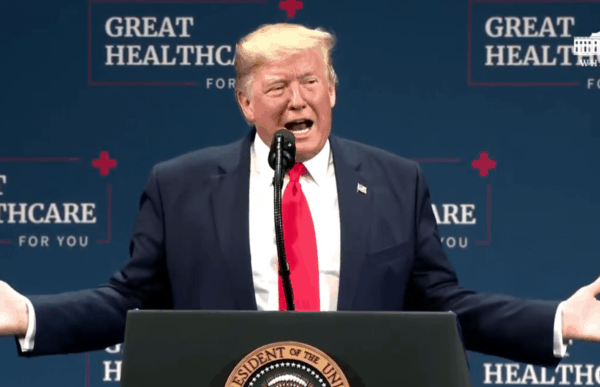

Trump “Buyout” Offer May Devastate Social Security Administration

Voters may have sent various messages to Washington last November, but they certainly did not include a call to gut the federal workforce that serves American seniors and people with disabilities. Yet, that’s exactly what the Trump administration — abetted by billionaire advisor ex-officio Elon Musk — is attempting to do.

On Tuesday, federal workers — including employees of the Social Security Administration — received an email from the U.S. Office of Personnel Management (OPM), offering “deferred resignation.” The email said employees could resign now and continue to receive pay and benefits through September — an offer of dubious legality that was immediately criticized by Democratic lawmakers and labor unions representing federal workers.

The email, which arrived under the subject line “Fork in the Road,” implies that federal employees who choose not to resign may be subject to future layoffs and also would have to conform to rigorous, new rules that the administration intends to impose — including an end to remote work and mandatory 5-days per week in the office. Workers’ advocates say that the email is an attempt to intimidate employees into resigning.

“It is clear that the Administration is seeking to undermine federal programs by eliminating career public servants,” wrote Senator Kirsten Gillibrand (D-NY) in a letter to OPM. “We have grave concerns for how these personnel decisions will affect the programs that serve the American people, especially those served by the Social Security Administration (SSA).”

The group Employees for Environmental Responsibility called Trump’s offer to federal workers “an illusion.”

“The offer is not a buyout and may be illegal. This is part of a larger effort by the Trump administration to get federal civil servants to quit by instilling fear and panic in the workforce.” – Employees for Environmental Responsibility, 1/27/25

Social Security advocates, including the National Committee, are alarmed (in particular) about the implications of the “buyout” offer for customers and employees of the Social Security Administration, which serves more than 68 million beneficiaries.

“SSA was already underfunded and understaffed,” says Dan Adcock, NCPMM’s director of government relations and policy. “This scheme by the administration will only exacerbate SSA’s existing problems. The agency currently does not have enough staff to meet beneficiaries’ needs — as is obvious from long hold times on SSA’s 1-800 phone number and interminable delays in hearing SSDI disability appeals.”

If the Trump administration is successful in culling the workforce at SSA, it will “take a sledgehammer to customer service,” says Adcock. He points out that many seniors are unable to conduct all of their business online and need direct contact with an SSA representative. “Bots replacing workers on the 800 phone line will not get the job done.”

Seniors and people with disabilities rely on SSA for a multitude of services — including claiming benefits, submitting changes in benefit status, and appealing benefit decisions, among other things. On top of its regular workload, SSA must now re-calculate benefits for some 3 million public sector retirees affected by the new Social Security Fairness Act. The agency announced that it may take up to one year for these workers to receive all of the payments to which they now are entitled under the new law. Advocates worry that this added workload may impede service for other current and future Social Security beneficiaries. (Some 10,000 Baby Boomers reach retirement age every day.)

The union representing Social Security administration workers, the American Federation of Government Employees (AFGE), is urging SSA staff not to accept the “buyout” offer at this time, pending further information from the Trump administration. “There is not yet any evidence the administration can or will uphold its end of the bargain, that Congress will go along with this unilateral massive restructuring, or that appropriated funds can be used this way,” said AFGE in an email to its members.

NCPSSM’s Dan Adcock accused the Trump administration of “running roughshod over the protections that civil servants have,” and predicts that there will be lawsuits over the “Fork in the Road” policy.

