Trump Administration No Friend to Seniors

President Trump at White House roundtable event, “Fighting for America’s Seniors”

With about five months until the 2020 elections, President Trump is underwater with senior voters – a demographic that he won in 2016. Since these polling numbers came out, the President has been making gestures toward older voters – one might say to curry favor – without advocating major policy changes that would significantly improve seniors’ lives. On Monday, President Trump held an event at the White House touting the administration’s supposed accomplishments in this area.

During this “Roundtable Discussion on Fighting for America’s Seniors,” the President touted an elder fraud hotline that the Dept. of Justice established this year, which has received some 1,800 calls. There is no doubt that criminals are preying on seniors using various scams around Social Security and Medicare – and that this activity has ratcheted up during the COVID pandemic. Any efforts to combat elder fraud are laudable.

Unfortunately, Trump used the elder fraud initiative as a springboard into some disingenuous claims about everything the administration has supposedly done for seniors. “We’re taking care of our senior citizens better than ever before,” he boasted. It’s an incredulous statement, not only in the wake of the pandemic that has claimed a disproportionate share of older Americans’ lives, but also in the broad sweep of history. Better than ever before? Better than FDR, who created Social Security? Better than LBJ, who signed Medicare and Medicaid into law? Better than President Obama, who provided older patients with protections from pre-existing conditions when seeking health insurance and made significant improvements to Medicare? The usual Trumpian hyperbole aside, the President made several claims about his administration’s ‘helpfulness’ to seniors during Monday’s event that don’t hold up.

TRUMP: “Last month, I announced the deal to slash out-of-pocket costs of insulin, and insulin is such a big deal and such a big factor of importance for our senior citizens. And we slashed costs for hundreds of thousands of Medicare beneficiaries.”

REALITY: The Trump administration announced that participating enhanced Medicare Part D prescription drug plans will allow beneficiaries to access insulin for a maximum copay of $35 for one month’s supply. Only patients who elect (and pay for) enhanced coverage will be able to take advantage of the $35 price cap – and only if their drug plans participate. Millions of seniors whose plans do not include this provision will continue to pay an average of over $1,100 in annual out of pocket insulin costs. The new policy does nothing to reduce the skyrocketing price of insulin.

TRUMP: “Average basic [Medicare] Part D [prescription drug] premiums have dropped 13.5 percent…”

Market forces, not the President, are mainly responsible for fluctuations in Medicare premiums. More importantly. premiums are not the only costs that seniors bear. Average out-of-pocket costs for Medicare beneficiaries have risen as premiums fluctuate. Many seniors, like other adults, choose plans with lower premiums without realizing that they may pay more out-of-pocket. At the end of 2018, US News and World Report indicated that, without federal intervention, “the prescription benefit in Medicare Part D will start drawing a lot more money out of the pockets of seniors taking pricey drugs.”

TRUMP: “As you know, last year was the first year where drug prices, in 52 years — where drug prices have actually gone down, the cost of prescription drugs.”

REALITY: The President likes to cite this statistic, but it is only one measure of drug prices and it is not the first time that this indicator has gone down in 52 years. This index reflects what the average consumer pays at retail pharmacies, not the actual costs of drugs. Meanwhile, prices for the most often-prescribed drugs for Medicare patients increased 10 times the rate of inflation during a recent five-year period. The popular anti-inflammatory, Humira – which seniors take for everything from arthritis to Crohn’s Disease – now costs up to $72,000 annually – with Medicare patients paying up to $5,000 out of pocket for this drug.

TRUMP: “We’re strongly defending Medicare and Social Security, and we always will.”

REALITY: This is probably the President’s most laughable claim regarding seniors. The Trump administration’s budgets have proposed cutting hundreds of billions of dollars from Medicare. The White House has relentlessly tried to repeal the Affordable Care Act, which made significant improvements to Medicare. The administration has proposed to cut Social Security Disability Insurance by tens of billions of dollars – and imposed a new rule to make it harder for people with disabilities to continue collecting benefits. The President has campaigned tirelessly to eliminate payroll taxes, which directly fund Social Security and Medicare, at a time when both programs need more, not less, revenue. The list goes on. This is the President’s notion of “strongly defending” both programs?

Meanwhile, seniors appear to strongly disagree with proposals from the White House and conservatives in Congress that would tamper with Social Security. This is made clear in a National Committee survey of its member and supporters released last week.

TRUMP: “We’ll always protect our senior citizens and everybody against preexisting conditions.”

REALITY: The opposite is true. The President has done everything to undermine protections for pre-existing conditions, especially for seniors. He tried to repeal the Affordable Care Act, which prevented health insurers from declining coverage for pre-existing conditions – which older patients tend to suffer from more than younger adults. The ACA also limited insurers’ ability to charge older patients higher premiums than younger ones. A president committed to protecting people with pre-existing conditions would not still be trying to destroy Obamacare. When the GOP-controlled Congress failed to repeal the ACA, the White House attempted to sabotage the program through administrative measures, and is still arguing (during a pandemic) that Obamacare should be struck down in the federal courts. The administration also began allowing junk insurance plans with high deductibles that do not protect patients with pre-existing conditions.

