Did you know that when you lay down $10, $20, or $30 for a copay at the pharmacy that you may be overpaying for the prescription itself — and a third party may be pocketing the difference? Or that you might save money by not going through insurance at all and paying a reduced cash price for the medication? Such is the head-spinning – and sometimes unethical – world of prescription drug benefits in the second decade of the 21st century.

Middlemen called Pharmacy Benefit Managers (PBMs) can skim extra profit by overcharging for medications. The PBMs’ ostensible purpose is to negotiate favorable pricing with pharmaceutical companies on behalf of insurers, including Medicare. But sometimes, especially with cheaper generic medicines, PBMs excessively mark up those prices and keep the remainder for themselves – causing consumers to pay more than they should. Unfortunately, this practice is especially costly for older Americans living on fixed incomes.

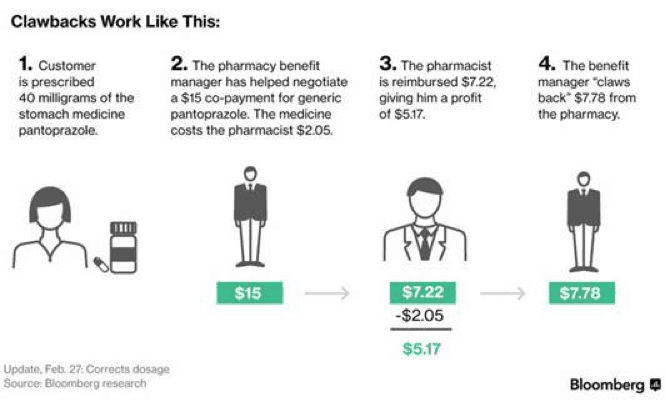

Unsuspecting customers are particularly vulnerable when paying co-pays at their local pharmacy, where PBMs can “claw back” excess profits. Here’s how it works:

A patient goes to a pharmacy and pays a co-pay amount — perhaps $10 — agreed to by the pharmacy benefits manager, or PBM, and the insurers who hire it. The pharmacist gets reimbursed for the price of the drug, say $2, and possibly a small profit. Then the benefits manager “claws back” the remainder. – Bloomberg, 2/24/17

(See also the graphic at the bottom of this post for a more detailed explanation of clawbacks.)

Though most customers are unaware of this practice, Bloomberg news reports that it is disturbingly common. More than 80% of independent pharmacists surveyed said that they have experienced clawbacks from PBMs at least 10 times a month.

In some cases, there is a simple way for customers to protect themselves from clawbacks. They can simply ask the pharmacist for the cash price of the prescription. If the cash price is lower than the co-pay, the customer can elect to pay it and bypass the insurance coverage for that medication. Consumers can also use prescription drug apps to determine the cash price (and available discounts) for various medications.

Unfortunately, PBMs do what they can to keep customers ignorant of this option. In fact, many PBMs (including one called OptumRx) contractually forbid pharmacists from educating customers about potential alternatives.

Pharmacists who contract with OptumRx in 2017 could be terminated for “actions detrimental to the provider network,” doing anything that “disparages” it or trying to “steer” customers to other coverage or discounted plans… – Bloomberg, 2/24/17

Some PBMs further restrict customers’ rights by mandating that enrollees in certain insurance plans use mail order and specialty pharmacies that they own, creating a conflict of interest.

Up to now, PBMs have operated with little transparency, so that no one really knows the inner workings of their deals with the drug companies or the details of their pricing structures. But pressure has been building on Capitol Hill. After all, the federal government is the largest health care provider in the country and is motivated to keep prescription drug costs under control. Hence, a bipartisan bill called the Prescription Drug Price Transparency Act (H.R. 1316) seeks to strengthen oversight of PBMs in the Medicare, Medicaid, and Federal Employee Health Benefit programs.

Three other bills – one in House and two in the Senate – have been introduced requiring greater transparency and accountability for PBMs. Meanwhile, New York State (under the leadership of Governor Andrew Cuomo) has unveiled new regulations for PBMs, and other states may do the same.

PBMs have also become the target of lawsuits (16 of them since October of last year) and have invited scrutiny from the U.S. Justice Department, which has alleged that the industry “is rife with conflicts of interests and undisclosed arrangements entered into at customers’ expense.”

Of course, the nascent clampdown on PBMs has to be seen in the context of soaring prescription drug prices overall, which are the main driver of rising medical costs. President Trump pledged to bring down drug prices, but so far has not delivered. Incremental measures to crack down on pricing abuses by PBMs are a good start. But until consumers receive actual deliverance from prescription price gouging, they will have to try their best to protect themselves.

*******************************************************************************************************************