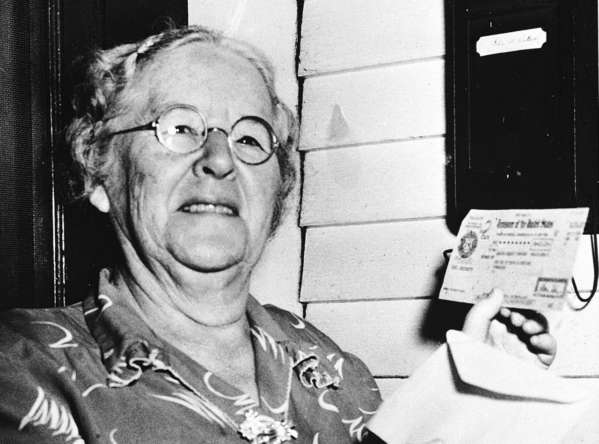

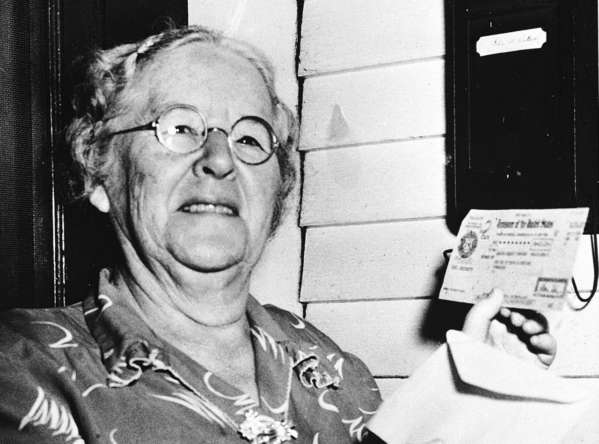

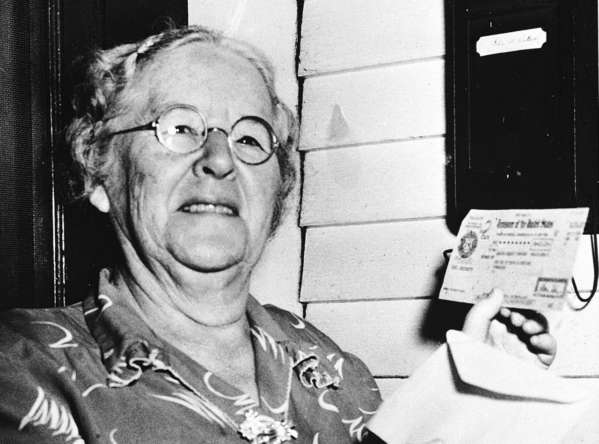

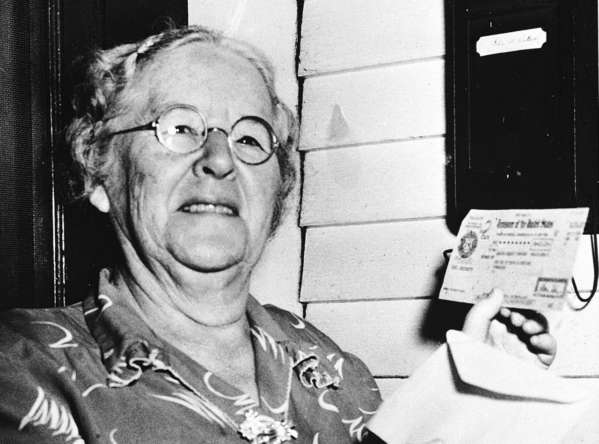

The First Social Security Beneficiary Got Her Check 85 Years Ago

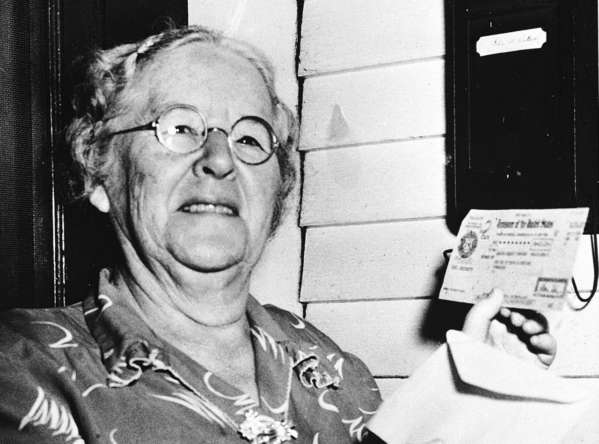

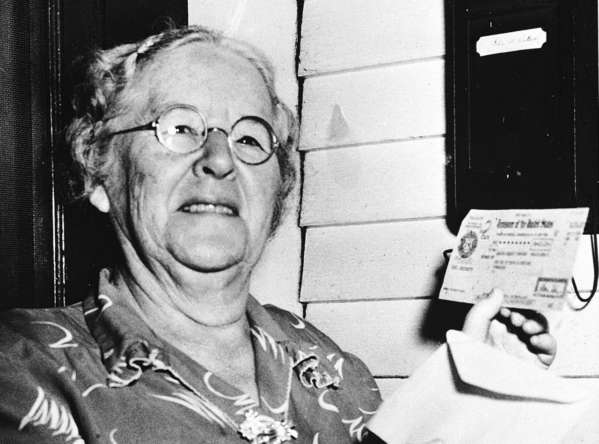

Ida Mae Fuller in 1940

The following article is reprinted from the Social Security Administration (SSA) website www.ssa.gov

The First Social Security Beneficiary

Ida May Fuller was the first beneficiary of recurring monthly Social Security payments. Miss Fuller (known as Aunt Ida to her friends and family) was born on September 6, 1874 on a farm outside of Ludlow, Vermont. She attended school in Rutland, Vermont where one of her classmates was Calvin Coolidge. In 1905, after working as a school teacher, she became a legal secretary. One of the partners in the firm, John G. Sargent, would later become Attorney General in the Coolidge Administration.

Ida May never married and had no children. She lived alone most of her life, but spent eight years near the end of her life living with her niece, Hazel Perkins, and her family in Brattleboro, Vermont.

Miss Fuller filed her retirement claim on November 4, 1939, having worked under Social Security for a little short of three years. While running an errand she dropped by the Rutland Social Security office to ask about possible benefits. She would later observe: “It wasn’t that I expected anything, mind you, but I knew I’d been paying for something called Social Security and I wanted to ask the people in Rutland about it.”

Her claim was taken by Claims Clerk, Elizabeth Corcoran Burke, and transmitted to the Claims Division in Washington, D.C. for adjudication. The case was adjudicated and reviewed and sent to the Treasury Department for payment in January 1940. The claims were grouped in batches of 1,000 and a Certification List for each batch was sent to Treasury. Miss Fuller’s claim was the first one on the first Certification List and so the first Social Security check, check number 00-000-001, was issued to Ida May Fuller in the amount of $22.54 and dated January 31, 1940.

NCPSSM Attends Signing of Social Security Fairness Act, Repealing WEP & GPO

NCPSSM CEO Max Richtman and President Biden at the signing ceremony

Labor and seniors’ advocates have been lobbying for decades to repeal two provisions of Social Security law that penalized public sector retirees and their families — the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO). On Sunday, the efforts of the advocacy community paid off, when President Biden signed the Social Security Fairness Act into law. The new law eliminates the WEP & GPO, allowing some 2.5 million public sector retirees and spouses to collect full Social Security benefits.

President Biden praised the law as a “big deal” for teachers, firefighters, police officers, and other public servants “who dedicate their lives to their communities.” He said these retirees now will receive an average $360 monthly increase in Social Security benefits in 2025 — and would also receive a lump sum payment for benefits they would have earned in 2024.

The president said that the new law is in keeping with the basic promise of Social Security, “that all Americans should be able to retire with financial security and dignity.”

NCPSSM CEO Max Richtman, political director Luke Warren, and communications director Walter Gottlieb attended the signing ceremony at the White House. Richtman said that the law represents the culmination of lobbying by the National Committee to Preserve Social Security and Medicare and myriad other groups to restore fairness to the system.

“President Biden’s signing of the Social Security Fairness Act truly is historic. The new law rights a wrong that has either reduced or eliminated the Social Security benefits of certain government retirees. Nearly 3 million public sector employees and families will now be eligible to collect their full Social Security benefits.” – Max Richtman, NCPSSM President & CEO

The bipartisan bill passed the House in November, with the Senate vote coming at the very end of the 118th Congress in late December. Three of the bill’s sponsors attended the signing ceremony: Rep. Abigail Spanberger (D-VA), former Senator Sherrod Brown (D-OH), and Senator Susan Collins (R-ME). The bill’s Republican sponsor in the House, Rep. Garrett Graves (R-LA), did not attend.