Instead of prevaricating and pandering, here is what the President would do if he were a true champion of seniors:

- Endorse legislation to expand and strengthen Social Security;

- Embrace the Lower Drug Costs Now Act, which would allow Medicare to negotiate prescription prices directly with Big Pharma;

- Stop promoting private Medicare Advantage plans over traditional Medicare;

- Significantly increase funding for the Social Security Administration to provide seniors with better customer service;

- Cease the campaign to eliminate Social Security and Medicare payroll taxes;

- Stop proposing $1.5 trillion in budget cuts to Medicare and Medicaid; Don’t propose to slash programs that help to feed lower income seniors and keep their homes heated in the winter;

- Condemn calls from conservatives to sacrifice seniors’ lives during COVID-19 for the sake of the economy.

These actions would go a long way toward “taking care of seniors,” but President Trump is not likely to take them. Perhaps that is why seniors, wary of this President’s commitment to their well-being – especially during the Coronavirus pandemic – have continued to turn away from him and may not vote Trump in 2020.

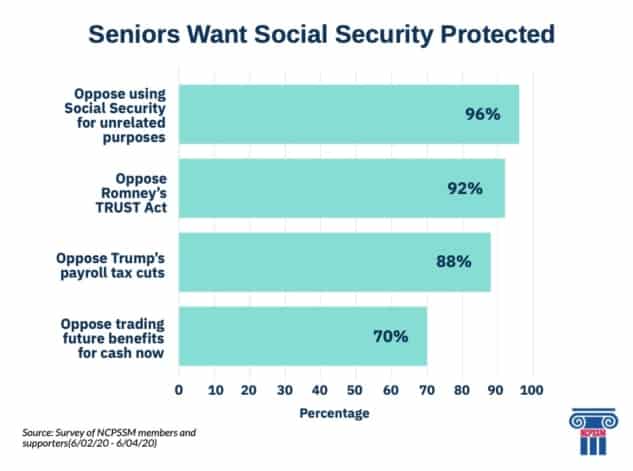

Survey Says: Seniors Want Social Security Protected, not Misused

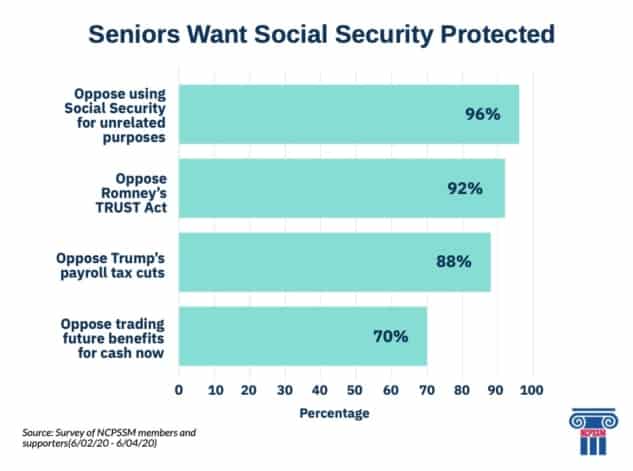

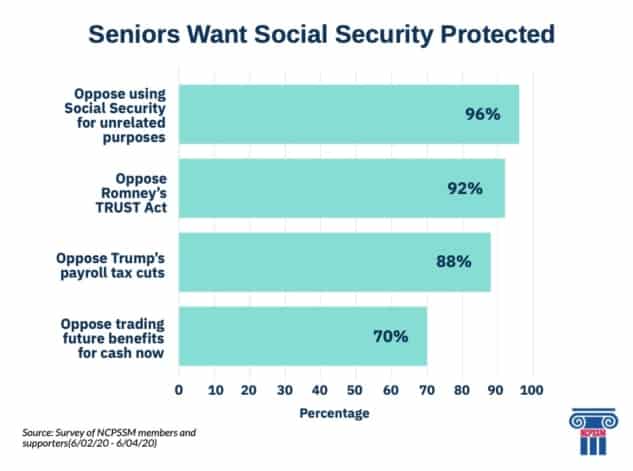

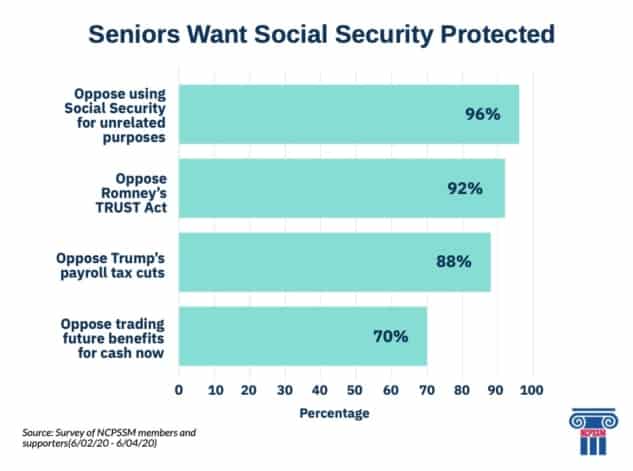

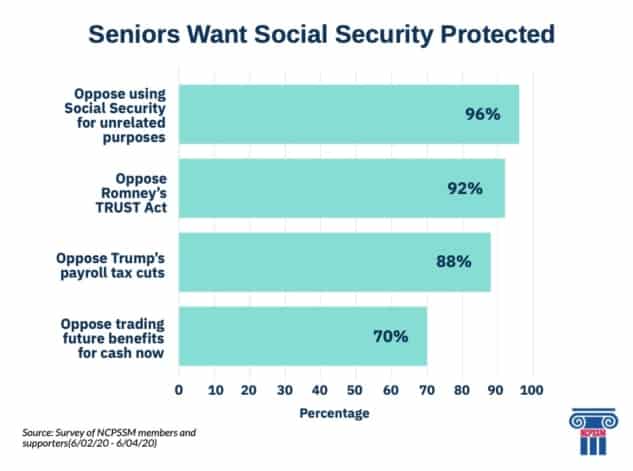

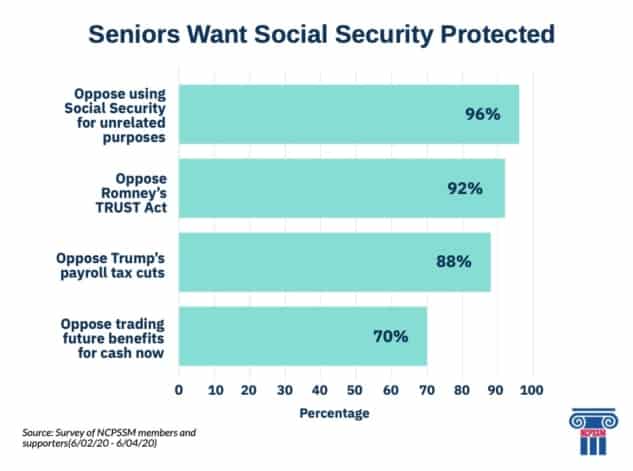

A new survey of National Committee members and supporters suggests that the Trump administration and so-called “fiscal hawks” in Congress are seriously out of step with American seniors when it comes to Social Security. In the face of an intensifying campaign to undermine the program using the COVID pandemic as cover, the majority of respondents told us they want Social Security expanded – and not misused for unrelated purposes.

Ninety-six percent said they oppose the use of Social Security funds to pay for other fiscal priorities. In particular, 88% oppose President Trump’s reckless proposals to cut the payroll taxes that fund Social Security. These proposals would not only interfere with the program’s revenue stream, they would mostly benefit larger companies and higher earners, instead of the low-income workers who need the most financial relief during the pandemic.

Ninety-two percent of our members and supporters reject Senator Mitt Romney’s TRUST Act, which would establish “rescue committees” for Social Security’s trust funds – and would allow severe benefit cuts to be fast-tracked in Congress.

