7 Questions for Trump’s Social Security Commissioner Nominee

President Trump’s pick to head the Social Security Administration, Frank Bisignano, will have his Senate confirmation hearing on Tuesday morning. The financial services CEO and Republican donor has been waiting in the wings since the Trump administration took over in January. In the meantime, Elon Musk and his DOGE squad have invaded the Social Security Administration (SSA) and wreaked considerable havoc on the agency — alarming seniors’ advocates and a sizeable swath of the general public. Under the banner of rooting out “fraud” (of which they have found none), Musk’s minions are in the process of rendering SSA dysfunctional and jeopardizing the delivery of benefits.

In the absence of a confirmed commissioner, Acting SSA chief Leland Dudek has abetted Musk and DOGE every step of the way, allowing them access to the sensitive personal data of 73 million Americans for no justifiable reason, radically reducing the workforce that serves Social Security customers, closing field offices, and slashing services on the agency’s 1-800 phone number that seniors rely on. He claims to be “following orders” from President Trump and Elon Musk. Dudek threatened to “shut down” SSA after a federal judge ruled against the agency’s decision to grant Musk and DOGE access to beneficiaries’ private data.

Bisignano has no appreciable experience in public service in general — or Social Security in particular — but Trump wants him to run one of the federal agencies that most closely touches Americans’ lives every day. We don’t know much about what Bisignano thinks of Social Security or what he will do to the program if confirmed.

Here are 7 questions we would like to see Frank Bisignano answer at Tuesdays’ hearing:

#1 Do you agree with the changes that Musk and Dudek have made at SSA pending your confirmation?

#2 A federal judge has ruled that Musk AND DOGE should not have access to the personal data of 73 million Americans. Do you agree or disagree?

#3 SSA has been chronically underfunded and understaffed. With 10,000 Baby Boomers reaching 65 every day, is this really the time to be slashing the workforce and closing field offices?

#4 Do you believe that Social Security itself or the functions of the SSA should be privatized? And if Social Security were to be privatized, would you and your peers in the financial services industry benefit?

#5 Do you think beneficiaries who have been overpaid (usually through no fault of their own) should have 100% of their Social Security checks clawed back pending repayment?

#6 Elon Musk recently called Social Security a Ponzi Scheme. Do you agree?

#7 What do you feel is the fair and just solution to the projected depletion of the Social Security trust fund? Do you support raising the Social Security retirement age?

Frankly, we don’t expect Bisignano to answer these kinds of questions, but they should be put to him on the record, anyway. We hope that committee members (especially Democrats including ranking member Ron Wyden, Bernie Sanders and Elizabeth Warren) will press the nominee on these extremely important issues to American seniors, people with disabilities, and their families. At this existential moment for Social Security, the public deserves nothing less.

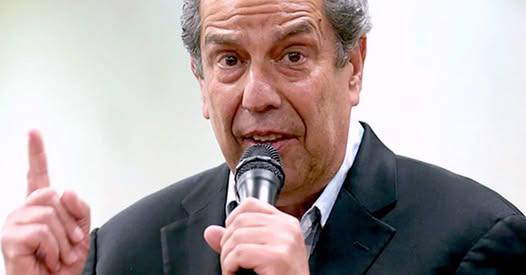

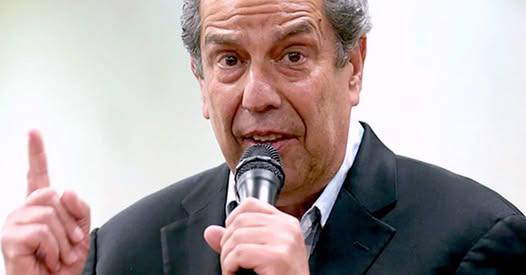

Jon “Bowzer” Bauman Sings the Praises of Social Security

Jon “Bowzer” Bauman is best known from the 70s tv show “Sha Na Na,” where he charmed audiences with his greaser persona, elastic expressions, and basso renditions of 1950s pop music classics — including the band’s cover of “Goodnight, Sweetheart.” Over the years, though, Bowzer has evolved from doo wop revivalist to seniors’ activist — especially when it comes to Social Security. He talked about his evolution from pure entertainment to entertainment and advocacy on a recent episode of the “You Earned This” podcast.

Bowzer’s Shift to Advocacy

Bowzer says that his advocacy work stems from a belief that programs like Social Security and Medicare are lifelines, not just for retirees, but for disabled workers and families too. “Social Security and Medicare represent the values of fairness and mutual support in our country,” he shared. He sees protecting them as a moral responsibility that ensures dignity for millions of Americans.

In the early 2010s, Bowzer teamed up with the National Committee to Preserve Social Security and Medicare to bolster public support for Social Security. (He now is Chair of Social Security Works’ political action committee.) “It’s not an entitlement. It’s what people paid into. It’s their money and their benefits,” he said. His mission is to counter misinformation and ensure the public knows what’s at stake, especially in the face of persistent proposals from the political right to cut and privatize the program.

Bauman, 77, also shared that he has officially stepped away from touring. He recently completed a series of cruise ship performances but admitted during the podcast that his touring days are mostly behind him. “I’ve reached the age where touring takes too much of a toll physically.” Though he’ll miss being on stage, he said he’s fully committed to his advocacy work and making a difference offstage.