The Social Security Administration (SSA) is responsible for paying benefits to newly eligible public sector workers and families — but has not yet specified how, promising to “provide more information as soon as available.”

Cosponsors Rep. Abigail Spanberger (2nd from left) and Sen. Susan Collins (3rd from left) look on as President Biden signs the Social Security Fairness Act

SSA also says that beneficiaries “do not need to take any action except to verify that we have your current mailing address and direct deposit information if it has recently changed. Most people can do this online with their personal My Social Security account without calling or visiting Social Security. Visit www.ssa.gov/myaccount to sign in or create your account. We will provide ongoing updates regarding implementation.”

For more information on the Social Security Fairness Act, listen to our podcast interview with Jeff Cruz of the American Federation of Government Employees (AFGE), one of the most forceful advocates for repeal of the WEP & GPO.

Seven Falsehoods in Senator Mike Lee’s Social Security Post

Earlier this week, Senator Mike Lee (R-UT) posted an extensive – and patently ridiculous – diatribe against Social Security on X (formerly Twitter). The thread is full of falsehoods and misleading assertions about America’s most popular social insurance program, including its origins. Senator Lee incorporates many tired myths that the political right propagates to undermine a successful government program they can’t stand – simply because it is a successful government program.

In her book, “The Truth About Social Security,” social insurance expert and advocate Nancy Altman writes that “today’s discussions of Social Security are replete with revisionist history. Some of today’s revisionist statements are ‘zombie lies’… that refuse to die.”

The motive of these revisionist attacks is clear: to undermine public faith in Social Security so conservatives can cut or privatize it. According to Newsweek, a video has resurfaced from 2010 involving Senator Lee in which he said his intentions were to “phase out” Social Security altogether.

Never mind that Social Security is largely beloved by the American public or that it keeps seniors, people with disabilities, and their families from falling into poverty. Of course, Senator Lee focuses exclusively on the retirement portion while neglecting to mention that the program covers Americans of all ages in the event of the disability or death of a family breadwinner.

Making matters worse, Senator Lee’s post was amplified by the billionaire owner of X and Trump crony, Elon Musk. With Musk’s assist, Lee’s propaganda received some 40 million views on X. The right-wing misinformation machine that helped elect Donald Trump is now targeting Americans’ cherished earned benefits.

Here are 7 claims in Senator Lee’s X post that don’t pass the sniff test, followed by – gasp! – the actual FACTS:

#1

Lee: In 1935, the American people were sold a bill of goods. They were told, “Pay into this system, and it’ll be YOUR money for retirement.” Sounds great, right?

FACT: The American people were not “sold a bill of goods” in any way. President Franklin D. Roosevelt, who signed the program into law in 1935, made clear that Social Security was a social insurance program to help “protect against the hazards and vicissitudes of life.” (In 1934, FDR said that the aim of Social Security was “furthering the security of the citizen and his family through social insurance.”)

Workers pay into the program in exchange for benefits upon retirement, disability, or the death of a family breadwinner — similar to the way customers pay private insurance premiums and receive payouts when something they are insured against occurs (a house fire, a car accident, etc.). The Roosevelt administration never characterized Social Security as a personal savings account, though that is a common misunderstanding perpetuated by Social Security opponents like Senator Lee.

In distorting the nature and intent of Social Security, revisionists like Lee “seek to expunge the far-sighted and noble vision of Social Security’s founders, President Roosevelt and those around him,” writes Altman.

#2

Lee: First of all, this money doesn’t sit in a nice, individual account with your name on it. No, it goes into a huge account called the “Social Security Trust Fund.”

FACT: Again, Social Security was not designed or promoted as an individual savings account. This can be a bit confusing because Americans do receive Social Security numbers to track their income and calculate benefits. Senator Lee and others exploit this confusion to undermine Social Security itself.

Benefits are calculated according to lifetime wages and are designed to be “progressive.” In other words, lower-income retirees receive a larger proportion of their former work income in benefits than higher-earners do. Benefits are also adjusted for inflation, so that, most years, retirees receive a boost in their monthly Social Security payments.

It is no secret that surplus payroll contributions from workers go into a Social Security trust fund, which is invested in government bonds and repaid with interest — which helps to pay future benefits. That is simply how the system works.

#3

Lee: Here’s the kicker—the government routinely raids this fund. Yes, you heard that right. They take “your money” and use it for whatever the current Congress deems “necessary.”

FACT: This is another bogus claim that Social Security’s opponents perpetuate. The Social Security trust fund (currently valued at $2.8 trillion) is invested in treasury bonds backed by the full faith and credit of the U.S. government. Those bonds are repaid with interest, like any others. As our president and CEO regularly points out, if you had $2.8 trillion, you probably would not hide it under your mattress; you would invest it in safe securities.

Like the revenue from other government-issued bonds, Congress may spend that money how it sees fit (the military, roads, bridges, etc.). This is no different than bonds held by Wall Street mutual funds or foreign governments. However, Congress is not allowed to “raid” the Social Security trust fund itself — and has not done so. The assets in the trust fund belong solely to Social Security and can only be used to pay benefits and the cost of administering the program. Politicians are not stealing from it.

#4

Lee: If you had put the same amount into literally ANYTHING else—a mutual fund, real estate, even a savings account—you’d be better off by the time you reached retirement age, even if the government kept some of it!

FACT: While it’s true that investments in commodities and other markets can sometimes pay off, they are not reliable. The markets can be lucrative, but they also are volatile. And if the timing isn’t right, you could lose all or most of your retirement funds. Just ask the millions of people who were all set to retire in 2008 and saw their 401K’s and other investments evaporate.

Once again, Social Security is not an investment fund. It is a collective social insurance program that pays out promised benefits. In its nearly 90 years of existence, Social Security has never missed a payment to beneficiaries, through recessions, wars, and natural disasters. Even COVID was not able to disrupt the payment of promised Social Security benefits.

#5

Lee: Let’s talk about how this system is set up to fail. The demographic shift? More retirees, fewer workers. It’s almost fair to compare it to a Ponzi scheme that’s running out of new investors.