Seventy percent of respondents are against a new scheme (which White House aides considered) to give Americans the option of forfeiting some of their future Social Security benefits for emergency cash now.

The National committee recognizes that working Americans need relief from the financial pain of the COVID crisis. But we disagree that Social Security – a program funded by Americans workers – should be misappropriated for purposes having nothing to do with its core mission, which is to provide basic income upon retirement, disability, or the death of a family breadwinner. That is the very reason that President Franklin Roosevelt and his aides crafted Social Security as a worker-funded program – to protect it from politicians who might seek to misuse or dismantle it.

“This polling shows that many policymakers continue to be tone-deaf to the overwhelming support for social security and overwhelming opposition to proposals to tamper with Social Security. These proposals may be attractive to campaign donors on Wall Street, but certainly not among American seniors.” – Dan Adcock, Director of Government Relations and Policy, National Committee to Preserve Social Security and Medicare

While our members and supporters reject the President’s and fiscal hawks’ policies, they overwhelmingly support legislation to expand and strengthen Social Security. Ninety-two percent say it’s time to pass the Social Security 2100 Act, which would boost earned benefits and ensure Social Security’s long-term solvency.

The future of Social Security very much hinges on the outcome of the 2020 elections. If the President is re-elected and his party maintains its Senate majority, the harmful proposals that most Americans reject could take root. If, on the other hand, seniors vote in their own interests – as they did in 2018 – destructive policies can be blocked and legislation like the Social Security 2100 Act can be enacted, giving beneficiaries a much-needed raise and safeguarding the program’s financial future. Seniors need true champions in the White House and in Congress. The new poll results are an encouraging sign for seniors… and a stunning rebuke for Social Security’s opponents.

African-Americans and Racial Disparity in Retirement Income

As journalist Alessandra Malito aptly points out in MarketWatch, at the same time as Americans protest for equal justice under the law for African-Americans, there is growing demand for economic justice, as well. “There are calls for overall societal changes, such as equity in education, banking, housing and health care,” she writes. This includes gross disparities in retirement income between whites and communities of color.