Carrying Stage Skills Into Advocacy

Even though activism is his focus now, Bauman’s time as “Bowzer” still shapes the way he connects with people. His years in Sha Na Na made him an expert in grabbing and holding attention — from live venues like Carnegie Hall to national television.

“The power of a message is about how it lands,” Bauman said. He noted that his ability to simplify complex topics and relate them to everyday experiences makes his advocacy more accessible. “What always mattered most was the ability to connect and communicate. Whether it’s music or policy, that never changes,” he said.

During the podcast, he reflected on the connection between his past and present work. “It’s all about communication. If I could get an entire crowd to sing along to ‘Goodnight Sweetheart,’ then I know I can convince a room full of people why Social Security matters,” he said.

His memories of performing tend to circle back to the causes he champions now. He compared rock and roll’s enduring power to the collective effort that protects Social Security. “Both are about bringing people together and standing for something that endures.” (Social Security celebrates its 90th anniversary later this year!)

The Need to Protect Social Security

He called out critics who frame it as outdated or a burden. “This is about dignity. Social Security allows people to live independently instead of struggling in despair,” he said. Bauman affirmed that Social Security isn’t a government handout; it’s an earned benefit for more than 70 million workers. He firmly believes cutting or privatizing the program would break trust with generations of Americans.

He also didn’t shy away from addressing related issues, such as medical costs and prescription drug prices, and how they connect to Social Security. He said, “You can’t separate Social Security from things like health care. They work hand in hand.”

A Call to Action

Bauman concluded the podcast with a message about the importance of protecting Social Security and Medicare not just for today’s seniors, but for generations to come. “This is about who we are as a society. How we treat our seniors says everything about us,” he explained.

There’s still a lot of work ahead, and Bauman shows no signs of slowing down. Whether it’s through advocating with organizations, speaking to policymakers, or educating the public, his commitment to his mission is clear.

“Social Security isn’t just a program,” Bauman said. “It’s a promise. And I’ll keep fighting to make sure that promise is never broken.”

******************************************************

Listen to Jon “Bowzer” Bauman’s podcast interview here.

Watch a snippet from Bowzer’s “Truth Tour” with NCPSSM in 2012.

Former Social Security Official Says Musk/DOGE Caused “Trauma and Chaos” at SSA

Laura Haltzel is the first former Social Security Administration (SSA) official who was present for the Trump administration’s takeover of the agency to speak out publicly in an on the record interview. In her first interview since leaving SSA, Haltzel told Entitled to Know that Elon Musk and his Department of Government Efficiency (DOGE) “traumatized” SSA employees — and created “gross inefficiencies” in the system. Haltzel resigned her post as Associate Commissioner Office of Research, Evaluation and Statistics on February 28, accepting an early retirement offer that the administration extended to all SSA employees.

Haltzel describes an atmosphere of chaos and fear at SSA headquarters, based on her own experience and communications with colleagues in other departments. (Haltzel was based at the agency’s DC office while the headquarters is in Baltimore.) She had worked at SSA for a cumulative 15 years when she exited her job.

When asked why she decided to go public, Haltzel explained, “I swore an oath to defend the Constitution against every enemy, foreign and domestic… and I witnessed illegal and unconstitutional activity by our top leadership in the Executive Branch, by President Trump, and by Elon Musk.”

Under the influence of Trump, Musk and DOGE, SSA leadership has taken several extreme steps to downsize the agency and undermine its ability to properly serve Social Security beneficiaries. These actions include:

- Radically shrinking the agency’s workforce when staffing already is at a 50-year low;

- Accessing the sensitive personal data of millions of Social Security beneficiaries;

- Closing SSA field offices around the country;

- Restoring an old policy of clawing back up to 100% of beneficiaries’ monthly checks in the case of overpayments;

- Eliminating entire divisions of the agency by illegally removing staff “for cause” despite any performance appraisals to the contrary;

- Proposing to severely reduce customer service on the agency’s 1-800 phone line;

- Trying to make it harder for parents to register newborns for Social Security

The former acting Social Security Commissioner, Michelle King, resigned in protest over Musk and DOGE’s demands for access to highly sensitive SSA data without following long-established protocols. (So did her deputy, Tiffany Flick, who submitted a court affidavit about Musk/DOGE abuses.).

Haltzel says she was horrified at the violation of precedent — and federal law. “As a department head, I did not have the right to access beneficiaries’ private data on a regular basis,” while Musk’s young DOGE minions (mostly IT people with no experience in government or auditing) were rushed through a scant ‘security clearance’ process and granted full access to SSA’s database. “These people were not vetted the way they should have been,” Haltzel says.

She points out that any SSA employee who accesses Americans’ personal data without permission is subject to a maximum 5-year prison sentence and up to $5,000 in fines. Yet, Musk’s team of unqualified outsiders was granted access in a hurry, a move that Haltzel characterizes as illegal. She is deeply concerned about potential abuse of private data by DOGE.

According to Haltzel, Musk and DOGE’s chief tactic at SSA, as with other federal agencies they targeted, is intimidation of employees and sowing chaos to create an untenably stressful workplace — in hopes of driving out long-term workers and shrink the payroll. “There’s only one word for it: trauma,” says Haltzel.

“There was a daily barrage of conflicting directives… and we were constantly responding to deadlines by 5pm every day. It was hard to get real work done where every day you’re trying to comply with some new directive from the top, and then they would reverse course the next day. It created whiplash.”