FACT: Lee does not explain how a system “set up to fail” has worked so well for almost a century. As for the “demographic shift” of “more retirees and fewer workers,” the historic Social Security reforms of 1983 already anticipated the swell in retirees that would occur when the Baby Boomers reached their senior years, and the coinciding trend toward lower birthrates. That is why the 1983 reforms were put in place — to keep Social Security financially strong well into the 21st century.

What the 1983 reformers did not anticipate (but perhaps should have) was the growing inequality in income that has plagued the country in the past 40 years, depriving Social Security of anticipated revenue. Four decades ago, 90% of the nation’s total wages were subject to Social Security payroll taxes. Today, that figure has sunk closer to 80% as the rich have gotten richer and most other Americans’ wages have stagnated. The solution is to adjust the payroll wage cap (now set at $176,100 for 2025) so that higher earners once again contribute their fair share — providing Social Security with billions of dollars in much-needed revenue.

Senator Lee falsely compares Social Security to a “Ponzi scheme.” (So have Donald Trump and other influential Republicans.). A Ponzi scheme is a criminal enterprise where investors are swindled out of promised returns. Social Security is an inter-generational compact which has worked remarkably well for nearly 90 years and never missed a payment.

#6

Lee: Remember, this isn’t just about retirement. It’s about independence, about controlling your own destiny. With Social Security, you control nothing.

FACT: This is probably the most absurd argument in Senator Lee’s post. Conservatives typically portray any government program that they don’t like (usually social programs, no matter how beneficial or successful) as compromising Americans’ freedom. Ronald Reagan famously warned against the passage of Medicare, saying, “You and I are going to spend our sunset years telling our children and our children’s children what it once was like in America when men were free.’

Of course, the opposite is true. Programs like Social Security and Medicare help to liberate seniors (and people with disabilities and their families) from fear of losing health coverage or falling into poverty. People who have baseline financial and health security are freer and more independent to live the way they wish, not less free.

To say that “you control nothing” with Social Security is patently ridiculous. Social Security provides you and your family with guaranteed retirement, disability, spousal, and survivor benefits. Participating in Social Security does not prevent you from investing in 401Ks, IRAs, real estate, or any other markets, or simply putting money in a savings account. More than half of the American workforce currently participates in an employer-sponsored retirement plan. These people are not prevented from doing that by Social Security. In fact, Social Security was once envisioned as part of a “three-legged stool” of retirement savings, pensions, and Social Security benefits. Unfortunately, Americans are having trouble saving for retirement because of growing income inequality and rising living costs, and few employers provide pensions anymore. That is an argument for expanding – not privatizing or cutting – Social Security.

#7

Lee: Social Security is government dependency at its worst.

FACT: Only in the fantasy world of the political right is Social Security “government dependency.” Social Security is not and has never been a welfare program. Americans contribute to it during the course of their working lives in return for promised benefits. It was designed that way on purpose; so that it would not be a government handout. Americans feel ownership of Social Security. That’s why when Senator Lee and others on the right float ideas to cut or privatize Social Security, seniors respond, “Hands off of Social Security. That’s our money. We paid for it!”

**********************************

2025 Medicare Premium Hike Nothing New, Part of Larger Trend

Medicare beneficiaries will be paying a higher premium for Part B insurance in 2025. Unfortunately, this is nothing new. Medicare premiums have been rising every year for decades now. The 2025 increase, though, is receiving an unusual amount of attention, probably because of the media’s hyper-focus on inflation in general.

Part B premiums will rise 2.7% (or $10.50 per month) for the average beneficiary. This exceeds the 2025 Social Security COLA of 2.5% (which also is not unusual). While seniors on fixed incomes already grappling with higher costs clearly won’t be happy paying an extra $10.50 per month for Medicare, the increase is in keeping with years past and part of a trend.

Health insurance premiums in general have been climbing, driven in part by soaring health care costs. The median increase in private marketplace premiums will be 7% in 2025, while premiums for employer-sponsored plans are expected to rise nine percent. The website Stretch Dollar attributes the spike in premiums to several factors, including:

*Higher labor costs in the health care sector.

*Hospital market consolidation gives insurance companies less negotiating power.

*The growing popularity of expensive specialty drugs like GLP-1 weight loss drugs and new gene therapies.

We don’t need to feel too sorry for the nation’s insurance behemoths, though. Unlike some other Western countries, profit motive is baked into our health coverage system. “All told, America’s biggest health insurers raked in more than $41 billion in profit in 2022,” reported the Penn Capital-Star — a “staggering sum of money” surpassing the GDP of some countries.

Annual premium hikes are to be expected given rising costs and massive inefficiencies in the U.S. health care system. In fact, Axios characterized ours as “one of the most inefficient health care systems among (the world’s) high-income countries.” Axios blames this, in part, on increased intervention in health care decisions by insurance companies (the ‘managed care’ model). “Administrative requirements that insurers sign off on care before it’s delivered… cost time and money.”

Unfortunately, this is the entire modus operandi of Medicare Advantage (MA), the privatized version of Medicare. MA insurers impose “prior authorizations” before patients can get certain treatments and procedures recommended by their doctors, often denying care that the publicly-administered “traditional Medicare” routinely covers. The built-in profit motive of M.A. plans (who receive fixed payments from Medicare for each patient) incentivizes insurers to pay out less for patient care.

The traditional Medicare program is far from perfect, but it is far more efficient at delivering care because it has no profit motive. In fact, traditional Medicare is one of the most efficiently administered health insurance programs. Traditional Medicare’s administrative costs are a scant two percent, while private insurance companies spend some 12-18% of their revenue on overhead.