According to the Center for Retirement Research at Boston University, African-American households have only 46% of the retirement income of their white counterparts. There are many reasons why it is harder for communities of color to build retirement income. Too many African-Americans are concentrated in lower-wage jobs that lack pensions – or retirement plans of any kind. Black workers face ongoing job discrimination and higher unemployment rates than whites (a trend that continues during the COVID pandemic), making it difficult to save or invest for retirement. The just-released May jobs report had good news for all other workers, but not African-Americans:

“Unemployment rates declined among white and Hispanic Americans, but the level ticked up among African Americans to 16.8%, matching the highest since 1984. That comes amid nationwide protests over police mistreatment of African-Americans, which have drawn renewed attention to black people’s economic plight.” – Bloomberg, 6/5/20

Social Security is often the only thing keeping African-American retirees out of poverty. Were it not for Social Security, black households would have only 16% the retirement assets of white households.

“Without the program, a typical black household would have five to seven times less wealth than a white household. Adding Social Security payments to their income reduces that gap to two to three times less.” – Alessandra Malito, Marketwatch, 6/3/20

In fact, Social Security provides most elderly African Americans with their sole or primary source of income in retirement. (Overall, some 40% of all retirees rely on Social Security for all of their living expenses.) This is why any attempts to weaken or cut Social Security would hurt all retirees, but impact African-Americans the most.

“Across-the-board benefit cuts, such as increases in the Full Retirement Age, will have an outsize impact on black and Hispanic households’ retirement wealth. As policymakers consider changes to the Social Security program to shore up its finances, considering ways to mitigate any impact on these groups may be important.” – Center for Retirement Research

Unfortunately, across-the-board benefit cuts are exactly what ‘fiscal hawks’ in Congress and the private sector have proposed under the guise of “entitlement reform.” President Trump, who promised not to touch Social Security, continues to signal that he is open to potentially devastating benefit reductions in the future. “Oh, we’ll be cutting,” he said at a FOX Town Hall in March.

The National Committee has ardently opposed any attempts by the administration and Congress to cut Social Security, while endorsing much-needed legislation to boost benefits – and guarantee the program’s financial future financial health, so that it is there for everyone, especially communities of color.

African-Americans would benefit from Rep. John Larson’s Social Security 2100 Act in several ways. The bill provides a 2% across-the-board benefit boost. But it also increases the special minimum benefit – designed to supplement low income workers’ retirement income – to 125% of the federal poverty level. And it adopts a more accurate cost-of-living adjustment formula, the CPI-E, which would help retirees better keep up with inflation. It’s time for Congress to move this legislation forward – for the benefit of communities of color and all workers.

Social Security is already a lifeline for millions of African-American retirees. As communities of color fight for social and economic justice, Social Security can play an even more crucial role moving forward – if our elected leaders have the conviction to strengthen and expand the program that keeps millions of our most vulnerable citizens out of poverty.

Senior Voters Are Turning Away From Trump

Older Americans helped propel President Trump to victory in 2016, but recent polling indicates that he is now underwater with senior voters. The president’s approach to the COVID crisis seems to be driving this change. In a recent Morning Consult poll, seniors’ approval of the President’s handling of the pandemic dropped 20 points since March, “and is now lower than that of any age group other than 18-29 year olds.”

“By a nearly 6-to-1 margin, people 65 years old and older say it’s more important for the government to address the spread of coronavirus than it is to focus on the economy. And as President Donald Trump increasingly signals interest in prioritizing economic interests, America’s senior citizens are growing critical of his approach.” – Morning Consult

It’s not surprising that when older voters see their peers dying in large numbers from COVID, mainly in nursing homes, that they might reject the administration’s handling of the crisis.

According to The Hill newspaper, seniors’ growing disapproval of the president may affect his prospects with this key voting bloc in November:

“Older voters view former Vice President Joe Biden as an ‘appealing alternative’ to Trump. Recent polling indicates that the former vice president now holds a 10-point advantage over Trump with older American voters.” – The Hill, 5/26/20

Trump is also trailing Biden in the key swing state of Florida, where the president beat Hillary Clinton by 17 points among seniors. In an April Quinnipiac poll, Biden had a 10-point edge on Trump with older Florida voters.

It can be argued that this shift in senior voter sentiment began in 2018, when older voters (who President Trump won by seven points in 2016) roughly split their votes between the two major parties, helping Democrats recapture the House.

“Nationally, Democrats won in 2018 because when it came to ‘the deciders’ — those Americans age 50 and up—they fought Republicans to a draw.” – Politico, 2018

The 2018 results no doubt pivoted on seniors’ understandable concerns about Trump and his party’s attempts to strip millions of Americans of health coverage (through repeal of the Affordable Care Act), including crucial protections for the pre-existing conditions that older patients typically experience.

In fact, there are plenty of other good reasons for seniors to re-evaluate their past support of Donald Trump. Before the 2018 elections, we urged older Americans to vote in their own interests and oppose congressional candidates who supported the President’s agenda on Social Security, Medicare, and a host of issues affecting seniors.

