The House Ways and Means Social Security Subcommittee held a hearing about the program’s trustees’ projection that the Social Security trust fund will become depleted in 2035, absent Congressional action. Even so, Social Security still could pay 83% of scheduled benefits at that time. No one wants Congressional inaction, but the hearing emphasized the difference in the two parties’ approaches to the problem.

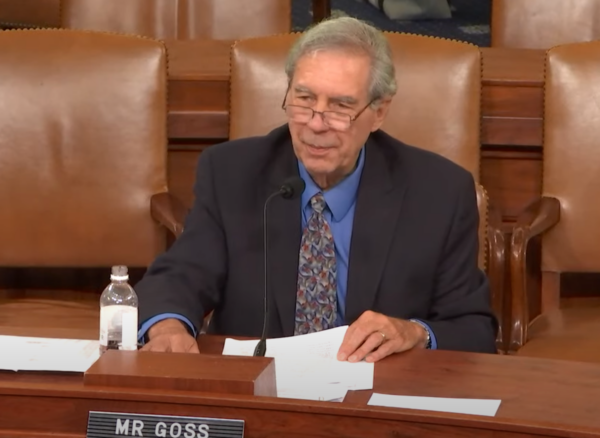

The main witness, Social Security Chief Actuary Stephen Goss, tamped down alarmism about the program’s financial future:

“At the start of 2024, reserves in the combined OASI and DI trust funds totaled $2.8 trillion, nearly double the amount in annual payments. Our contingency reserve fund is strong for the moment.” – Social Security Chief Actuary Stephen Goss

Goss reminded committee members that Social Security does not add to the national debt and has no borrowing authority, despite Republican claims that the program is one of the main drivers of federal red ink. (In fact, the number one driver of the debt is tax expenditures — giveaways to the wealthy and major corporations like the Trump tax cuts that GOP members now want to extend.)

Social Security Chief Actuary Stephen C. Goss

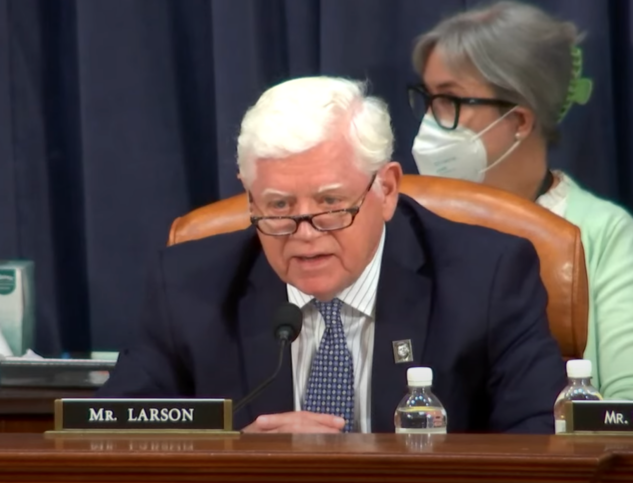

Ranking Member Rep. John Larson (D-CT) took aim at Republican lawmakers and many of their supposedly “fiscally responsible” proposals to cut Social Security — such as raising the retirement age to 69 or 70.

“The American public knows for every year you raise the age that’s a 7% cut in benefits,” Larson said, pointing out that raising the age by three years would amount to a bigger benefit cut (21%) than allowing the trust fund to run dry.

Democratic committee members promoted revenue-side solutions to strengthen Social Security’s finances, including Rep. Larson’s Social Security 2100 Act. His legislation would require the wealthy to begin contributing their fair share by adjusting the payroll wage cap and leveraging some investment income that is not now included in FICA taxes.

“We will make the wealthiest Americans pay into Social Security at the same rate as those Bay City teachers, Saginaw firefighters, and Midland factory workers that I represent, are paying,” said Rep. Dan Kildee (D-MI).

“The answer to the long-term solvency of Social Security is not to increase the retirement age, not to cut benefits. It’s time that we advance legislation that increases Social Security benefits to reflect the true cost of living that they experience, doing so by making the wealthiest Americans pay their fair share”. – Rep. Dan Kildee (D-MI)

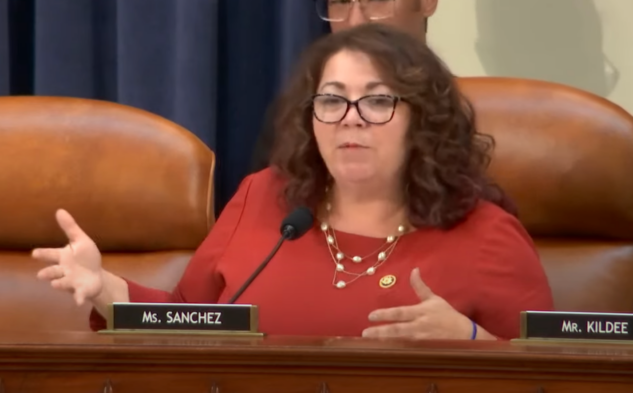

Rep. Linda Sanchez (D-CA) pointed out that any cuts to Social Security would impact communities of color in particular. “People of color are less likely to work for employers who offer pensions and other retirement plans and are therefore more reliant on these benefits,” she said. “Proposed cuts to Social Security would be a direct attack on communities of color, specifically the Latino population, who relies almost exclusively on (these benefits) for their retirement.”

Rep. Linda Sanchez (D-CA) at House Social Security Subcommittee hearing

In written testimony, National Committee to Preserve Social Security and Medicare President Max Richtman insisted that benefits must be expanded, not cut, to meet the needs of future retirees. (Rep. Larson’s bill would provide an across-the-board benefit boost and targeted increases to especially vulnerable beneficiaries.)

“While Social Security has lifted generations of seniors out of poverty, benefits must be improved to protect the growing share of seniors who depend on the program for all or most of their retirement income,” said Richtman.