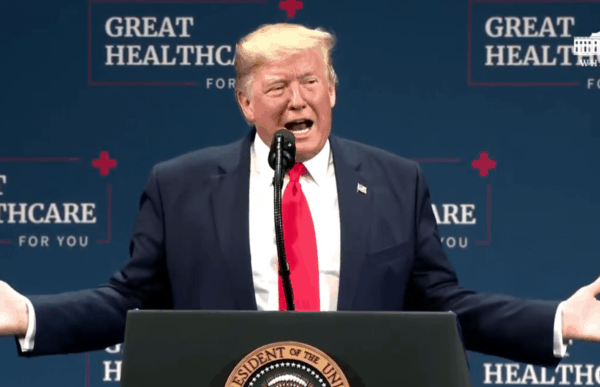

Trump & Musk Tried to Make it Harder for Parents to Register Newborns for Social Security

It started as a baffling and alarming decision. The Social Security Administration (SSA), under the influence of President Trump’s campaign to gut the federal government and Elon Musk’s DOGE team, announced the termination of Maine’s Enumeration at Birth (EAB) program. For 35 years, the EAB program had allowed parents to register their newborns for Social Security numbers right at the hospital. But suddenly, without warning, SSA moved to rescind this critical service, which would have compelled parents to register their children for Social Security with an SSA representative after leaving the hospital, at a time when Trump and Musk are closing SSA field offices and radically reducing the agency’s workforce.

Tellingly, SSA offered no reason for the original policy change — or its reversal shortly after. – NCPSSM, 3/7/25

Thankfully, after blowback from media reports and pressure from the Maine Department of Health and Human Services (DHHS), the SSA reversed its decision and rescinded the new policy. This quick reversal is good for Maine families, but make no mistake, the attempt itself speaks volumes about the Trump administration’s apparent agenda to dismantle Social Security from within.

Max Richtman, President and CEO of the National Committee to Preserve Social Security and Medicare, captured the severity of the situation when he noted, “The attempt to end the EAB program in Maine was the latest effort by Trump, Musk, and DOGE to incapacitate the agency that administers Social Security benefits for 73 million Americans. Even though they’ve backtracked in Maine, this obviously is part of a policy aimed at undermining the program.”

The Broader Strategy to Chip Away at Social Security

While the decision to reinstate EAB in Maine is welcome news for now, other states—including Arizona, Maryland, Michigan, New Mexico, and Rhode Island— are listed on the DOGE website as having their EAB contracts terminated as part of Musk’s “cost cutting” efforts.

Trump and Musk’s intentions are becoming increasingly obvious. This is part of a systematic effort to make Social Security harder to access and, in the process, shrink the program as a whole. “By closing field offices, coercing experienced employees into early retirement, and cutting over 7,000 jobs, the administration is methodically stripping the SSA of its ability to serve Americans efficiently,” said Richtman.

“Trump clearly has his priorities backwards. First, he makes the absurd claim that 360 year-olds may be collecting benefits, then he tries to strip parents of the ability to easily register their children for Social Security.” – Max Richtman, NCPSSM President and CEO

Temporary Reprieve in Maine, but an Ongoing Threat

The reversal of the EAB policy in Maine shows what media exposure can accomplish. The fact remains that SSA thought it could quietly eliminate this program with little to no accountability.

Policies like this create barriers. Barriers discourage participation. Discouraged participation weakens the system. It’s a chain reaction designed to dismantle Social Security — not in one master stroke but piece by piece.

This strategy isn’t just cruel; it’s deliberate. Richtman summed it up perfectly:

“Why on earth would the administration want to make it harder for parents to register their children for Social Security unless the aim was to shrink the size of the program?” – Max Richtman, 3/7/25

A Bigger Pattern of Sabotage

At the heart of this issue lies a deeper truth. Trump and Musk have long criticized Social Security. Musk recently called it a “Ponzi Scheme,” and Trump dismissed it as a “scam.” Their solution? Slash one of the government’s most effective and efficient programs, which currently has an overhead of less than 1%. By targeting EAB programs, shuttering field offices, and radically reducing staff, they’re advancing this goal. It isn’t just bad policy. It’s a blatant betrayal of Trump’s promise “not to touch” Social Security.

