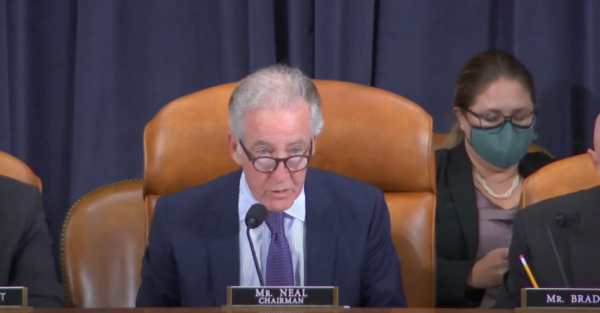

Chairman Richard Neal presides as House Ways & Means Committee advances Social Security legislation

A bill to repeal two largely unpopular rules affecting some public sector workers’ ability to collect Social Security benefits was reported out of the House Ways & Means Committee today. The Social Security Fairness Act was introduced by Rep. Rodney Davis (R-IL), and currently has more than 290 cosponsors from both parties.

The bill would eliminate the Windfall Elimination Provision (WEP), which in some instances reduces Social Security benefits for individuals who also receive a pension or disability benefit from an employer who did not withhold Social Security taxes. It would also repeal the Government Pension Offset (GPO), which can reduce survivors’ benefits for spouses, widows, and widowers who receive their own government pensions.

“This bill aims to address longstanding problems of WEP and GPO. While well intentioned, these provisions penalize many hard-working public servants and their family members. After serving their communities for years, teachers, firefighters, police officers, and other public employees in certain states are hit with an unwelcome surprise after retiring, a reduction in their Social Security benefits due to WEP and GPO.” – Rep. Richard Neal (D-MA), Chair of the House Ways & Means Committee

The National Committee to Preserve Social Security and Medicare supports enactment of Rep. Davis’ bill, but prefers that WEP and GPO be addressed as part of broader Social Security reform, preferably via Rep. John Larson’s Social Security 2100: A Sacred Trust legislation.

Rep. Larson’s bill not only would repeal WEP and GPO, but boost Social Security benefits across the board and extend the solvency of the trust fund. And, unlike the Social Security Fairness Act, the elimination of WEP and GPO are paid for in Larson’s legislation. Rep. Davis’ bill does not have a funding mechanism and actually would accelerate the projected depletion of the Social Security trust fund.

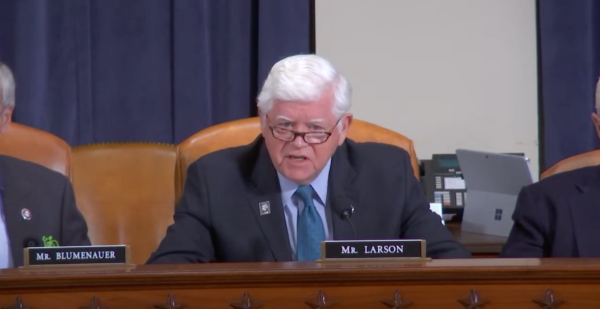

House leadership has so far prevented Social Security 2100 Act from going through committee mark-up and proceeding to the floor for a vote, prompting Rep. Larson to offer his bill as a substitute for Rep. Davis’ legislation during today’s committee meeting. Congressman Larson withdrew his amendment shortly afterward, knowing that it was going to be ruled “not germane” to the committee’s business at hand. But it did give him an opportunity to make an impassioned plea for the House to take up his own bill – benefitting all 65 million Americans on Social Security and not just the 2.7 million affected by WEP and GPO – before the 117th Congress is gaveled to a close.

“The group that’s hit hardest by inflation and pandemic are the seniors of this great nation. For 51 years Congress has kicked the can down the road without improving benefits. Repealing WEP and GPO are part of my bill — they are paid for. Seniors on fixed incomes need us to not only talk the talk, but walk the walk. We need to vote on (my bill) instead of kicking the can down the road.” – Rep. John Larson, 9/20/22

Dan Adcock, NCPSSM’s Director of Government Relations and Policy, says that the National Committee will continue to work with Rep. Larson to urge House leadership to take up Social Security 2100. But, he says, “the chances that bill will be considered by the full House grow dimmer as the number of days on the legislative calendar for the 117th Congress dwindles.”

Meanwhile, Adcock says, although Rep. Davis’ Social Security Fairness Act was advanced out of the Ways and Means Committee (albeit ‘without recommendation’), its fate is uncertain. “Given that Rep. Davis’ bill is not paid for and violates the Congressional PAYGO rule, it is unlikely that the bill will be considered by the House during this Congress.”

Rep. John Larson makes an impassioned plea for his Social Security 2100 Act. “Let’s not kick the can down the road any longer.”

If, as looks increasingly likely, neither Davis’ or Larson’s bills come up for a vote, another session of the U.S. Congress will have gone by without real improvements to Social Security, which current and future seniors most definitely need in order to retire with financial security and dignity. It will be up to voters this November to elect more members of Congress who will do what it takes to pass meaningful legislation to boost Social Security.