Haltzel says that one person on her staff lost 20 pounds because they were sick to their stomach every day from uncertainty and “threatening emails essentially telling federal employees that they are worthless and disposable.” That staffer took up the administration’s offer of early retirement, according to Haltzel.

By Haltzel’s account, Musk and DOGE clearly have made the agency less efficient — even though their stated goal was to root out inefficiencies — along with supposed “waste, fraud, and abuse.” In truth, the Social Security Administration always has been one of the most efficient federal agencies, with overhead costs of about 1% of its operating budget.

Haltzel criticizes the leadership of acting Commissioner Leland Dudek, who took over after Michelle King resigned and appeared sympathetic to Musk and DOGE’s mission. In fact, before being promoted, Dudek reportedly had been placed on administrative leave for cooperating with Musk and DOGE’s requests for access to sensitive data. According to the Washington Post, Dudek told Social Security advocates at a closed-door meeting that Musk and Trump were “calling the shots” at SSA and he was merely implementing their policies.

She did not personally interact with Dudek, but Haltzel was told by colleagues that his personal style was “very mercurial and dismissive.” She says that Dudek seemed uncurious about the workings of the agency he had just taken over. When staffers would brief Dudek on their departments’ operations, Haltzel says, he would “cut them off after one minute and say, ‘I’ve heard enough.”

According to Pro Publica, Dudek defended himself by telling advocates, “I’ve had to make some tough choices, choices I didn’t agree with. But the president wanted it and I did it.”

When asked why she thinks Trump and Musk are trying so hard to disrupt the Social Security Administration, Haltzel said it is part of their effort to discredit the entire federal government. “There’s a narrative that they want to sell that government doesn’t work. Apparently, the best way to prove that narrative… is to make it so.”

She acknowledges that the administration also may be targeting SSA because of Musk’s apparent hostility to Social Security itself, which he recently called a “Ponzi scheme.” Musk told the media that there is $700 billion in waste, fraud and abuse in “entitlement programs,” and that he intends to slash spending by that same amount — even though his baseless claims about Social Security fraud have been thoroughly discredited.

Underfunded and understaffed, SSA already was struggling to provide adequate customer service to beneficiaries before Trump and Musk took over. DOGE’s raiding of agency resources will only worsen SSA’s ability to serve the public. “The reduction in customer service ironically reinforces the Musk/DOGE narrative of government dysfunction. It has the potential to become self-fulfilling prophecy,” says Haltzel.

While the media have quoted unnamed SSA staffers in reports about Musk/DOGE interference, no agency officials who were there at the beginning of the Trump administration have gone ‘on-the-record’ with their criticisms until today. Haltzel believes that by being outside the Agency now — and having freedom of speech — she has a special duty to ensure that she speaks on behalf of those still within SSA, for whom doing so would put their jobs at risk. Haltzel realizes that going public is a risk to herself and her family, though she notes that they have taken precautions against retribution by Trump and Musk’s supporters.

“I have taken the oath of office multiple times at multiple agencies. Just because I’m not a federal employee does not diminish the oath I took. It has no expiration date,” she says. “I believe you are either a person of integrity and speak up — or you are not. I will continue to be a person of integrity. I’m not going to change who I am.”

Former Official Reveals Recklessness of Musk’s Meddling in Social Security System

The Social Security Administration (SSA) is facing mounting scrutiny after a lawsuit was filed by labor unions seeking to block Elon Musk’s Department of Government Efficiency (DOGE) from accessing Americans’ sensitive personal data. According to the Washington Post, the legal challenge includes testimony from Tiffany Flick, a former senior SSA official, who warned in court filings that DOGE’s interference poses a serious threat to the security of data belonging to millions of people. Flick, who resigned her post at SSA after three decades, cited these actions as part of broader concerns over mismanagement and policy risk brought on by interference in the agency by Trump, Musk, and DOGE.

“DOGE’s requests were unprecedented and reckless,” Flick stated in her affidavit. “They demanded immediate access to taxpayer data without completing standard security checks or following any established protocols. Ignoring these safeguards is more than just careless; it’s a direct threat to the privacy of millions of Americans.”

Tiffany Flick resigned her job as acting chief of staff at SSA at the same time as acting commissioner Michelle King quit in protest of DOGE’s requests for sensitive data. A former long-time SSA staffer who did not wish his name to be used in this article, says, “Flick’s principled approach, along with former acting commissioner Michelle King, shows courage and professionalism in the face of illegal and inappropriate access requests. She and Ms. King were quite brave and paid a heavy price to adhere to the rule of law.”

What Drove Her to Leave?

Flick’s resignation stemmed from repeated attempts by DOGE to gain unauthorized access to critical databases containing highly sensitive taxpayer information. These databases were safeguarded under strict protocols designed to ensure privacy and data security. When DOGE sought to bypass these safeguards, Flick and King pushed back, risking their careers for what they believed to be the right course of action.

The methods employed by DOGE were described by Flick as “unorthodox and alarming,” undermining established security procedures. The risks were too great for her to ignore, and rather than compromise the values she had built her career upon, Flick chose to step away. “It became clear that the safety and trust SSA relies on were deliberately being disregarded,” she noted in her affidavit.