Millionaires Are Done Paying Into Social Security for 2025

Millionaires stop paying into Social Security for the year this week — and billionaires already stopped contributing wages to the program in January. The rest of us continue paying into the system for the entire year. Is it fair that Elon Musk, Rupert Murdoch, Charles Koch, and Tim Cook of Apple don’t have to contribute to Social Security for the rest of the year while most Americans do? We don’t think so. Our Social Security expert, Maria Freese, explains why we need to scrap — or adjust — the payroll wage cap.

Q: For those who don’t know, what is the Social Security “payroll wage cap?”

FREESE: Most people have no idea that there’s a limit on how much of your wages are subject to Social Security payroll taxes because they don’t make enough money to ever reach the cap. This year the cap is $176,100. Once you reach that amount in wages, you stop paying into Social Security for the rest of the year.

Q: So the slogan is: “Scrap the Cap” and we support adjusting the payroll wage cap. Why? Why do we support that?

FREESE: High-income earners pay a significantly smaller percentage of their wages into Social Security than the rest of us. That’s not only patently unfair; it deprives Social Security of much-needed revenue, and we believe that the best way to infuse new revenue into Social Security is to ask the wealthiest among us to pay their fair share.

Q: In years past, 90% of wages in this country fell below the cap, so that income was captured. Today, only about 83% of those earnings are subject to the Social Security payroll tax. That’s because of widening wealth inequality, correct?

FREESE: While middle-income workers’ wages have been stagnating for the last couple of decades, the earnings of the highest paid workers in the country have continued to grow disproportionately. This imbalance means that more and more of the income earned by the wealthy is exempt from paying into Social Security, while workers who are already suffering because their wages haven’t kept up with the cost of living over the past decades they continue contributing on every dollar they earn.

Q: Senator Bernie Sanders and Representative John Larson have offered legislation that would adjust the payroll wage cap, which would go a long way toward keeping the Social Security trust fund solvent beyond its projected depletion date in 2035. Tell us more about how these bills would do that.

FREESE: Both bills ask the wealthiest among us to pay their fair share. They just start at different thresholds. The bill by Senator Sanders reinstates Social Security payroll taxes for wages over $250,000 a year. The bill by Congressman Larson, on the other hand, begins the Social Security payroll taxes again for those earning over $400,000 a year. They did that intentionally, so that it would line up with President Biden’s commitment not to raise taxes on anyone earning under $400,000.

In addition to raising the wage cap, they also both impose a tax on investment income for the wealthiest, who, more and more, are living on the income produced by stocks and bonds rather than wages.

Q: In return for the wealthy contributing more, which they would under this legislation, they would get a higher benefit? Is that right?

FREESE: We believe they should, and in Congressman Larson’s bill, they do. Social security is an earned benefit. The taxes we contribute have a direct relationship to the amount of benefits we earn. For those who earn the least over their lifetimes, Social Security provides a higher proportionate benefit either in retirement or in case of disability — as a percentage of what they earned while they were working.

Q: To be clear, Congressman Larson’s bill does not raise payroll taxes for anyone earning less than $400,000 per year?

FREESE: That’s exactly right. And in fact, as I mentioned earlier, the bill by Congressman Larson does exactly that. It does not affect taxes paid by anyone earning under $400,000 a year. And that was done intentionally to align with former President Biden’s commitment not to raise taxes for anyone earning under that amount.

Q: If the Republicans oppose bringing in new revenue to Social Security by having the wealthy contribute a little more, what do the Republicans propose instead?

FREESE: That’s actually a very good question. Republicans have generally been unwilling to put any of their proposals on paper for obvious reasons. But they have floated proposals to raise the retirement age (a huge benefit cut), adopt a more miserly COLA formula, and even means-test benefits, which could seriously hurt middle class beneficiaries. Meanwhile, Donald Trump and Elon Musk appear to be hunting for revenue from the Social Security program by radically reducing Social Security Administration staff and claiming that there is “massive fraud” in the program. This is what we call “cutting benefits by cutting the SSA.”

Q: A recent survey that we did of our members and supporters indicates 96% support for raising the payroll wage cap. So I ask you again, if this is so popular, why hasn’t it been done?

FREESE: Republicans don’t support and have not supported in the past any proposals to raise taxes on their wealthy contributors or on corporations. So you can’t get any Republican support. You couldn’t get a bill through the current GOP-controlled House or Senate, let alone signed by President Trump.

Q: We have been beating this drum for many years now about adjusting the payroll wage cap. What do you think the likelihood is of this happening anytime soon?