Since taking office, President Trump has blatantly broken his campaign promises “not to touch” seniors’ earned benefits. His administration has proposed deep cuts to Social Security Disability Insurance, Medicare, and Medicaid (which covers long-term care services and supports). The administration has shown a preference for private Medicare Advantage plans over traditional Medicare to the detriment of enrollees. Trump’s annual budgets have called for eliminating federal grants for programs that feed low-income seniors and keep their homes warm in the winter.

Most recently, the President has crusaded for a payroll tax cut that would reduce the revenue streams for Social Security and Medicare, placing the future of seniors’ earned benefits at unnecessary risk. In fact, the White House continues to explore proposals that would similarly misuse Social Security funding for unrelated purposes.

Seniors are savvy. They may have believed President Trump’s promises in 2016, but now they’ve seen and heard enough from this administration to know when they’re being played. Because seniors are one of the nation’s most reliable and enthusiastic voting blocs, that does not bode well for his re-election prospects in 2020.

Sorry, Reuters: Payroll Tax Cut Would Not Benefit Lower Income Workers the Most

It’s crucial that the news media put President Trump’s harmful proposals for payroll tax cuts in perspective. Many publications are doing a decent job of that, including the Los Angeles Times, CNBC, and MarketWatch. But Reuters stumbled in a May 19 article about recent comments by chief White House economist Larry Kudlow:

Trump wants payroll tax holiday to mitigate coronavirus economic pain: Kudlow

“A holiday, essentially a temporary tax cut, generally benefits lower-paid households the most,” Reuters reported, as if that were a widely accepted fact. Payroll tax cut advocates like Kudlow may believe that eliminating FICA payroll contributions are a boon to the working class, but that doesn’t make it true. In fact, recent analyses suggest that lower-income households would realize the least benefit from a payroll tax cut, while high earners would reap a relative windfall.

As the Institution on Taxation and Economic Policy (ITEP) reported earlier this month…

“Nearly half of the benefits [of a payroll tax cut] would go to the richest 20 percent of taxpayers, meaning it would not be particularly targeted to those who need help.”

… while the Center on Budget and Policy Priorities observes:

“Cutting the employee share of payroll taxes gives the most help (in dollar terms) to higher earners, who are less likely to need the help or to spend most or all of the extra money.”

ITEP calculates that, with a 2% payroll tax cut, the average worker in the lowest 20% income bracket would receive only $200 in relief for the rest of 2020 while an earner in the top bracket would yield more than $4,000.

In addition to the obvious inequities, a payroll tax cut would do nothing to help the more than 30 million Americans who have lost their jobs since the pandemic began – or the many public service workers at all levels of government who do not participate in Social Security.

As in much of the media coverage of President Trump’s payroll tax cut proposals, the Reuters story does not even mention Social Security – which workers’ payroll contributions fund.

“The conservative leaning Tax Foundation has estimated that if the Trump administration held a holiday starting on April 1 that lasted through the end of the year, the government would lose out on $950 billion.” – Reuters, 5/19/20

It would be a lot more accurate to say that Social Security – and all the American families who depend on it – would lose $950 billion in much-needed revenue. (If Congress takes no action, the Social Security trust fund will become depleted by 2035.) But the Reuters story and others like it fail to make the link between payroll taxes and the program they were established to fund. Social Security is the very reason they exist.

That omission plays into the hands of President Trump, some of his advisors, and his allies in Congress who talk about payroll contributions as if they were ‘just another tax to be cut,’ rather than the lifeblood of America’s most successful social insurance program.

The Reuters article also takes for granted that Trump and Kudlow’s main motivation is “staunching economic pain caused by the coronavirus pandemic,” rather than undermining the earned benefits of retirees, people with disabilities, and their families by constricting Social Security’s revenue stream. Payroll tax cuts will not relieve working people’s economic pain; they will exacerbate it by compromising the basic financial security that Social Security provides when Americans need it most.

Trump Administration No Friend to Seniors

President Trump at White House roundtable event, “Fighting for America’s Seniors”

With about five months until the 2020 elections, President Trump is underwater with senior voters – a demographic that he won in 2016. Since these polling numbers came out, the President has been making gestures toward older voters – one might say to curry favor – without advocating major policy changes that would significantly improve seniors’ lives. On Monday, President Trump held an event at the White House touting the administration’s supposed accomplishments in this area.

During this “Roundtable Discussion on Fighting for America’s Seniors,” the President touted an elder fraud hotline that the Dept. of Justice established this year, which has received some 1,800 calls. There is no doubt that criminals are preying on seniors using various scams around Social Security and Medicare – and that this activity has ratcheted up during the COVID pandemic. Any efforts to combat elder fraud are laudable.

Unfortunately, Trump used the elder fraud initiative as a springboard into some disingenuous claims about everything the administration has supposedly done for seniors. “We’re taking care of our senior citizens better than ever before,” he boasted. It’s an incredulous statement, not only in the wake of the pandemic that has claimed a disproportionate share of older Americans’ lives, but also in the broad sweep of history. Better than ever before? Better than FDR, who created Social Security? Better than LBJ, who signed Medicare and Medicaid into law? Better than President Obama, who provided older patients with protections from pre-existing conditions when seeking health insurance and made significant improvements to Medicare? The usual Trumpian hyperbole aside, the President made several claims about his administration’s ‘helpfulness’ to seniors during Monday’s event that don’t hold up.