An Agency Facing Growing Challenges

Since Flick’s departure, reports indicate that DOGE’s interference has only intensified. Acting Commissioner Leland Dudek has announced plans for radical downsizing (at an agency where staffing already is at a 50-year low), including firings, coerced early retirement, and the closure of field offices that service the public. Seniors’ advocates warn that these decisions could jeopardize the agency’s ability to serve its beneficiaries effectively, particularly those who rely on in-person assistance. Adding to these difficulties, many of Dudek’s decisions appear to be heavily influenced by DOGE. According to the Post, he admitted to advocacy groups that Musk and his team are “calling the shots” at SSA.

“This is about more than just internal disputes,” Flick declared in her affidavit. “It’s about whether the SSA can remain a trusted institution, or whether it becomes a tool for external agendas that put the public at risk.”

A Warning About the Risks

According to Maria Freese, senior Social Security expert at the National Committee to Preserve Social Security and Medicare (NCPSSM), the ongoing interference and mismanagement represent a profound threat.

“What billionaire Elon Musk does not seem to understand is that accessing federal records is not a game. Security procedures are in place for a reason – the Social Security Administration collects Americans’ most personal and private information including Social Security numbers, banking information, work histories and in many cases, troves of personal medical records. The American people share this information with SSA because they have been assured that the government employees who have access to it have gone through rigorous screening to ensure they can be trusted.” – Maria Freese, NCPSSM senior legislative representative, 3/9/25

Musk claims all these employees have ‘security clearances,’ but Flick’s affidavit shines a bright light on the perfunctory process the DOGE staffers underwent before being cleared. “The process was clearly a ‘security clearance’ in name only – under intense pressure from Musk to approve his acolytes quickly – with little attention to whether they truly could be trusted to safely handle our personal information,” says Freese.

Freese emphasizes that any diminishment of the SSA’s ability to protect this information not only risks significant harm to individuals but also damages the trust that is fundamental to public support of Social Security. Compromising the system, she warns, is a direct threat to beneficiaries.

The Importance of Stability at SSA

Social Security serves as a vital safety net for retirees, disabled individuals, and families who rely on survivor benefits. Disruptions to this system could have devastating consequences for millions of Americans who depend on their earned benefits for financial Security. Former SSA Commissioner Martin O’Malley warned that Musk and DOGE’s meddling in SSA could damage the system and result in missed payments “within 30 to 90 days.”

Tiffany Flick’s decision to speak out serves as a powerful reminder of the importance of integrity and courage when public trust is at stake. “The SSA’s mission is not a commodity to be traded for political convenience,” Flick stated in her affidavit. “It’s a promise, one that must be defended for the sake of Americans today and for generations to come.”

LISTEN TO OUR PODCAST here.

JOIN THE NATIONAL COMMITTEE here.

Trump & Musk Tried to Make it Harder for Parents to Register Newborns for Social Security

It started as a baffling and alarming decision. The Social Security Administration (SSA), under the influence of President Trump’s campaign to gut the federal government and Elon Musk’s DOGE team, announced the termination of Maine’s Enumeration at Birth (EAB) program. For 35 years, the EAB program had allowed parents to register their newborns for Social Security numbers right at the hospital. But suddenly, without warning, SSA moved to rescind this critical service, which would have compelled parents to register their children for Social Security with an SSA representative after leaving the hospital, at a time when Trump and Musk are closing SSA field offices and radically reducing the agency’s workforce.

Tellingly, SSA offered no reason for the original policy change — or its reversal shortly after. – NCPSSM, 3/7/25

Thankfully, after blowback from media reports and pressure from the Maine Department of Health and Human Services (DHHS), the SSA reversed its decision and rescinded the new policy. This quick reversal is good for Maine families, but make no mistake, the attempt itself speaks volumes about the Trump administration’s apparent agenda to dismantle Social Security from within.

Max Richtman, President and CEO of the National Committee to Preserve Social Security and Medicare, captured the severity of the situation when he noted, “The attempt to end the EAB program in Maine was the latest effort by Trump, Musk, and DOGE to incapacitate the agency that administers Social Security benefits for 73 million Americans. Even though they’ve backtracked in Maine, this obviously is part of a policy aimed at undermining the program.”

The Broader Strategy to Chip Away at Social Security

While the decision to reinstate EAB in Maine is welcome news for now, other states—including Arizona, Maryland, Michigan, New Mexico, and Rhode Island— are listed on the DOGE website as having their EAB contracts terminated as part of Musk’s “cost cutting” efforts.

Trump and Musk’s intentions are becoming increasingly obvious. This is part of a systematic effort to make Social Security harder to access and, in the process, shrink the program as a whole. “By closing field offices, coercing experienced employees into early retirement, and cutting over 7,000 jobs, the administration is methodically stripping the SSA of its ability to serve Americans efficiently,” said Richtman.

“Trump clearly has his priorities backwards. First, he makes the absurd claim that 360 year-olds may be collecting benefits, then he tries to strip parents of the ability to easily register their children for Social Security.” – Max Richtman, NCPSSM President and CEO

Temporary Reprieve in Maine, but an Ongoing Threat

The reversal of the EAB policy in Maine shows what media exposure can accomplish. The fact remains that SSA thought it could quietly eliminate this program with little to no accountability.

Policies like this create barriers. Barriers discourage participation. Discouraged participation weakens the system. It’s a chain reaction designed to dismantle Social Security — not in one master stroke but piece by piece.