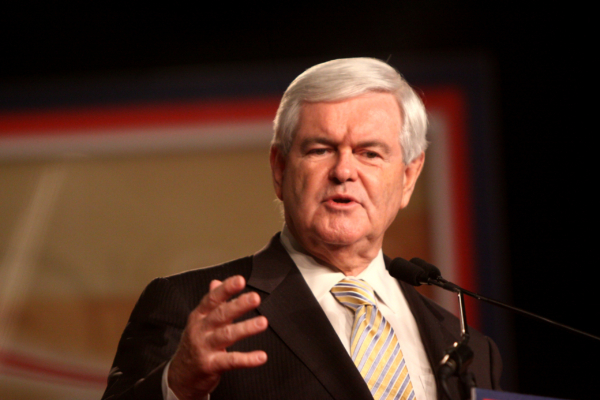

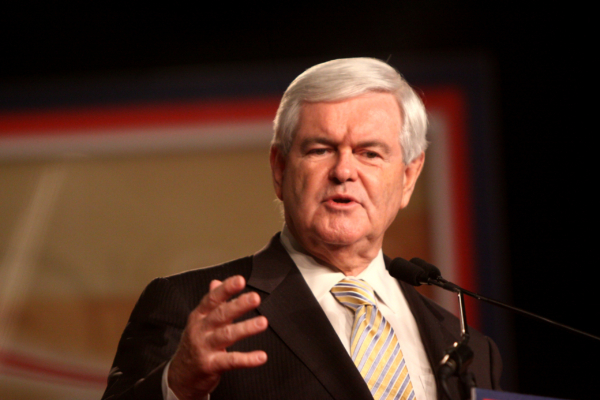

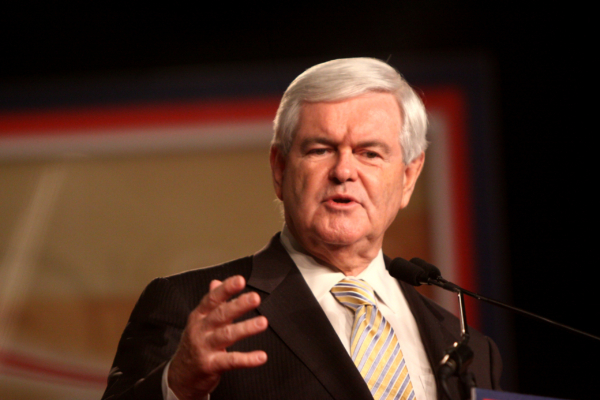

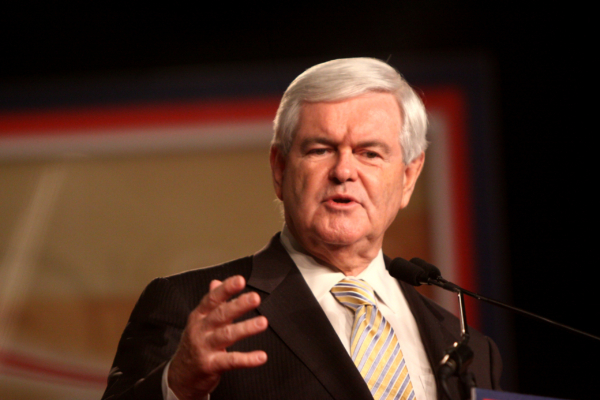

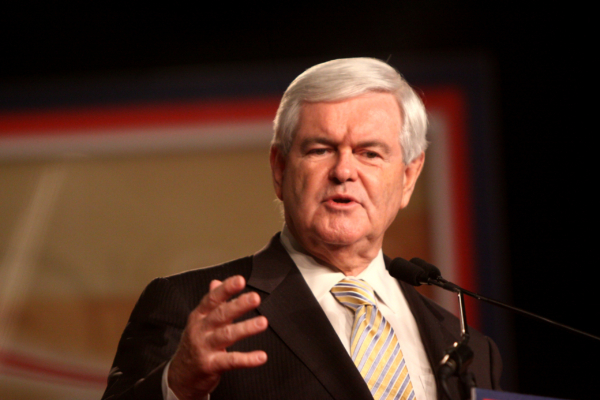

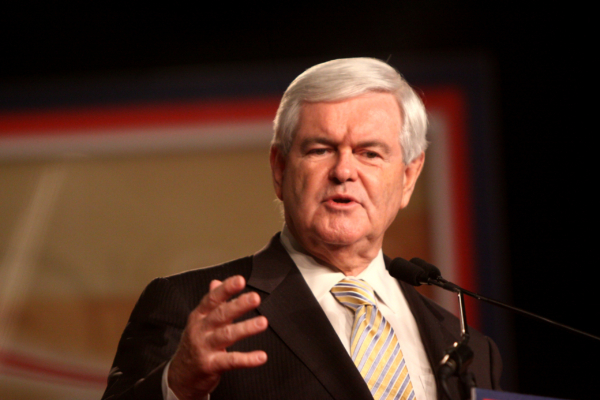

Fmr. House Speaker Newt Gingrich once said traditional Medicare would “wither on the vine.”

This is not to say that traditional Medicare can’t be improved. The same trends in health care costs that buffet the private markets affect Medicare as well. The Obama and Biden administrations attempted to cut Medicare’s costs without compromising patient care. In fact, the Inflation Reduction Act of 2022 is expected to save the program $6 billion by 2026 by lowering prescription drug costs. This and other Democratic proposals to cut Medicare costs — and increase revenue — will now languish in a second Trump administration with a Republican-controlled Congress.

In fact, the Republican agenda (as laid out in Project 2025) is to undermine traditional Medicare by steering seniors toward for-profit Medicare Advantage plans. If successful, they will have realized Newt Gingrich’s dream of leaving traditional Medicare to “wither on the vine.” Seniors do not deserve that.

Despite the increase in annual premiums, Medicare remains one of the most popular federal programs. According to Kaiser Family Foundation, 90% percent of Medicare beneficiaries rate their coverage positively, including half who say it is “excellent.” We and other advocates will continue to fight for a thriving Medicare program that prioritizes patients over profits.

Our senior health policy expert, Anne Montgomery, explains the choices confronting seniors during this year’s Medicare open enrollment season on the “Your Earned This” podcast. Listen here.

Trump “Buyout” Offer May Devastate Social Security Administration

Voters may have sent various messages to Washington last November, but they certainly did not include a call to gut the federal workforce that serves American seniors and people with disabilities. Yet, that’s exactly what the Trump administration — abetted by billionaire advisor ex-officio Elon Musk — is attempting to do.

On Tuesday, federal workers — including employees of the Social Security Administration — received an email from the U.S. Office of Personnel Management (OPM), offering “deferred resignation.” The email said employees could resign now and continue to receive pay and benefits through September — an offer of dubious legality that was immediately criticized by Democratic lawmakers and labor unions representing federal workers.

The email, which arrived under the subject line “Fork in the Road,” implies that federal employees who choose not to resign may be subject to future layoffs and also would have to conform to rigorous, new rules that the administration intends to impose — including an end to remote work and mandatory 5-days per week in the office. Workers’ advocates say that the email is an attempt to intimidate employees into resigning.