FREESE: It’s really hard to get members of Congress to agree on anything unless they’re faced with a deadline or a crisis. And even then, it’s not easy to find consensus these days. Social Security doesn’t face that deadline until the trust funds become insolvent, which currently, as you mentioned, is projected to happen in the mid 2030s. It would be better for everyone if they were able to do it sooner rather than later, but Congress just doesn’t tend to work that way.

What the Heck is Going on at the Social Security Administration?

\

In the short period of time that Trump, Elon Musk and DOGE have had their hooks in the Social Security Administration, there have been alarming changes at the agency. The most obvious – and most egregious – is Musk and DOGE’s access to the sensitive personal data of some 70 million Social Security beneficiaries, creating the potential for enormous abuse. This was the first line of attack in Musk’s bogus campaign to expose fraud at an agency where improper payments are less than 1% of total benefits paid. (See his widely discredited claim that ‘150 year-olds are receiving benefits’ and other nonsense.)

Today, the American Prospect reported that Social Security’s acting commissioner asked that managers present him with a plan to cut the agency’s staff by 50%. The Prospect characterized this as “a mass firing that could affect tens of thousands of employees across the country.” This comes at a point when staffing at SSA is already at a 50-year low, with 10,000 Baby Boomers reaching retirement age every day.

“The idea of cutting the staff by 50% is outrageous and irresponsible — and would devastate customer service to the 70 million Americans on Social Security. There is no reason for slashing SSA’s workforce by half, other than the ideological crusade of Elon Musk, DOGE, and their sympathizers in SSA leadership to hollow out the agency that administers our most popular social insurance program and privatize as much of the federal government as they possibly can.” – National Committee to Preserve Social Security and Medicare, 2/26/25

Other troubling developments this week include the closure of SSA divisions (or offices) that Trump and Musk likely oppose on ideological grounds. This week SSA announced the closures of the Office of Civil Rights and the Office of Transformation. Former Commissioner Martin O’Malley created the Office of Transformation to spearhead the improvement of customer service at the understaffed, underfunded agency. By closing that office, Trump and Musk are signaling that improving service to beneficiaries no longer is a priority.

The closure of the Office Civil Rights and Equal Opportunity no doubt is part of the Trump administration’s crusade to eliminate protections for groups that have traditionally faced discrimination.

According to a former SSA employee who wishes to remain anonymous, the Office of Civil Rights “spent most of their time processing sexual harassment complaints, race and sex discrimination complaints, and advising on administrative issues, such as reasonable accommodation (RA) requests from staff with physical disabilities.”

SSA disingenuously claims that this office was ‘redundant’ and is shifting responsibilities to different departments. This move seems more symbolic than pragmatic — and is consistent with the mean-spirted MAGA campaign against Diversity, Equity, and Inclusion (DEI). “So much for the land of equality,” said one of our grassroots volunteers in Florida.

“This is an ideological campaign, not a good faith effort to improve government. What Musk & DOGE are trying to do is discredit our most popular social insurance program that has been doing its job quite well for almost 90 years. Perhaps they hope not only to question the value of Social Security, but lay the groundwork to cut benefits going forward. – NCPSSM President and CEO Max Richtman, 2/26/25

It’s noteworthy that these changes are all being made before a confirmed Social Security commissioner takes over. President Trump nominated financial services executive Frank Bisignano, but he has yet to be confirmed or sworn in. In the meantime, Leland Dudek, a GS-15 employee not in the ranks of upper management, was elevated to acting commissioner after the previous person in that post resigned in protest. Dudek, who is considered sympathetic to Musk and DOGE’s crusade, is the one who reportedly is considering firing 50% of the agency’s staff, and who presided over this week’s other alarming changes.

Social Security’s controversial new acting commissioner, Leland Dudek

On Monday, the union representing most SSA employees (AFSCME), filed suit in federal court “to stop DOGE’s unlawful seizure of people’s personal, sensitive data from the Social Security Administration.” The only apparent public resistance to the Musk/DOGE takeover of Social Security has come from unions, advocacy groups, and Democrats in Congress; but congressional Republicans and the President himself seem fine with the unelected billionaire Musk and his minions taking a wrecking ball to the Social Security Administration — one of the most efficient agencies in the federal government.

Trump “Buyout” Offer May Devastate Social Security Administration

Voters may have sent various messages to Washington last November, but they certainly did not include a call to gut the federal workforce that serves American seniors and people with disabilities. Yet, that’s exactly what the Trump administration — abetted by billionaire advisor ex-officio Elon Musk — is attempting to do.