TRUMP: “Last month, I announced the deal to slash out-of-pocket costs of insulin, and insulin is such a big deal and such a big factor of importance for our senior citizens. And we slashed costs for hundreds of thousands of Medicare beneficiaries.”

REALITY: The Trump administration announced that participating enhanced Medicare Part D prescription drug plans will allow beneficiaries to access insulin for a maximum copay of $35 for one month’s supply. Only patients who elect (and pay for) enhanced coverage will be able to take advantage of the $35 price cap – and only if their drug plans participate. Millions of seniors whose plans do not include this provision will continue to pay an average of over $1,100 in annual out of pocket insulin costs. The new policy does nothing to reduce the skyrocketing price of insulin.

TRUMP: “Average basic [Medicare] Part D [prescription drug] premiums have dropped 13.5 percent…”

Market forces, not the President, are mainly responsible for fluctuations in Medicare premiums. More importantly. premiums are not the only costs that seniors bear. Average out-of-pocket costs for Medicare beneficiaries have risen as premiums fluctuate. Many seniors, like other adults, choose plans with lower premiums without realizing that they may pay more out-of-pocket. At the end of 2018, US News and World Report indicated that, without federal intervention, “the prescription benefit in Medicare Part D will start drawing a lot more money out of the pockets of seniors taking pricey drugs.”

TRUMP: “As you know, last year was the first year where drug prices, in 52 years — where drug prices have actually gone down, the cost of prescription drugs.”

REALITY: The President likes to cite this statistic, but it is only one measure of drug prices and it is not the first time that this indicator has gone down in 52 years. This index reflects what the average consumer pays at retail pharmacies, not the actual costs of drugs. Meanwhile, prices for the most often-prescribed drugs for Medicare patients increased 10 times the rate of inflation during a recent five-year period. The popular anti-inflammatory, Humira – which seniors take for everything from arthritis to Crohn’s Disease – now costs up to $72,000 annually – with Medicare patients paying up to $5,000 out of pocket for this drug.

TRUMP: “We’re strongly defending Medicare and Social Security, and we always will.”

REALITY: This is probably the President’s most laughable claim regarding seniors. The Trump administration’s budgets have proposed cutting hundreds of billions of dollars from Medicare. The White House has relentlessly tried to repeal the Affordable Care Act, which made significant improvements to Medicare. The administration has proposed to cut Social Security Disability Insurance by tens of billions of dollars – and imposed a new rule to make it harder for people with disabilities to continue collecting benefits. The President has campaigned tirelessly to eliminate payroll taxes, which directly fund Social Security and Medicare, at a time when both programs need more, not less, revenue. The list goes on. This is the President’s notion of “strongly defending” both programs?

Meanwhile, seniors appear to strongly disagree with proposals from the White House and conservatives in Congress that would tamper with Social Security. This is made clear in a National Committee survey of its member and supporters released last week.

TRUMP: “We’ll always protect our senior citizens and everybody against preexisting conditions.”

REALITY: The opposite is true. The President has done everything to undermine protections for pre-existing conditions, especially for seniors. He tried to repeal the Affordable Care Act, which prevented health insurers from declining coverage for pre-existing conditions – which older patients tend to suffer from more than younger adults. The ACA also limited insurers’ ability to charge older patients higher premiums than younger ones. A president committed to protecting people with pre-existing conditions would not still be trying to destroy Obamacare. When the GOP-controlled Congress failed to repeal the ACA, the White House attempted to sabotage the program through administrative measures, and is still arguing (during a pandemic) that Obamacare should be struck down in the federal courts. The administration also began allowing junk insurance plans with high deductibles that do not protect patients with pre-existing conditions.

Instead of prevaricating and pandering, here is what the President would do if he were a true champion of seniors:

- Endorse legislation to expand and strengthen Social Security;

- Embrace the Lower Drug Costs Now Act, which would allow Medicare to negotiate prescription prices directly with Big Pharma;

- Stop promoting private Medicare Advantage plans over traditional Medicare;

- Significantly increase funding for the Social Security Administration to provide seniors with better customer service;

- Cease the campaign to eliminate Social Security and Medicare payroll taxes;

- Stop proposing $1.5 trillion in budget cuts to Medicare and Medicaid; Don’t propose to slash programs that help to feed lower income seniors and keep their homes heated in the winter;

- Condemn calls from conservatives to sacrifice seniors’ lives during COVID-19 for the sake of the economy.

These actions would go a long way toward “taking care of seniors,” but President Trump is not likely to take them. Perhaps that is why seniors, wary of this President’s commitment to their well-being – especially during the Coronavirus pandemic – have continued to turn away from him and may not vote Trump in 2020.

Survey Says: Seniors Want Social Security Protected, not Misused

A new survey of National Committee members and supporters suggests that the Trump administration and so-called “fiscal hawks” in Congress are seriously out of step with American seniors when it comes to Social Security. In the face of an intensifying campaign to undermine the program using the COVID pandemic as cover, the majority of respondents told us they want Social Security expanded – and not misused for unrelated purposes.