“It is clear that the Administration is seeking to undermine federal programs by eliminating career public servants,” wrote Senator Kirsten Gillibrand (D-NY) in a letter to OPM. “We have grave concerns for how these personnel decisions will affect the programs that serve the American people, especially those served by the Social Security Administration (SSA).”

The group Employees for Environmental Responsibility called Trump’s offer to federal workers “an illusion.”

“The offer is not a buyout and may be illegal. This is part of a larger effort by the Trump administration to get federal civil servants to quit by instilling fear and panic in the workforce.” – Employees for Environmental Responsibility, 1/27/25

Social Security advocates, including the National Committee, are alarmed (in particular) about the implications of the “buyout” offer for customers and employees of the Social Security Administration, which serves more than 68 million beneficiaries.

“SSA was already underfunded and understaffed,” says Dan Adcock, NCPMM’s director of government relations and policy. “This scheme by the administration will only exacerbate SSA’s existing problems. The agency currently does not have enough staff to meet beneficiaries’ needs — as is obvious from long hold times on SSA’s 1-800 phone number and interminable delays in hearing SSDI disability appeals.”

If the Trump administration is successful in culling the workforce at SSA, it will “take a sledgehammer to customer service,” says Adcock. He points out that many seniors are unable to conduct all of their business online and need direct contact with an SSA representative. “Bots replacing workers on the 800 phone line will not get the job done.”

Seniors and people with disabilities rely on SSA for a multitude of services — including claiming benefits, submitting changes in benefit status, and appealing benefit decisions, among other things. On top of its regular workload, SSA must now re-calculate benefits for some 3 million public sector retirees affected by the new Social Security Fairness Act. The agency announced that it may take up to one year for these workers to receive all of the payments to which they now are entitled under the new law. Advocates worry that this added workload may impede service for other current and future Social Security beneficiaries. (Some 10,000 Baby Boomers reach retirement age every day.)

The union representing Social Security administration workers, the American Federation of Government Employees (AFGE), is urging SSA staff not to accept the “buyout” offer at this time, pending further information from the Trump administration. “There is not yet any evidence the administration can or will uphold its end of the bargain, that Congress will go along with this unilateral massive restructuring, or that appropriated funds can be used this way,” said AFGE in an email to its members.

NCPSSM’s Dan Adcock accused the Trump administration of “running roughshod over the protections that civil servants have,” and predicts that there will be lawsuits over the “Fork in the Road” policy.

The First Social Security Beneficiary Got Her Check 85 Years Ago

Ida Mae Fuller in 1940

The following article is reprinted from the Social Security Administration (SSA) website www.ssa.gov

The First Social Security Beneficiary

Ida May Fuller was the first beneficiary of recurring monthly Social Security payments. Miss Fuller (known as Aunt Ida to her friends and family) was born on September 6, 1874 on a farm outside of Ludlow, Vermont. She attended school in Rutland, Vermont where one of her classmates was Calvin Coolidge. In 1905, after working as a school teacher, she became a legal secretary. One of the partners in the firm, John G. Sargent, would later become Attorney General in the Coolidge Administration.

Ida May never married and had no children. She lived alone most of her life, but spent eight years near the end of her life living with her niece, Hazel Perkins, and her family in Brattleboro, Vermont.

Miss Fuller filed her retirement claim on November 4, 1939, having worked under Social Security for a little short of three years. While running an errand she dropped by the Rutland Social Security office to ask about possible benefits. She would later observe: “It wasn’t that I expected anything, mind you, but I knew I’d been paying for something called Social Security and I wanted to ask the people in Rutland about it.”

Her claim was taken by Claims Clerk, Elizabeth Corcoran Burke, and transmitted to the Claims Division in Washington, D.C. for adjudication. The case was adjudicated and reviewed and sent to the Treasury Department for payment in January 1940. The claims were grouped in batches of 1,000 and a Certification List for each batch was sent to Treasury. Miss Fuller’s claim was the first one on the first Certification List and so the first Social Security check, check number 00-000-001, was issued to Ida May Fuller in the amount of $22.54 and dated January 31, 1940.

NCPSSM Attends Signing of Social Security Fairness Act, Repealing WEP & GPO

NCPSSM CEO Max Richtman and President Biden at the signing ceremony

Labor and seniors’ advocates have been lobbying for decades to repeal two provisions of Social Security law that penalized public sector retirees and their families — the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO). On Sunday, the efforts of the advocacy community paid off, when President Biden signed the Social Security Fairness Act into law. The new law eliminates the WEP & GPO, allowing some 2.5 million public sector retirees and spouses to collect full Social Security benefits.

President Biden praised the law as a “big deal” for teachers, firefighters, police officers, and other public servants “who dedicate their lives to their communities.” He said these retirees now will receive an average $360 monthly increase in Social Security benefits in 2025 — and would also receive a lump sum payment for benefits they would have earned in 2024.

The president said that the new law is in keeping with the basic promise of Social Security, “that all Americans should be able to retire with financial security and dignity.”

NCPSSM CEO Max Richtman, political director Luke Warren, and communications director Walter Gottlieb attended the signing ceremony at the White House. Richtman said that the law represents the culmination of lobbying by the National Committee to Preserve Social Security and Medicare and myriad other groups to restore fairness to the system.

“President Biden’s signing of the Social Security Fairness Act truly is historic. The new law rights a wrong that has either reduced or eliminated the Social Security benefits of certain government retirees. Nearly 3 million public sector employees and families will now be eligible to collect their full Social Security benefits.” – Max Richtman, NCPSSM President & CEO

The bipartisan bill passed the House in November, with the Senate vote coming at the very end of the 118th Congress in late December. Three of the bill’s sponsors attended the signing ceremony: Rep. Abigail Spanberger (D-VA), former Senator Sherrod Brown (D-OH), and Senator Susan Collins (R-ME). The bill’s Republican sponsor in the House, Rep. Garrett Graves (R-LA), did not attend.

The Social Security Administration (SSA) is responsible for paying benefits to newly eligible public sector workers and families — but has not yet specified how, promising to “provide more information as soon as available.”