On Tuesday, federal workers — including employees of the Social Security Administration — received an email from the U.S. Office of Personnel Management (OPM), offering “deferred resignation.” The email said employees could resign now and continue to receive pay and benefits through September — an offer of dubious legality that was immediately criticized by Democratic lawmakers and labor unions representing federal workers.

The email, which arrived under the subject line “Fork in the Road,” implies that federal employees who choose not to resign may be subject to future layoffs and also would have to conform to rigorous, new rules that the administration intends to impose — including an end to remote work and mandatory 5-days per week in the office. Workers’ advocates say that the email is an attempt to intimidate employees into resigning.

“It is clear that the Administration is seeking to undermine federal programs by eliminating career public servants,” wrote Senator Kirsten Gillibrand (D-NY) in a letter to OPM. “We have grave concerns for how these personnel decisions will affect the programs that serve the American people, especially those served by the Social Security Administration (SSA).”

The group Employees for Environmental Responsibility called Trump’s offer to federal workers “an illusion.”

“The offer is not a buyout and may be illegal. This is part of a larger effort by the Trump administration to get federal civil servants to quit by instilling fear and panic in the workforce.” – Employees for Environmental Responsibility, 1/27/25

Social Security advocates, including the National Committee, are alarmed (in particular) about the implications of the “buyout” offer for customers and employees of the Social Security Administration, which serves more than 68 million beneficiaries.

“SSA was already underfunded and understaffed,” says Dan Adcock, NCPMM’s director of government relations and policy. “This scheme by the administration will only exacerbate SSA’s existing problems. The agency currently does not have enough staff to meet beneficiaries’ needs — as is obvious from long hold times on SSA’s 1-800 phone number and interminable delays in hearing SSDI disability appeals.”

If the Trump administration is successful in culling the workforce at SSA, it will “take a sledgehammer to customer service,” says Adcock. He points out that many seniors are unable to conduct all of their business online and need direct contact with an SSA representative. “Bots replacing workers on the 800 phone line will not get the job done.”

Seniors and people with disabilities rely on SSA for a multitude of services — including claiming benefits, submitting changes in benefit status, and appealing benefit decisions, among other things. On top of its regular workload, SSA must now re-calculate benefits for some 3 million public sector retirees affected by the new Social Security Fairness Act. The agency announced that it may take up to one year for these workers to receive all of the payments to which they now are entitled under the new law. Advocates worry that this added workload may impede service for other current and future Social Security beneficiaries. (Some 10,000 Baby Boomers reach retirement age every day.)

The union representing Social Security administration workers, the American Federation of Government Employees (AFGE), is urging SSA staff not to accept the “buyout” offer at this time, pending further information from the Trump administration. “There is not yet any evidence the administration can or will uphold its end of the bargain, that Congress will go along with this unilateral massive restructuring, or that appropriated funds can be used this way,” said AFGE in an email to its members.

NCPSSM’s Dan Adcock accused the Trump administration of “running roughshod over the protections that civil servants have,” and predicts that there will be lawsuits over the “Fork in the Road” policy.

The First Social Security Beneficiary Got Her Check 85 Years Ago

Ida Mae Fuller in 1940

The following article is reprinted from the Social Security Administration (SSA) website www.ssa.gov

The First Social Security Beneficiary

Ida May Fuller was the first beneficiary of recurring monthly Social Security payments. Miss Fuller (known as Aunt Ida to her friends and family) was born on September 6, 1874 on a farm outside of Ludlow, Vermont. She attended school in Rutland, Vermont where one of her classmates was Calvin Coolidge. In 1905, after working as a school teacher, she became a legal secretary. One of the partners in the firm, John G. Sargent, would later become Attorney General in the Coolidge Administration.

Ida May never married and had no children. She lived alone most of her life, but spent eight years near the end of her life living with her niece, Hazel Perkins, and her family in Brattleboro, Vermont.

Miss Fuller filed her retirement claim on November 4, 1939, having worked under Social Security for a little short of three years. While running an errand she dropped by the Rutland Social Security office to ask about possible benefits. She would later observe: “It wasn’t that I expected anything, mind you, but I knew I’d been paying for something called Social Security and I wanted to ask the people in Rutland about it.”