This strategy isn’t just cruel; it’s deliberate. Richtman summed it up perfectly:

“Why on earth would the administration want to make it harder for parents to register their children for Social Security unless the aim was to shrink the size of the program?” – Max Richtman, 3/7/25

A Bigger Pattern of Sabotage

At the heart of this issue lies a deeper truth. Trump and Musk have long criticized Social Security. Musk recently called it a “Ponzi Scheme,” and Trump dismissed it as a “scam.” Their solution? Slash one of the government’s most effective and efficient programs, which currently has an overhead of less than 1%. By targeting EAB programs, shuttering field offices, and radically reducing staff, they’re advancing this goal. It isn’t just bad policy. It’s a blatant betrayal of Trump’s promise “not to touch” Social Security.

7 Questions for Trump’s Social Security Commissioner Nominee

President Trump’s pick to head the Social Security Administration, Frank Bisignano, will have his Senate confirmation hearing on Tuesday morning. The financial services CEO and Republican donor has been waiting in the wings since the Trump administration took over in January. In the meantime, Elon Musk and his DOGE squad have invaded the Social Security Administration (SSA) and wreaked considerable havoc on the agency — alarming seniors’ advocates and a sizeable swath of the general public. Under the banner of rooting out “fraud” (of which they have found none), Musk’s minions are in the process of rendering SSA dysfunctional and jeopardizing the delivery of benefits.

In the absence of a confirmed commissioner, Acting SSA chief Leland Dudek has abetted Musk and DOGE every step of the way, allowing them access to the sensitive personal data of 73 million Americans for no justifiable reason, radically reducing the workforce that serves Social Security customers, closing field offices, and slashing services on the agency’s 1-800 phone number that seniors rely on. He claims to be “following orders” from President Trump and Elon Musk. Dudek threatened to “shut down” SSA after a federal judge ruled against the agency’s decision to grant Musk and DOGE access to beneficiaries’ private data.

Bisignano has no appreciable experience in public service in general — or Social Security in particular — but Trump wants him to run one of the federal agencies that most closely touches Americans’ lives every day. We don’t know much about what Bisignano thinks of Social Security or what he will do to the program if confirmed.

Here are 7 questions we would like to see Frank Bisignano answer at Tuesdays’ hearing:

#1 Do you agree with the changes that Musk and Dudek have made at SSA pending your confirmation?

#2 A federal judge has ruled that Musk AND DOGE should not have access to the personal data of 73 million Americans. Do you agree or disagree?

#3 SSA has been chronically underfunded and understaffed. With 10,000 Baby Boomers reaching 65 every day, is this really the time to be slashing the workforce and closing field offices?

#4 Do you believe that Social Security itself or the functions of the SSA should be privatized? And if Social Security were to be privatized, would you and your peers in the financial services industry benefit?

#5 Do you think beneficiaries who have been overpaid (usually through no fault of their own) should have 100% of their Social Security checks clawed back pending repayment?

#6 Elon Musk recently called Social Security a Ponzi Scheme. Do you agree?

#7 What do you feel is the fair and just solution to the projected depletion of the Social Security trust fund? Do you support raising the Social Security retirement age?

Frankly, we don’t expect Bisignano to answer these kinds of questions, but they should be put to him on the record, anyway. We hope that committee members (especially Democrats including ranking member Ron Wyden, Bernie Sanders and Elizabeth Warren) will press the nominee on these extremely important issues to American seniors, people with disabilities, and their families. At this existential moment for Social Security, the public deserves nothing less.

Jon “Bowzer” Bauman Sings the Praises of Social Security

Jon “Bowzer” Bauman is best known from the 70s tv show “Sha Na Na,” where he charmed audiences with his greaser persona, elastic expressions, and basso renditions of 1950s pop music classics — including the band’s cover of “Goodnight, Sweetheart.” Over the years, though, Bowzer has evolved from doo wop revivalist to seniors’ activist — especially when it comes to Social Security. He talked about his evolution from pure entertainment to entertainment and advocacy on a recent episode of the “You Earned This” podcast.

Bowzer’s Shift to Advocacy

Bowzer says that his advocacy work stems from a belief that programs like Social Security and Medicare are lifelines, not just for retirees, but for disabled workers and families too. “Social Security and Medicare represent the values of fairness and mutual support in our country,” he shared. He sees protecting them as a moral responsibility that ensures dignity for millions of Americans.

In the early 2010s, Bowzer teamed up with the National Committee to Preserve Social Security and Medicare to bolster public support for Social Security. (He now is Chair of Social Security Works’ political action committee.) “It’s not an entitlement. It’s what people paid into. It’s their money and their benefits,” he said. His mission is to counter misinformation and ensure the public knows what’s at stake, especially in the face of persistent proposals from the political right to cut and privatize the program.

Bauman, 77, also shared that he has officially stepped away from touring. He recently completed a series of cruise ship performances but admitted during the podcast that his touring days are mostly behind him. “I’ve reached the age where touring takes too much of a toll physically.” Though he’ll miss being on stage, he said he’s fully committed to his advocacy work and making a difference offstage.

Carrying Stage Skills Into Advocacy

Even though activism is his focus now, Bauman’s time as “Bowzer” still shapes the way he connects with people. His years in Sha Na Na made him an expert in grabbing and holding attention — from live venues like Carnegie Hall to national television.

“The power of a message is about how it lands,” Bauman said. He noted that his ability to simplify complex topics and relate them to everyday experiences makes his advocacy more accessible. “What always mattered most was the ability to connect and communicate. Whether it’s music or policy, that never changes,” he said.

