Social Security is among the nation’s largest programs serving children. About 3.8 million American children receive approximately $3.4 billion in Social Security benefits each month because at least one of their parents is disabled, retired or deceased. Although Social Security is well known as an essential source of retirement security for older Americans, there is less awareness of the critical income protection it has provided for survivors since 1939, and for the disabled since 1956. Social Security is a safety net for millions of working parents who may have no other resources to fall back on when tragedy strikes and they are no longer able to earn an income to support their family. From clothing and feeding their children to buying needed supplies, paying health care costs and saving for college, parents and grandparents understand that Social Security benefits are a stabilizing source of income for children ages birth to eighteen.

Social Security lifts about 900,000 children out of poverty. Children of deceased military service members depend on Social Security survivors benefits, as well as benefits from the Department of Veterans Affairs. The nation’s devastating COVID-19 pandemic clearly showed the importance of Social Security’s survivors benefit for American families. According to the Centers for Disease Control (CDC) from April 1, 2020 through June 30, 2021, COVID-19 left more than 140,000 children under age 18 in the United States without a parent, custodial grandparent, or grandparent caregiver who provided the child’s home and basic needs. Overall, approximately 1 out of 500 children in the United States experienced COVID-19-associated orphanhood or death of a grandparent caregiver. There were racial, ethnic, and geographic disparities in COVID-19-associated death of caregivers: children of racial and ethnic minorities accounted for 65 percent of those who lost a primary caregiver due to the pandemic. These children were eligible for children’s benefits. These benefits do not replace the support and love of the lost parents, but they will help keep these children out of poverty. The value of the life insurance provided to survivors through Social Security and the value of disability protection for a young disabled worker with a spouse and 2 children is about $1.5 million. This level of coverage would be unaffordable for many families if they had to purchase it in the private market.

African American parents are more likely than others to become disabled or die before retirement. Because of this, the percentage of African American children who receive Social Security survivor benefits is higher than their percentage representation in the population of all children. Likewise, more Latino children receive benefits because their parents are more likely than the population at large to receive disability benefits.

How Much Financial Support do Children Receive?

There are several factors used when SSA determines the monthly benefit amount to be paid to the children of deceased, disabled or retired workers. Eligible children of a deceased worker are entitled to benefits of up to 75 percent of that deceased parent’s benefit, and children of disabled or retired workers receive benefits of up to one-half of their parent’s benefit. In general, total monthly benefits are capped if three or more people in the family are entitled to Social Security benefits.

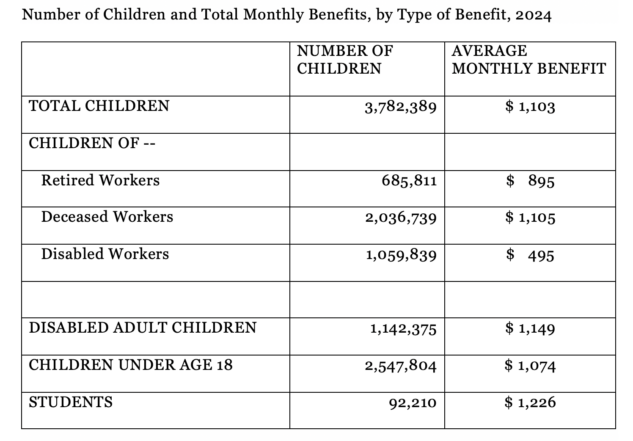

Source: Social Security Administration, Annual Statistical Supplement, 2024, Table 5.F4 & Table 5.F6

https://www.ssa.gov/policy/docs/statcomps/supplement/2024/5f.pdf

Monthly Statistical Snapshot, October, 2024

https://www.ssa.gov/policy/docs/quickfacts/stat_snapshot/2024-10.pdf

Note: Totals do not necessarily equal the sum of rounded components

To summarize, there are over 2 million children of deceased workers receiving an average monthly survivor benefit of $1,105; as well as over 685,000 children of retired workers receiving an average monthly benefit of $895 and over 1 million children of disabled workers receiving an average monthly benefit of $495.