Her claim was taken by Claims Clerk, Elizabeth Corcoran Burke, and transmitted to the Claims Division in Washington, D.C. for adjudication. The case was adjudicated and reviewed and sent to the Treasury Department for payment in January 1940. The claims were grouped in batches of 1,000 and a Certification List for each batch was sent to Treasury. Miss Fuller’s claim was the first one on the first Certification List and so the first Social Security check, check number 00-000-001, was issued to Ida May Fuller in the amount of $22.54 and dated January 31, 1940.

Trump & Musk Tried to Make it Harder for Parents to Register Newborns for Social Security

It started as a baffling and alarming decision. The Social Security Administration (SSA), under the influence of President Trump’s campaign to gut the federal government and Elon Musk’s DOGE team, announced the termination of Maine’s Enumeration at Birth (EAB) program. For 35 years, the EAB program had allowed parents to register their newborns for Social Security numbers right at the hospital. But suddenly, without warning, SSA moved to rescind this critical service, which would have compelled parents to register their children for Social Security with an SSA representative after leaving the hospital, at a time when Trump and Musk are closing SSA field offices and radically reducing the agency’s workforce.

Tellingly, SSA offered no reason for the original policy change — or its reversal shortly after. – NCPSSM, 3/7/25

Thankfully, after blowback from media reports and pressure from the Maine Department of Health and Human Services (DHHS), the SSA reversed its decision and rescinded the new policy. This quick reversal is good for Maine families, but make no mistake, the attempt itself speaks volumes about the Trump administration’s apparent agenda to dismantle Social Security from within.

Max Richtman, President and CEO of the National Committee to Preserve Social Security and Medicare, captured the severity of the situation when he noted, “The attempt to end the EAB program in Maine was the latest effort by Trump, Musk, and DOGE to incapacitate the agency that administers Social Security benefits for 73 million Americans. Even though they’ve backtracked in Maine, this obviously is part of a policy aimed at undermining the program.”

The Broader Strategy to Chip Away at Social Security

While the decision to reinstate EAB in Maine is welcome news for now, other states—including Arizona, Maryland, Michigan, New Mexico, and Rhode Island— are listed on the DOGE website as having their EAB contracts terminated as part of Musk’s “cost cutting” efforts.

Trump and Musk’s intentions are becoming increasingly obvious. This is part of a systematic effort to make Social Security harder to access and, in the process, shrink the program as a whole. “By closing field offices, coercing experienced employees into early retirement, and cutting over 7,000 jobs, the administration is methodically stripping the SSA of its ability to serve Americans efficiently,” said Richtman.

“Trump clearly has his priorities backwards. First, he makes the absurd claim that 360 year-olds may be collecting benefits, then he tries to strip parents of the ability to easily register their children for Social Security.” – Max Richtman, NCPSSM President and CEO

Temporary Reprieve in Maine, but an Ongoing Threat

The reversal of the EAB policy in Maine shows what media exposure can accomplish. The fact remains that SSA thought it could quietly eliminate this program with little to no accountability.

Policies like this create barriers. Barriers discourage participation. Discouraged participation weakens the system. It’s a chain reaction designed to dismantle Social Security — not in one master stroke but piece by piece.

This strategy isn’t just cruel; it’s deliberate. Richtman summed it up perfectly:

“Why on earth would the administration want to make it harder for parents to register their children for Social Security unless the aim was to shrink the size of the program?” – Max Richtman, 3/7/25

A Bigger Pattern of Sabotage

At the heart of this issue lies a deeper truth. Trump and Musk have long criticized Social Security. Musk recently called it a “Ponzi Scheme,” and Trump dismissed it as a “scam.” Their solution? Slash one of the government’s most effective and efficient programs, which currently has an overhead of less than 1%. By targeting EAB programs, shuttering field offices, and radically reducing staff, they’re advancing this goal. It isn’t just bad policy. It’s a blatant betrayal of Trump’s promise “not to touch” Social Security.

Millionaires Are Done Paying Into Social Security for 2025

Millionaires stop paying into Social Security for the year this week — and billionaires already stopped contributing wages to the program in January. The rest of us continue paying into the system for the entire year. Is it fair that Elon Musk, Rupert Murdoch, Charles Koch, and Tim Cook of Apple don’t have to contribute to Social Security for the rest of the year while most Americans do? We don’t think so. Our Social Security expert, Maria Freese, explains why we need to scrap — or adjust — the payroll wage cap.

Q: For those who don’t know, what is the Social Security “payroll wage cap?”