During the podcast, he reflected on the connection between his past and present work. “It’s all about communication. If I could get an entire crowd to sing along to ‘Goodnight Sweetheart,’ then I know I can convince a room full of people why Social Security matters,” he said.

His memories of performing tend to circle back to the causes he champions now. He compared rock and roll’s enduring power to the collective effort that protects Social Security. “Both are about bringing people together and standing for something that endures.” (Social Security celebrates its 90th anniversary later this year!)

The Need to Protect Social Security

He called out critics who frame it as outdated or a burden. “This is about dignity. Social Security allows people to live independently instead of struggling in despair,” he said. Bauman affirmed that Social Security isn’t a government handout; it’s an earned benefit for more than 70 million workers. He firmly believes cutting or privatizing the program would break trust with generations of Americans.

He also didn’t shy away from addressing related issues, such as medical costs and prescription drug prices, and how they connect to Social Security. He said, “You can’t separate Social Security from things like health care. They work hand in hand.”

A Call to Action

Bauman concluded the podcast with a message about the importance of protecting Social Security and Medicare not just for today’s seniors, but for generations to come. “This is about who we are as a society. How we treat our seniors says everything about us,” he explained.

There’s still a lot of work ahead, and Bauman shows no signs of slowing down. Whether it’s through advocating with organizations, speaking to policymakers, or educating the public, his commitment to his mission is clear.

“Social Security isn’t just a program,” Bauman said. “It’s a promise. And I’ll keep fighting to make sure that promise is never broken.”

******************************************************

Listen to Jon “Bowzer” Bauman’s podcast interview here.

Watch a snippet from Bowzer’s “Truth Tour” with NCPSSM in 2012.

Former Social Security Official Says Musk/DOGE Caused “Trauma and Chaos” at SSA

Laura Haltzel is the first former Social Security Administration (SSA) official who was present for the Trump administration’s takeover of the agency to speak out publicly in an on the record interview. In her first interview since leaving SSA, Haltzel told Entitled to Know that Elon Musk and his Department of Government Efficiency (DOGE) “traumatized” SSA employees — and created “gross inefficiencies” in the system. Haltzel resigned her post as Associate Commissioner Office of Research, Evaluation and Statistics on February 28, accepting an early retirement offer that the administration extended to all SSA employees.

Haltzel describes an atmosphere of chaos and fear at SSA headquarters, based on her own experience and communications with colleagues in other departments. (Haltzel was based at the agency’s DC office while the headquarters is in Baltimore.) She had worked at SSA for a cumulative 15 years when she exited her job.

When asked why she decided to go public, Haltzel explained, “I swore an oath to defend the Constitution against every enemy, foreign and domestic… and I witnessed illegal and unconstitutional activity by our top leadership in the Executive Branch, by President Trump, and by Elon Musk.”

Under the influence of Trump, Musk and DOGE, SSA leadership has taken several extreme steps to downsize the agency and undermine its ability to properly serve Social Security beneficiaries. These actions include:

- Radically shrinking the agency’s workforce when staffing already is at a 50-year low;

- Accessing the sensitive personal data of millions of Social Security beneficiaries;

- Closing SSA field offices around the country;

- Restoring an old policy of clawing back up to 100% of beneficiaries’ monthly checks in the case of overpayments;

- Eliminating entire divisions of the agency by illegally removing staff “for cause” despite any performance appraisals to the contrary;

- Proposing to severely reduce customer service on the agency’s 1-800 phone line;

- Trying to make it harder for parents to register newborns for Social Security

The former acting Social Security Commissioner, Michelle King, resigned in protest over Musk and DOGE’s demands for access to highly sensitive SSA data without following long-established protocols. (So did her deputy, Tiffany Flick, who submitted a court affidavit about Musk/DOGE abuses.).

Haltzel says she was horrified at the violation of precedent — and federal law. “As a department head, I did not have the right to access beneficiaries’ private data on a regular basis,” while Musk’s young DOGE minions (mostly IT people with no experience in government or auditing) were rushed through a scant ‘security clearance’ process and granted full access to SSA’s database. “These people were not vetted the way they should have been,” Haltzel says.

She points out that any SSA employee who accesses Americans’ personal data without permission is subject to a maximum 5-year prison sentence and up to $5,000 in fines. Yet, Musk’s team of unqualified outsiders was granted access in a hurry, a move that Haltzel characterizes as illegal. She is deeply concerned about potential abuse of private data by DOGE.

According to Haltzel, Musk and DOGE’s chief tactic at SSA, as with other federal agencies they targeted, is intimidation of employees and sowing chaos to create an untenably stressful workplace — in hopes of driving out long-term workers and shrink the payroll. “There’s only one word for it: trauma,” says Haltzel.

“There was a daily barrage of conflicting directives… and we were constantly responding to deadlines by 5pm every day. It was hard to get real work done where every day you’re trying to comply with some new directive from the top, and then they would reverse course the next day. It created whiplash.”

Haltzel says that one person on her staff lost 20 pounds because they were sick to their stomach every day from uncertainty and “threatening emails essentially telling federal employees that they are worthless and disposable.” That staffer took up the administration’s offer of early retirement, according to Haltzel.

By Haltzel’s account, Musk and DOGE clearly have made the agency less efficient — even though their stated goal was to root out inefficiencies — along with supposed “waste, fraud, and abuse.” In truth, the Social Security Administration always has been one of the most efficient federal agencies, with overhead costs of about 1% of its operating budget.