Ninety-six percent said they oppose the use of Social Security funds to pay for other fiscal priorities. In particular, 88% oppose President Trump’s reckless proposals to cut the payroll taxes that fund Social Security. These proposals would not only interfere with the program’s revenue stream, they would mostly benefit larger companies and higher earners, instead of the low-income workers who need the most financial relief during the pandemic.

Ninety-two percent of our members and supporters reject Senator Mitt Romney’s TRUST Act, which would establish “rescue committees” for Social Security’s trust funds – and would allow severe benefit cuts to be fast-tracked in Congress.

Seventy percent of respondents are against a new scheme (which White House aides considered) to give Americans the option of forfeiting some of their future Social Security benefits for emergency cash now.

The National committee recognizes that working Americans need relief from the financial pain of the COVID crisis. But we disagree that Social Security – a program funded by Americans workers – should be misappropriated for purposes having nothing to do with its core mission, which is to provide basic income upon retirement, disability, or the death of a family breadwinner. That is the very reason that President Franklin Roosevelt and his aides crafted Social Security as a worker-funded program – to protect it from politicians who might seek to misuse or dismantle it.

“This polling shows that many policymakers continue to be tone-deaf to the overwhelming support for social security and overwhelming opposition to proposals to tamper with Social Security. These proposals may be attractive to campaign donors on Wall Street, but certainly not among American seniors.” – Dan Adcock, Director of Government Relations and Policy, National Committee to Preserve Social Security and Medicare

While our members and supporters reject the President’s and fiscal hawks’ policies, they overwhelmingly support legislation to expand and strengthen Social Security. Ninety-two percent say it’s time to pass the Social Security 2100 Act, which would boost earned benefits and ensure Social Security’s long-term solvency.

The future of Social Security very much hinges on the outcome of the 2020 elections. If the President is re-elected and his party maintains its Senate majority, the harmful proposals that most Americans reject could take root. If, on the other hand, seniors vote in their own interests – as they did in 2018 – destructive policies can be blocked and legislation like the Social Security 2100 Act can be enacted, giving beneficiaries a much-needed raise and safeguarding the program’s financial future. Seniors need true champions in the White House and in Congress. The new poll results are an encouraging sign for seniors… and a stunning rebuke for Social Security’s opponents.

African-Americans and Racial Disparity in Retirement Income

As journalist Alessandra Malito aptly points out in MarketWatch, at the same time as Americans protest for equal justice under the law for African-Americans, there is growing demand for economic justice, as well. “There are calls for overall societal changes, such as equity in education, banking, housing and health care,” she writes. This includes gross disparities in retirement income between whites and communities of color.

According to the Center for Retirement Research at Boston University, African-American households have only 46% of the retirement income of their white counterparts. There are many reasons why it is harder for communities of color to build retirement income. Too many African-Americans are concentrated in lower-wage jobs that lack pensions – or retirement plans of any kind. Black workers face ongoing job discrimination and higher unemployment rates than whites (a trend that continues during the COVID pandemic), making it difficult to save or invest for retirement. The just-released May jobs report had good news for all other workers, but not African-Americans:

“Unemployment rates declined among white and Hispanic Americans, but the level ticked up among African Americans to 16.8%, matching the highest since 1984. That comes amid nationwide protests over police mistreatment of African-Americans, which have drawn renewed attention to black people’s economic plight.” – Bloomberg, 6/5/20

Social Security is often the only thing keeping African-American retirees out of poverty. Were it not for Social Security, black households would have only 16% the retirement assets of white households.

“Without the program, a typical black household would have five to seven times less wealth than a white household. Adding Social Security payments to their income reduces that gap to two to three times less.” – Alessandra Malito, Marketwatch, 6/3/20

In fact, Social Security provides most elderly African Americans with their sole or primary source of income in retirement. (Overall, some 40% of all retirees rely on Social Security for all of their living expenses.) This is why any attempts to weaken or cut Social Security would hurt all retirees, but impact African-Americans the most.

“Across-the-board benefit cuts, such as increases in the Full Retirement Age, will have an outsize impact on black and Hispanic households’ retirement wealth. As policymakers consider changes to the Social Security program to shore up its finances, considering ways to mitigate any impact on these groups may be important.” – Center for Retirement Research

Unfortunately, across-the-board benefit cuts are exactly what ‘fiscal hawks’ in Congress and the private sector have proposed under the guise of “entitlement reform.” President Trump, who promised not to touch Social Security, continues to signal that he is open to potentially devastating benefit reductions in the future. “Oh, we’ll be cutting,” he said at a FOX Town Hall in March.

The National Committee has ardently opposed any attempts by the administration and Congress to cut Social Security, while endorsing much-needed legislation to boost benefits – and guarantee the program’s financial future financial health, so that it is there for everyone, especially communities of color.