Cosponsors Rep. Abigail Spanberger (2nd from left) and Sen. Susan Collins (3rd from left) look on as President Biden signs the Social Security Fairness Act

SSA also says that beneficiaries “do not need to take any action except to verify that we have your current mailing address and direct deposit information if it has recently changed. Most people can do this online with their personal My Social Security account without calling or visiting Social Security. Visit www.ssa.gov/myaccount to sign in or create your account. We will provide ongoing updates regarding implementation.”

For more information on the Social Security Fairness Act, listen to our podcast interview with Jeff Cruz of the American Federation of Government Employees (AFGE), one of the most forceful advocates for repeal of the WEP & GPO.

Seven Falsehoods in Senator Mike Lee’s Social Security Post

Earlier this week, Senator Mike Lee (R-UT) posted an extensive – and patently ridiculous – diatribe against Social Security on X (formerly Twitter). The thread is full of falsehoods and misleading assertions about America’s most popular social insurance program, including its origins. Senator Lee incorporates many tired myths that the political right propagates to undermine a successful government program they can’t stand – simply because it is a successful government program.

In her book, “The Truth About Social Security,” social insurance expert and advocate Nancy Altman writes that “today’s discussions of Social Security are replete with revisionist history. Some of today’s revisionist statements are ‘zombie lies’… that refuse to die.”

The motive of these revisionist attacks is clear: to undermine public faith in Social Security so conservatives can cut or privatize it. According to Newsweek, a video has resurfaced from 2010 involving Senator Lee in which he said his intentions were to “phase out” Social Security altogether.

Never mind that Social Security is largely beloved by the American public or that it keeps seniors, people with disabilities, and their families from falling into poverty. Of course, Senator Lee focuses exclusively on the retirement portion while neglecting to mention that the program covers Americans of all ages in the event of the disability or death of a family breadwinner.

Making matters worse, Senator Lee’s post was amplified by the billionaire owner of X and Trump crony, Elon Musk. With Musk’s assist, Lee’s propaganda received some 40 million views on X. The right-wing misinformation machine that helped elect Donald Trump is now targeting Americans’ cherished earned benefits.

Here are 7 claims in Senator Lee’s X post that don’t pass the sniff test, followed by – gasp! – the actual FACTS:

#1

Lee: In 1935, the American people were sold a bill of goods. They were told, “Pay into this system, and it’ll be YOUR money for retirement.” Sounds great, right?

FACT: The American people were not “sold a bill of goods” in any way. President Franklin D. Roosevelt, who signed the program into law in 1935, made clear that Social Security was a social insurance program to help “protect against the hazards and vicissitudes of life.” (In 1934, FDR said that the aim of Social Security was “furthering the security of the citizen and his family through social insurance.”)

Workers pay into the program in exchange for benefits upon retirement, disability, or the death of a family breadwinner — similar to the way customers pay private insurance premiums and receive payouts when something they are insured against occurs (a house fire, a car accident, etc.). The Roosevelt administration never characterized Social Security as a personal savings account, though that is a common misunderstanding perpetuated by Social Security opponents like Senator Lee.

In distorting the nature and intent of Social Security, revisionists like Lee “seek to expunge the far-sighted and noble vision of Social Security’s founders, President Roosevelt and those around him,” writes Altman.

#2

Lee: First of all, this money doesn’t sit in a nice, individual account with your name on it. No, it goes into a huge account called the “Social Security Trust Fund.”

FACT: Again, Social Security was not designed or promoted as an individual savings account. This can be a bit confusing because Americans do receive Social Security numbers to track their income and calculate benefits. Senator Lee and others exploit this confusion to undermine Social Security itself.

Benefits are calculated according to lifetime wages and are designed to be “progressive.” In other words, lower-income retirees receive a larger proportion of their former work income in benefits than higher-earners do. Benefits are also adjusted for inflation, so that, most years, retirees receive a boost in their monthly Social Security payments.

It is no secret that surplus payroll contributions from workers go into a Social Security trust fund, which is invested in government bonds and repaid with interest — which helps to pay future benefits. That is simply how the system works.

#3

Lee: Here’s the kicker—the government routinely raids this fund. Yes, you heard that right. They take “your money” and use it for whatever the current Congress deems “necessary.”

FACT: This is another bogus claim that Social Security’s opponents perpetuate. The Social Security trust fund (currently valued at $2.8 trillion) is invested in treasury bonds backed by the full faith and credit of the U.S. government. Those bonds are repaid with interest, like any others. As our president and CEO regularly points out, if you had $2.8 trillion, you probably would not hide it under your mattress; you would invest it in safe securities.

Like the revenue from other government-issued bonds, Congress may spend that money how it sees fit (the military, roads, bridges, etc.). This is no different than bonds held by Wall Street mutual funds or foreign governments. However, Congress is not allowed to “raid” the Social Security trust fund itself — and has not done so. The assets in the trust fund belong solely to Social Security and can only be used to pay benefits and the cost of administering the program. Politicians are not stealing from it.

#4

Lee: If you had put the same amount into literally ANYTHING else—a mutual fund, real estate, even a savings account—you’d be better off by the time you reached retirement age, even if the government kept some of it!

FACT: While it’s true that investments in commodities and other markets can sometimes pay off, they are not reliable. The markets can be lucrative, but they also are volatile. And if the timing isn’t right, you could lose all or most of your retirement funds. Just ask the millions of people who were all set to retire in 2008 and saw their 401K’s and other investments evaporate.

Once again, Social Security is not an investment fund. It is a collective social insurance program that pays out promised benefits. In its nearly 90 years of existence, Social Security has never missed a payment to beneficiaries, through recessions, wars, and natural disasters. Even COVID was not able to disrupt the payment of promised Social Security benefits.

#5

Lee: Let’s talk about how this system is set up to fail. The demographic shift? More retirees, fewer workers. It’s almost fair to compare it to a Ponzi scheme that’s running out of new investors.

FACT: Lee does not explain how a system “set up to fail” has worked so well for almost a century. As for the “demographic shift” of “more retirees and fewer workers,” the historic Social Security reforms of 1983 already anticipated the swell in retirees that would occur when the Baby Boomers reached their senior years, and the coinciding trend toward lower birthrates. That is why the 1983 reforms were put in place — to keep Social Security financially strong well into the 21st century.