Haltzel criticizes the leadership of acting Commissioner Leland Dudek, who took over after Michelle King resigned and appeared sympathetic to Musk and DOGE’s mission. In fact, before being promoted, Dudek reportedly had been placed on administrative leave for cooperating with Musk and DOGE’s requests for access to sensitive data. According to the Washington Post, Dudek told Social Security advocates at a closed-door meeting that Musk and Trump were “calling the shots” at SSA and he was merely implementing their policies.

She did not personally interact with Dudek, but Haltzel was told by colleagues that his personal style was “very mercurial and dismissive.” She says that Dudek seemed uncurious about the workings of the agency he had just taken over. When staffers would brief Dudek on their departments’ operations, Haltzel says, he would “cut them off after one minute and say, ‘I’ve heard enough.”

According to Pro Publica, Dudek defended himself by telling advocates, “I’ve had to make some tough choices, choices I didn’t agree with. But the president wanted it and I did it.”

When asked why she thinks Trump and Musk are trying so hard to disrupt the Social Security Administration, Haltzel said it is part of their effort to discredit the entire federal government. “There’s a narrative that they want to sell that government doesn’t work. Apparently, the best way to prove that narrative… is to make it so.”

She acknowledges that the administration also may be targeting SSA because of Musk’s apparent hostility to Social Security itself, which he recently called a “Ponzi scheme.” Musk told the media that there is $700 billion in waste, fraud and abuse in “entitlement programs,” and that he intends to slash spending by that same amount — even though his baseless claims about Social Security fraud have been thoroughly discredited.

Underfunded and understaffed, SSA already was struggling to provide adequate customer service to beneficiaries before Trump and Musk took over. DOGE’s raiding of agency resources will only worsen SSA’s ability to serve the public. “The reduction in customer service ironically reinforces the Musk/DOGE narrative of government dysfunction. It has the potential to become self-fulfilling prophecy,” says Haltzel.

While the media have quoted unnamed SSA staffers in reports about Musk/DOGE interference, no agency officials who were there at the beginning of the Trump administration have gone ‘on-the-record’ with their criticisms until today. Haltzel believes that by being outside the Agency now — and having freedom of speech — she has a special duty to ensure that she speaks on behalf of those still within SSA, for whom doing so would put their jobs at risk. Haltzel realizes that going public is a risk to herself and her family, though she notes that they have taken precautions against retribution by Trump and Musk’s supporters.

“I have taken the oath of office multiple times at multiple agencies. Just because I’m not a federal employee does not diminish the oath I took. It has no expiration date,” she says. “I believe you are either a person of integrity and speak up — or you are not. I will continue to be a person of integrity. I’m not going to change who I am.”

Former Official Reveals Recklessness of Musk’s Meddling in Social Security System

The Social Security Administration (SSA) is facing mounting scrutiny after a lawsuit was filed by labor unions seeking to block Elon Musk’s Department of Government Efficiency (DOGE) from accessing Americans’ sensitive personal data. According to the Washington Post, the legal challenge includes testimony from Tiffany Flick, a former senior SSA official, who warned in court filings that DOGE’s interference poses a serious threat to the security of data belonging to millions of people. Flick, who resigned her post at SSA after three decades, cited these actions as part of broader concerns over mismanagement and policy risk brought on by interference in the agency by Trump, Musk, and DOGE.

“DOGE’s requests were unprecedented and reckless,” Flick stated in her affidavit. “They demanded immediate access to taxpayer data without completing standard security checks or following any established protocols. Ignoring these safeguards is more than just careless; it’s a direct threat to the privacy of millions of Americans.”

Tiffany Flick resigned her job as acting chief of staff at SSA at the same time as acting commissioner Michelle King quit in protest of DOGE’s requests for sensitive data. A former long-time SSA staffer who did not wish his name to be used in this article, says, “Flick’s principled approach, along with former acting commissioner Michelle King, shows courage and professionalism in the face of illegal and inappropriate access requests. She and Ms. King were quite brave and paid a heavy price to adhere to the rule of law.”

What Drove Her to Leave?

Flick’s resignation stemmed from repeated attempts by DOGE to gain unauthorized access to critical databases containing highly sensitive taxpayer information. These databases were safeguarded under strict protocols designed to ensure privacy and data security. When DOGE sought to bypass these safeguards, Flick and King pushed back, risking their careers for what they believed to be the right course of action.

The methods employed by DOGE were described by Flick as “unorthodox and alarming,” undermining established security procedures. The risks were too great for her to ignore, and rather than compromise the values she had built her career upon, Flick chose to step away. “It became clear that the safety and trust SSA relies on were deliberately being disregarded,” she noted in her affidavit.

An Agency Facing Growing Challenges

Since Flick’s departure, reports indicate that DOGE’s interference has only intensified. Acting Commissioner Leland Dudek has announced plans for radical downsizing (at an agency where staffing already is at a 50-year low), including firings, coerced early retirement, and the closure of field offices that service the public. Seniors’ advocates warn that these decisions could jeopardize the agency’s ability to serve its beneficiaries effectively, particularly those who rely on in-person assistance. Adding to these difficulties, many of Dudek’s decisions appear to be heavily influenced by DOGE. According to the Post, he admitted to advocacy groups that Musk and his team are “calling the shots” at SSA.

“This is about more than just internal disputes,” Flick declared in her affidavit. “It’s about whether the SSA can remain a trusted institution, or whether it becomes a tool for external agendas that put the public at risk.”