FREESE: Most people have no idea that there’s a limit on how much of your wages are subject to Social Security payroll taxes because they don’t make enough money to ever reach the cap. This year the cap is $176,100. Once you reach that amount in wages, you stop paying into Social Security for the rest of the year.

Q: So the slogan is: “Scrap the Cap” and we support adjusting the payroll wage cap. Why? Why do we support that?

FREESE: High-income earners pay a significantly smaller percentage of their wages into Social Security than the rest of us. That’s not only patently unfair; it deprives Social Security of much-needed revenue, and we believe that the best way to infuse new revenue into Social Security is to ask the wealthiest among us to pay their fair share.

Q: In years past, 90% of wages in this country fell below the cap, so that income was captured. Today, only about 83% of those earnings are subject to the Social Security payroll tax. That’s because of widening wealth inequality, correct?

FREESE: While middle-income workers’ wages have been stagnating for the last couple of decades, the earnings of the highest paid workers in the country have continued to grow disproportionately. This imbalance means that more and more of the income earned by the wealthy is exempt from paying into Social Security, while workers who are already suffering because their wages haven’t kept up with the cost of living over the past decades they continue contributing on every dollar they earn.

Q: Senator Bernie Sanders and Representative John Larson have offered legislation that would adjust the payroll wage cap, which would go a long way toward keeping the Social Security trust fund solvent beyond its projected depletion date in 2035. Tell us more about how these bills would do that.

FREESE: Both bills ask the wealthiest among us to pay their fair share. They just start at different thresholds. The bill by Senator Sanders reinstates Social Security payroll taxes for wages over $250,000 a year. The bill by Congressman Larson, on the other hand, begins the Social Security payroll taxes again for those earning over $400,000 a year. They did that intentionally, so that it would line up with President Biden’s commitment not to raise taxes on anyone earning under $400,000.

In addition to raising the wage cap, they also both impose a tax on investment income for the wealthiest, who, more and more, are living on the income produced by stocks and bonds rather than wages.

Q: In return for the wealthy contributing more, which they would under this legislation, they would get a higher benefit? Is that right?

FREESE: We believe they should, and in Congressman Larson’s bill, they do. Social security is an earned benefit. The taxes we contribute have a direct relationship to the amount of benefits we earn. For those who earn the least over their lifetimes, Social Security provides a higher proportionate benefit either in retirement or in case of disability — as a percentage of what they earned while they were working.

Q: To be clear, Congressman Larson’s bill does not raise payroll taxes for anyone earning less than $400,000 per year?

FREESE: That’s exactly right. And in fact, as I mentioned earlier, the bill by Congressman Larson does exactly that. It does not affect taxes paid by anyone earning under $400,000 a year. And that was done intentionally to align with former President Biden’s commitment not to raise taxes for anyone earning under that amount.

Q: If the Republicans oppose bringing in new revenue to Social Security by having the wealthy contribute a little more, what do the Republicans propose instead?

FREESE: That’s actually a very good question. Republicans have generally been unwilling to put any of their proposals on paper for obvious reasons. But they have floated proposals to raise the retirement age (a huge benefit cut), adopt a more miserly COLA formula, and even means-test benefits, which could seriously hurt middle class beneficiaries. Meanwhile, Donald Trump and Elon Musk appear to be hunting for revenue from the Social Security program by radically reducing Social Security Administration staff and claiming that there is “massive fraud” in the program. This is what we call “cutting benefits by cutting the SSA.”

Q: A recent survey that we did of our members and supporters indicates 96% support for raising the payroll wage cap. So I ask you again, if this is so popular, why hasn’t it been done?

FREESE: Republicans don’t support and have not supported in the past any proposals to raise taxes on their wealthy contributors or on corporations. So you can’t get any Republican support. You couldn’t get a bill through the current GOP-controlled House or Senate, let alone signed by President Trump.

Q: We have been beating this drum for many years now about adjusting the payroll wage cap. What do you think the likelihood is of this happening anytime soon?

FREESE: It’s really hard to get members of Congress to agree on anything unless they’re faced with a deadline or a crisis. And even then, it’s not easy to find consensus these days. Social Security doesn’t face that deadline until the trust funds become insolvent, which currently, as you mentioned, is projected to happen in the mid 2030s. It would be better for everyone if they were able to do it sooner rather than later, but Congress just doesn’t tend to work that way.

What the Heck is Going on at the Social Security Administration?