What the 1983 reformers did not anticipate (but perhaps should have) was the growing inequality in income that has plagued the country in the past 40 years, depriving Social Security of anticipated revenue. Four decades ago, 90% of the nation’s total wages were subject to Social Security payroll taxes. Today, that figure has sunk closer to 80% as the rich have gotten richer and most other Americans’ wages have stagnated. The solution is to adjust the payroll wage cap (now set at $176,100 for 2025) so that higher earners once again contribute their fair share — providing Social Security with billions of dollars in much-needed revenue.

Senator Lee falsely compares Social Security to a “Ponzi scheme.” (So have Donald Trump and other influential Republicans.). A Ponzi scheme is a criminal enterprise where investors are swindled out of promised returns. Social Security is an inter-generational compact which has worked remarkably well for nearly 90 years and never missed a payment.

#6

Lee: Remember, this isn’t just about retirement. It’s about independence, about controlling your own destiny. With Social Security, you control nothing.

FACT: This is probably the most absurd argument in Senator Lee’s post. Conservatives typically portray any government program that they don’t like (usually social programs, no matter how beneficial or successful) as compromising Americans’ freedom. Ronald Reagan famously warned against the passage of Medicare, saying, “You and I are going to spend our sunset years telling our children and our children’s children what it once was like in America when men were free.’

Of course, the opposite is true. Programs like Social Security and Medicare help to liberate seniors (and people with disabilities and their families) from fear of losing health coverage or falling into poverty. People who have baseline financial and health security are freer and more independent to live the way they wish, not less free.

To say that “you control nothing” with Social Security is patently ridiculous. Social Security provides you and your family with guaranteed retirement, disability, spousal, and survivor benefits. Participating in Social Security does not prevent you from investing in 401Ks, IRAs, real estate, or any other markets, or simply putting money in a savings account. More than half of the American workforce currently participates in an employer-sponsored retirement plan. These people are not prevented from doing that by Social Security. In fact, Social Security was once envisioned as part of a “three-legged stool” of retirement savings, pensions, and Social Security benefits. Unfortunately, Americans are having trouble saving for retirement because of growing income inequality and rising living costs, and few employers provide pensions anymore. That is an argument for expanding – not privatizing or cutting – Social Security.

#7

Lee: Social Security is government dependency at its worst.

FACT: Only in the fantasy world of the political right is Social Security “government dependency.” Social Security is not and has never been a welfare program. Americans contribute to it during the course of their working lives in return for promised benefits. It was designed that way on purpose; so that it would not be a government handout. Americans feel ownership of Social Security. That’s why when Senator Lee and others on the right float ideas to cut or privatize Social Security, seniors respond, “Hands off of Social Security. That’s our money. We paid for it!”

**********************************

2025 Medicare Premium Hike Nothing New, Part of Larger Trend

Medicare beneficiaries will be paying a higher premium for Part B insurance in 2025. Unfortunately, this is nothing new. Medicare premiums have been rising every year for decades now. The 2025 increase, though, is receiving an unusual amount of attention, probably because of the media’s hyper-focus on inflation in general.

Part B premiums will rise 2.7% (or $10.50 per month) for the average beneficiary. This exceeds the 2025 Social Security COLA of 2.5% (which also is not unusual). While seniors on fixed incomes already grappling with higher costs clearly won’t be happy paying an extra $10.50 per month for Medicare, the increase is in keeping with years past and part of a trend.

Health insurance premiums in general have been climbing, driven in part by soaring health care costs. The median increase in private marketplace premiums will be 7% in 2025, while premiums for employer-sponsored plans are expected to rise nine percent. The website Stretch Dollar attributes the spike in premiums to several factors, including:

*Higher labor costs in the health care sector.

*Hospital market consolidation gives insurance companies less negotiating power.

*The growing popularity of expensive specialty drugs like GLP-1 weight loss drugs and new gene therapies.

We don’t need to feel too sorry for the nation’s insurance behemoths, though. Unlike some other Western countries, profit motive is baked into our health coverage system. “All told, America’s biggest health insurers raked in more than $41 billion in profit in 2022,” reported the Penn Capital-Star — a “staggering sum of money” surpassing the GDP of some countries.

Annual premium hikes are to be expected given rising costs and massive inefficiencies in the U.S. health care system. In fact, Axios characterized ours as “one of the most inefficient health care systems among (the world’s) high-income countries.” Axios blames this, in part, on increased intervention in health care decisions by insurance companies (the ‘managed care’ model). “Administrative requirements that insurers sign off on care before it’s delivered… cost time and money.”

Unfortunately, this is the entire modus operandi of Medicare Advantage (MA), the privatized version of Medicare. MA insurers impose “prior authorizations” before patients can get certain treatments and procedures recommended by their doctors, often denying care that the publicly-administered “traditional Medicare” routinely covers. The built-in profit motive of M.A. plans (who receive fixed payments from Medicare for each patient) incentivizes insurers to pay out less for patient care.

The traditional Medicare program is far from perfect, but it is far more efficient at delivering care because it has no profit motive. In fact, traditional Medicare is one of the most efficiently administered health insurance programs. Traditional Medicare’s administrative costs are a scant two percent, while private insurance companies spend some 12-18% of their revenue on overhead.

Fmr. House Speaker Newt Gingrich once said traditional Medicare would “wither on the vine.”

This is not to say that traditional Medicare can’t be improved. The same trends in health care costs that buffet the private markets affect Medicare as well. The Obama and Biden administrations attempted to cut Medicare’s costs without compromising patient care. In fact, the Inflation Reduction Act of 2022 is expected to save the program $6 billion by 2026 by lowering prescription drug costs. This and other Democratic proposals to cut Medicare costs — and increase revenue — will now languish in a second Trump administration with a Republican-controlled Congress.

In fact, the Republican agenda (as laid out in Project 2025) is to undermine traditional Medicare by steering seniors toward for-profit Medicare Advantage plans. If successful, they will have realized Newt Gingrich’s dream of leaving traditional Medicare to “wither on the vine.” Seniors do not deserve that.

Despite the increase in annual premiums, Medicare remains one of the most popular federal programs. According to Kaiser Family Foundation, 90% percent of Medicare beneficiaries rate their coverage positively, including half who say it is “excellent.” We and other advocates will continue to fight for a thriving Medicare program that prioritizes patients over profits.

Our senior health policy expert, Anne Montgomery, explains the choices confronting seniors during this year’s Medicare open enrollment season on the “Your Earned This” podcast. Listen here.