A Warning About the Risks

According to Maria Freese, senior Social Security expert at the National Committee to Preserve Social Security and Medicare (NCPSSM), the ongoing interference and mismanagement represent a profound threat.

“What billionaire Elon Musk does not seem to understand is that accessing federal records is not a game. Security procedures are in place for a reason – the Social Security Administration collects Americans’ most personal and private information including Social Security numbers, banking information, work histories and in many cases, troves of personal medical records. The American people share this information with SSA because they have been assured that the government employees who have access to it have gone through rigorous screening to ensure they can be trusted.” – Maria Freese, NCPSSM senior legislative representative, 3/9/25

Musk claims all these employees have ‘security clearances,’ but Flick’s affidavit shines a bright light on the perfunctory process the DOGE staffers underwent before being cleared. “The process was clearly a ‘security clearance’ in name only – under intense pressure from Musk to approve his acolytes quickly – with little attention to whether they truly could be trusted to safely handle our personal information,” says Freese.

Freese emphasizes that any diminishment of the SSA’s ability to protect this information not only risks significant harm to individuals but also damages the trust that is fundamental to public support of Social Security. Compromising the system, she warns, is a direct threat to beneficiaries.

The Importance of Stability at SSA

Social Security serves as a vital safety net for retirees, disabled individuals, and families who rely on survivor benefits. Disruptions to this system could have devastating consequences for millions of Americans who depend on their earned benefits for financial Security. Former SSA Commissioner Martin O’Malley warned that Musk and DOGE’s meddling in SSA could damage the system and result in missed payments “within 30 to 90 days.”

Tiffany Flick’s decision to speak out serves as a powerful reminder of the importance of integrity and courage when public trust is at stake. “The SSA’s mission is not a commodity to be traded for political convenience,” Flick stated in her affidavit. “It’s a promise, one that must be defended for the sake of Americans today and for generations to come.”

LISTEN TO OUR PODCAST here.

JOIN THE NATIONAL COMMITTEE here.

Trump & Musk Tried to Make it Harder for Parents to Register Newborns for Social Security

It started as a baffling and alarming decision. The Social Security Administration (SSA), under the influence of President Trump’s campaign to gut the federal government and Elon Musk’s DOGE team, announced the termination of Maine’s Enumeration at Birth (EAB) program. For 35 years, the EAB program had allowed parents to register their newborns for Social Security numbers right at the hospital. But suddenly, without warning, SSA moved to rescind this critical service, which would have compelled parents to register their children for Social Security with an SSA representative after leaving the hospital, at a time when Trump and Musk are closing SSA field offices and radically reducing the agency’s workforce.

Tellingly, SSA offered no reason for the original policy change — or its reversal shortly after. – NCPSSM, 3/7/25

Thankfully, after blowback from media reports and pressure from the Maine Department of Health and Human Services (DHHS), the SSA reversed its decision and rescinded the new policy. This quick reversal is good for Maine families, but make no mistake, the attempt itself speaks volumes about the Trump administration’s apparent agenda to dismantle Social Security from within.

Max Richtman, President and CEO of the National Committee to Preserve Social Security and Medicare, captured the severity of the situation when he noted, “The attempt to end the EAB program in Maine was the latest effort by Trump, Musk, and DOGE to incapacitate the agency that administers Social Security benefits for 73 million Americans. Even though they’ve backtracked in Maine, this obviously is part of a policy aimed at undermining the program.”

The Broader Strategy to Chip Away at Social Security

While the decision to reinstate EAB in Maine is welcome news for now, other states—including Arizona, Maryland, Michigan, New Mexico, and Rhode Island— are listed on the DOGE website as having their EAB contracts terminated as part of Musk’s “cost cutting” efforts.

Trump and Musk’s intentions are becoming increasingly obvious. This is part of a systematic effort to make Social Security harder to access and, in the process, shrink the program as a whole. “By closing field offices, coercing experienced employees into early retirement, and cutting over 7,000 jobs, the administration is methodically stripping the SSA of its ability to serve Americans efficiently,” said Richtman.

“Trump clearly has his priorities backwards. First, he makes the absurd claim that 360 year-olds may be collecting benefits, then he tries to strip parents of the ability to easily register their children for Social Security.” – Max Richtman, NCPSSM President and CEO

Temporary Reprieve in Maine, but an Ongoing Threat

The reversal of the EAB policy in Maine shows what media exposure can accomplish. The fact remains that SSA thought it could quietly eliminate this program with little to no accountability.

Policies like this create barriers. Barriers discourage participation. Discouraged participation weakens the system. It’s a chain reaction designed to dismantle Social Security — not in one master stroke but piece by piece.

This strategy isn’t just cruel; it’s deliberate. Richtman summed it up perfectly:

“Why on earth would the administration want to make it harder for parents to register their children for Social Security unless the aim was to shrink the size of the program?” – Max Richtman, 3/7/25

A Bigger Pattern of Sabotage

At the heart of this issue lies a deeper truth. Trump and Musk have long criticized Social Security. Musk recently called it a “Ponzi Scheme,” and Trump dismissed it as a “scam.” Their solution? Slash one of the government’s most effective and efficient programs, which currently has an overhead of less than 1%. By targeting EAB programs, shuttering field offices, and radically reducing staff, they’re advancing this goal. It isn’t just bad policy. It’s a blatant betrayal of Trump’s promise “not to touch” Social Security.