\

In the short period of time that Trump, Elon Musk and DOGE have had their hooks in the Social Security Administration, there have been alarming changes at the agency. The most obvious – and most egregious – is Musk and DOGE’s access to the sensitive personal data of some 70 million Social Security beneficiaries, creating the potential for enormous abuse. This was the first line of attack in Musk’s bogus campaign to expose fraud at an agency where improper payments are less than 1% of total benefits paid. (See his widely discredited claim that ‘150 year-olds are receiving benefits’ and other nonsense.)

Today, the American Prospect reported that Social Security’s acting commissioner asked that managers present him with a plan to cut the agency’s staff by 50%. The Prospect characterized this as “a mass firing that could affect tens of thousands of employees across the country.” This comes at a point when staffing at SSA is already at a 50-year low, with 10,000 Baby Boomers reaching retirement age every day.

“The idea of cutting the staff by 50% is outrageous and irresponsible — and would devastate customer service to the 70 million Americans on Social Security. There is no reason for slashing SSA’s workforce by half, other than the ideological crusade of Elon Musk, DOGE, and their sympathizers in SSA leadership to hollow out the agency that administers our most popular social insurance program and privatize as much of the federal government as they possibly can.” – National Committee to Preserve Social Security and Medicare, 2/26/25

Other troubling developments this week include the closure of SSA divisions (or offices) that Trump and Musk likely oppose on ideological grounds. This week SSA announced the closures of the Office of Civil Rights and the Office of Transformation. Former Commissioner Martin O’Malley created the Office of Transformation to spearhead the improvement of customer service at the understaffed, underfunded agency. By closing that office, Trump and Musk are signaling that improving service to beneficiaries no longer is a priority.

The closure of the Office Civil Rights and Equal Opportunity no doubt is part of the Trump administration’s crusade to eliminate protections for groups that have traditionally faced discrimination.

According to a former SSA employee who wishes to remain anonymous, the Office of Civil Rights “spent most of their time processing sexual harassment complaints, race and sex discrimination complaints, and advising on administrative issues, such as reasonable accommodation (RA) requests from staff with physical disabilities.”

SSA disingenuously claims that this office was ‘redundant’ and is shifting responsibilities to different departments. This move seems more symbolic than pragmatic — and is consistent with the mean-spirted MAGA campaign against Diversity, Equity, and Inclusion (DEI). “So much for the land of equality,” said one of our grassroots volunteers in Florida.

“This is an ideological campaign, not a good faith effort to improve government. What Musk & DOGE are trying to do is discredit our most popular social insurance program that has been doing its job quite well for almost 90 years. Perhaps they hope not only to question the value of Social Security, but lay the groundwork to cut benefits going forward. – NCPSSM President and CEO Max Richtman, 2/26/25

It’s noteworthy that these changes are all being made before a confirmed Social Security commissioner takes over. President Trump nominated financial services executive Frank Bisignano, but he has yet to be confirmed or sworn in. In the meantime, Leland Dudek, a GS-15 employee not in the ranks of upper management, was elevated to acting commissioner after the previous person in that post resigned in protest. Dudek, who is considered sympathetic to Musk and DOGE’s crusade, is the one who reportedly is considering firing 50% of the agency’s staff, and who presided over this week’s other alarming changes.

Social Security’s controversial new acting commissioner, Leland Dudek

On Monday, the union representing most SSA employees (AFSCME), filed suit in federal court “to stop DOGE’s unlawful seizure of people’s personal, sensitive data from the Social Security Administration.” The only apparent public resistance to the Musk/DOGE takeover of Social Security has come from unions, advocacy groups, and Democrats in Congress; but congressional Republicans and the President himself seem fine with the unelected billionaire Musk and his minions taking a wrecking ball to the Social Security Administration — one of the most efficient agencies in the federal government.

Trump “Buyout” Offer May Devastate Social Security Administration

Voters may have sent various messages to Washington last November, but they certainly did not include a call to gut the federal workforce that serves American seniors and people with disabilities. Yet, that’s exactly what the Trump administration — abetted by billionaire advisor ex-officio Elon Musk — is attempting to do.

On Tuesday, federal workers — including employees of the Social Security Administration — received an email from the U.S. Office of Personnel Management (OPM), offering “deferred resignation.” The email said employees could resign now and continue to receive pay and benefits through September — an offer of dubious legality that was immediately criticized by Democratic lawmakers and labor unions representing federal workers.

