

Listen to our podcast interview with former Social Security Commissioner Martin O’Malley here.

Watch our documentary about the 90th anniversary of Social Security here.

DOGE ‘Very Badly’ Mishandles Americans’ Social Security Data

Back in February, we warned that DOGE was compromising Americans’ personal information by accessing sensitive Social Security data:

“Seniors, their families, and people with disabilities most certainly cannot trust Trump and Musk with their crucial federal benefits — or their personal data.” – Max Richtman, NCPSSM President, 2/3/25

This week, our fears were confirmed. For no justifiable reason, DOGE team members uploaded the personal information of hundreds of millions of Americans to “a vulnerable cloud server,” according to a whistleblower within the Social Security Administration (SSA). As Trump himself would say, they mishandled our data ‘very badly.’

The New York Times reported on Tuesday that SSA’s chief data officer, Charles Borges, filed a whistleblower complaint alleging that DOGE members “copied the data to a server that only DOGE could access… creating enormous vulnerabilities.”

A subsequent CNN story underlined the dangers of this reckless move. Correspondent Matt Egan reported that DOGE’s “move fast, break things” strategy at SSA could lead to “widespread identity theft.” Egan warned that if the data uploaded to the unsecure cloud server is breached, the government might have to re-issue Social Security numbers to everyone who currently has one.

Last winter, we implored the courts to halt DOGE’s invasion of SSA’s database. A lower court in Maryland blocked DOGE’s insidious efforts. But in June, the Supreme Court’s right-wing majority overturned that ruling, allowing DOGE unfettered access. Investigative journalist Marcy Wheeler explains:

“Once SCOTUS (ruled), SSA’s General Counsel told the DOGE boys to blow off the (Chief Data Officer, Charles Borges), who is the whistleblower, and not just create a live replica (of the SSA database), but to do so without any audit trail.” – Marcy Wheeler, journalist/blogger

A former 42-year SSA employee who consults with NCPSSM on Social Security issues tells us:

“After DOGE took over at SSA, senior officials were dismissed and run out of the agency as they fought to protect this data. Everyone with any experience or knowledge raised alarms. No one knows or can predict what eventual use or misuse will occur here — because it is limitless.”

Democrats on Capitol Hill are, to say the least, disturbed by this week’s revelations. “Credible whistleblower claims show our worst fears have come true: the Trump Administration is carelessly and dangerously mishandling the people’s most private information,” said Reps. John Larson and Richard Neal, ranking members of the House Ways & Means Social Security subcommittee.

Reps. John Larson (D-CT) and Richard Neal (D-MA)

Congressmen Larson and Neal have introduced the Protecting Americans’ Social Security Data Act to block political appointees, including DOGE members, from accessing sensitive SSA data systems.

The legislation would also establish privacy requirements for beneficiary data — and strengthen oversight and civil penalties for violating Social Security beneficiaries’ personal information. We endorsed the bill, with NCPSSM President Max Richtman writing to Reps. Larson and Neal: “On behalf of all working Americans and their families, we appreciate your steadfast support for this critical agency — and its mission to deliver the benefits workers have earned during their working lives.”

************************************************

Listen to former Social Security Commissioner Martin O’Malley warning about the dangers of DOGE on our podcast here.

Watch our new documentary, “Social Security: 90 Years Strong” here.