In addition to children directly eligible for benefits, many children indirectly benefit from Social Security as a consequence of living in a household that includes older family members who receive benefits. Since 2000, the share of children in the United States living with at least one grandparent has increased by more than 36 percent to 12.7 percent, so that by 2019 one in eight children lived with a grandparent. Most children still live in parent-only households (65 percent), but the share of these children has been decreasing as the percentage of children who live with grandparents has increased. By 2019, about 10.5 percent of children lived with at least one grandparent, while 2.2 percent lived in households where neither parent is present and the grandparents are responsible for their basic needs. Children living in these households are more likely to be living in poverty and facing multiple hardships. Black children are twice as likely to live in these households as those from other groups; as of 2019, 4.5 percent of Black children lived with only their grandparents.

How Long Do Children Receive Benefits?

Dependent children receive benefits until they reach 18 years of age, unless they are still in high school full-time and then can continue to receive benefits until age 19. Approximately 92,000 high school students currently receive benefits under this provision. In the past, student benefits had continued until age 22 if the child was a full-time student in college or in a vocational school. However, Congress ended post-secondary students’ benefits in 1981. Recipients of this benefit were disproportionately children of parents in lower-income or blue-collar jobs, or were African Americans.

Childhood Disability Benefits

Social Security also provides protection to disabled adult children who were disabled before reaching age 22 and who are unmarried. The childhood disability benefit is based on the work record of a parent who is deceased, or receiving retirement or disability benefits. Over 1.1 million disabled adult children are receiving such benefits.

Policy Recommendations

The National Committee proposes a reinstatement of benefits for children of disabled or deceased workers until age 22 when the child is attending a college or vocational school on a full-time basis. This proposal was included as part of the National Committee’s Eleanor’s Hope Initiative unveiled in the fall of 2014. With the cost of post-secondary education at an all-time high, this benefit improvement could go a long way toward helping more children access college opportunities.

Benefits for disabled adult children should be improved by allowing them to reestablish entitlement to benefits after their marriages have ended in divorce, and by computing their benefits without regard to the family maximum. When a disabled adult child qualifies on a parent’s record, benefits for the child and for other family members may be adjusted due to the family maximum. If all eligible family members live in the same household, expenses and income are usually shared. However, people with disabilities are increasingly deciding to live independently from their families, creating a difficult situation for those disabled adult children whose benefit is reduced because of the cap on the family maximum. Computing the benefit for a disabled adult child without regard to the family maximum, as is already done when calculating the benefit for a divorced spouse, will address this situation.

Providing caregiver credits would strengthen a parent’s earnings history which should also result in a higher benefit amount for themselves and their eligible children. Interrupting participation in the labor force to look after other family members, usually children and elderly parents or relatives, can result in a significant reduction in the amount of the caregiver’s Social Security benefit. This disproportionately impacts women. Providing credits for the time caregivers take out of the workforce, or some other type of caregiving benefit, would greatly improve women’s retirement security.

Proposals to Reduce Social Security Benefits Will Hurt Children

Proponents of reducing Social Security benefits by changing the formula for cost-of-living adjustment (COLA) increases, raising the retirement age and other benefit cuts argue that these benefit reductions are needed in order to save Social Security for our children and grandchildren. The irony of that claim, however, is that of the 6 million children in families that receive Social Security, 20 percent would be considered poor if their households did not receive Social Security. In fact, Social Security currently lifts 900,000 children out of poverty. This illustrates the value of the program to current and future generations of children. It is imperative that discussions about any changes to Social Security policies must consider the program’s importance to American families, including parents and their children.

SOURCES

https://www.ssa.gov/policy/docs/statcomps/supplement/2024/6d.pdf

https://archive.cdc.gov/www_cdc_gov/media/releases/2021/p1007-covid-19-orphaned-children.html