The email, which arrived under the subject line “Fork in the Road,” implies that federal employees who choose not to resign may be subject to future layoffs and also would have to conform to rigorous, new rules that the administration intends to impose — including an end to remote work and mandatory 5-days per week in the office. Workers’ advocates say that the email is an attempt to intimidate employees into resigning.

“It is clear that the Administration is seeking to undermine federal programs by eliminating career public servants,” wrote Senator Kirsten Gillibrand (D-NY) in a letter to OPM. “We have grave concerns for how these personnel decisions will affect the programs that serve the American people, especially those served by the Social Security Administration (SSA).”

The group Employees for Environmental Responsibility called Trump’s offer to federal workers “an illusion.”

“The offer is not a buyout and may be illegal. This is part of a larger effort by the Trump administration to get federal civil servants to quit by instilling fear and panic in the workforce.” – Employees for Environmental Responsibility, 1/27/25

Social Security advocates, including the National Committee, are alarmed (in particular) about the implications of the “buyout” offer for customers and employees of the Social Security Administration, which serves more than 68 million beneficiaries.

“SSA was already underfunded and understaffed,” says Dan Adcock, NCPMM’s director of government relations and policy. “This scheme by the administration will only exacerbate SSA’s existing problems. The agency currently does not have enough staff to meet beneficiaries’ needs — as is obvious from long hold times on SSA’s 1-800 phone number and interminable delays in hearing SSDI disability appeals.”

If the Trump administration is successful in culling the workforce at SSA, it will “take a sledgehammer to customer service,” says Adcock. He points out that many seniors are unable to conduct all of their business online and need direct contact with an SSA representative. “Bots replacing workers on the 800 phone line will not get the job done.”

Seniors and people with disabilities rely on SSA for a multitude of services — including claiming benefits, submitting changes in benefit status, and appealing benefit decisions, among other things. On top of its regular workload, SSA must now re-calculate benefits for some 3 million public sector retirees affected by the new Social Security Fairness Act. The agency announced that it may take up to one year for these workers to receive all of the payments to which they now are entitled under the new law. Advocates worry that this added workload may impede service for other current and future Social Security beneficiaries. (Some 10,000 Baby Boomers reach retirement age every day.)

The union representing Social Security administration workers, the American Federation of Government Employees (AFGE), is urging SSA staff not to accept the “buyout” offer at this time, pending further information from the Trump administration. “There is not yet any evidence the administration can or will uphold its end of the bargain, that Congress will go along with this unilateral massive restructuring, or that appropriated funds can be used this way,” said AFGE in an email to its members.

NCPSSM’s Dan Adcock accused the Trump administration of “running roughshod over the protections that civil servants have,” and predicts that there will be lawsuits over the “Fork in the Road” policy.

The First Social Security Beneficiary Got Her Check 85 Years Ago

Ida Mae Fuller in 1940

The following article is reprinted from the Social Security Administration (SSA) website www.ssa.gov

The First Social Security Beneficiary

Ida May Fuller was the first beneficiary of recurring monthly Social Security payments. Miss Fuller (known as Aunt Ida to her friends and family) was born on September 6, 1874 on a farm outside of Ludlow, Vermont. She attended school in Rutland, Vermont where one of her classmates was Calvin Coolidge. In 1905, after working as a school teacher, she became a legal secretary. One of the partners in the firm, John G. Sargent, would later become Attorney General in the Coolidge Administration.

Ida May never married and had no children. She lived alone most of her life, but spent eight years near the end of her life living with her niece, Hazel Perkins, and her family in Brattleboro, Vermont.

Miss Fuller filed her retirement claim on November 4, 1939, having worked under Social Security for a little short of three years. While running an errand she dropped by the Rutland Social Security office to ask about possible benefits. She would later observe: “It wasn’t that I expected anything, mind you, but I knew I’d been paying for something called Social Security and I wanted to ask the people in Rutland about it.”

Her claim was taken by Claims Clerk, Elizabeth Corcoran Burke, and transmitted to the Claims Division in Washington, D.C. for adjudication. The case was adjudicated and reviewed and sent to the Treasury Department for payment in January 1940. The claims were grouped in batches of 1,000 and a Certification List for each batch was sent to Treasury. Miss Fuller’s claim was the first one on the first Certification List and so the first Social Security check, check number 00-000-001, was issued to Ida May Fuller in the amount of $22.54 and dated January 31, 1940.