African-Americans would benefit from Rep. John Larson’s Social Security 2100 Act in several ways. The bill provides a 2% across-the-board benefit boost. But it also increases the special minimum benefit – designed to supplement low income workers’ retirement income – to 125% of the federal poverty level. And it adopts a more accurate cost-of-living adjustment formula, the CPI-E, which would help retirees better keep up with inflation. It’s time for Congress to move this legislation forward – for the benefit of communities of color and all workers.

Social Security is already a lifeline for millions of African-American retirees. As communities of color fight for social and economic justice, Social Security can play an even more crucial role moving forward – if our elected leaders have the conviction to strengthen and expand the program that keeps millions of our most vulnerable citizens out of poverty.

Senior Voters Are Turning Away From Trump

Older Americans helped propel President Trump to victory in 2016, but recent polling indicates that he is now underwater with senior voters. The president’s approach to the COVID crisis seems to be driving this change. In a recent Morning Consult poll, seniors’ approval of the President’s handling of the pandemic dropped 20 points since March, “and is now lower than that of any age group other than 18-29 year olds.”

“By a nearly 6-to-1 margin, people 65 years old and older say it’s more important for the government to address the spread of coronavirus than it is to focus on the economy. And as President Donald Trump increasingly signals interest in prioritizing economic interests, America’s senior citizens are growing critical of his approach.” – Morning Consult

It’s not surprising that when older voters see their peers dying in large numbers from COVID, mainly in nursing homes, that they might reject the administration’s handling of the crisis.

According to The Hill newspaper, seniors’ growing disapproval of the president may affect his prospects with this key voting bloc in November:

“Older voters view former Vice President Joe Biden as an ‘appealing alternative’ to Trump. Recent polling indicates that the former vice president now holds a 10-point advantage over Trump with older American voters.” – The Hill, 5/26/20

Trump is also trailing Biden in the key swing state of Florida, where the president beat Hillary Clinton by 17 points among seniors. In an April Quinnipiac poll, Biden had a 10-point edge on Trump with older Florida voters.

It can be argued that this shift in senior voter sentiment began in 2018, when older voters (who President Trump won by seven points in 2016) roughly split their votes between the two major parties, helping Democrats recapture the House.

“Nationally, Democrats won in 2018 because when it came to ‘the deciders’ — those Americans age 50 and up—they fought Republicans to a draw.” – Politico, 2018

The 2018 results no doubt pivoted on seniors’ understandable concerns about Trump and his party’s attempts to strip millions of Americans of health coverage (through repeal of the Affordable Care Act), including crucial protections for the pre-existing conditions that older patients typically experience.

In fact, there are plenty of other good reasons for seniors to re-evaluate their past support of Donald Trump. Before the 2018 elections, we urged older Americans to vote in their own interests and oppose congressional candidates who supported the President’s agenda on Social Security, Medicare, and a host of issues affecting seniors.

Since taking office, President Trump has blatantly broken his campaign promises “not to touch” seniors’ earned benefits. His administration has proposed deep cuts to Social Security Disability Insurance, Medicare, and Medicaid (which covers long-term care services and supports). The administration has shown a preference for private Medicare Advantage plans over traditional Medicare to the detriment of enrollees. Trump’s annual budgets have called for eliminating federal grants for programs that feed low-income seniors and keep their homes warm in the winter.

Most recently, the President has crusaded for a payroll tax cut that would reduce the revenue streams for Social Security and Medicare, placing the future of seniors’ earned benefits at unnecessary risk. In fact, the White House continues to explore proposals that would similarly misuse Social Security funding for unrelated purposes.

Seniors are savvy. They may have believed President Trump’s promises in 2016, but now they’ve seen and heard enough from this administration to know when they’re being played. Because seniors are one of the nation’s most reliable and enthusiastic voting blocs, that does not bode well for his re-election prospects in 2020.

Sorry, Reuters: Payroll Tax Cut Would Not Benefit Lower Income Workers the Most

It’s crucial that the news media put President Trump’s harmful proposals for payroll tax cuts in perspective. Many publications are doing a decent job of that, including the Los Angeles Times, CNBC, and MarketWatch. But Reuters stumbled in a May 19 article about recent comments by chief White House economist Larry Kudlow:

Trump wants payroll tax holiday to mitigate coronavirus economic pain: Kudlow

“A holiday, essentially a temporary tax cut, generally benefits lower-paid households the most,” Reuters reported, as if that were a widely accepted fact. Payroll tax cut advocates like Kudlow may believe that eliminating FICA payroll contributions are a boon to the working class, but that doesn’t make it true. In fact, recent analyses suggest that lower-income households would realize the least benefit from a payroll tax cut, while high earners would reap a relative windfall.

As the Institution on Taxation and Economic Policy (ITEP) reported earlier this month…

“Nearly half of the benefits [of a payroll tax cut] would go to the richest 20 percent of taxpayers, meaning it would not be particularly targeted to those who need help.”

… while the Center on Budget and Policy Priorities observes:

“Cutting the employee share of payroll taxes gives the most help (in dollar terms) to higher earners, who are less likely to need the help or to spend most or all of the extra money.”

ITEP calculates that, with a 2% payroll tax cut, the average worker in the lowest 20% income bracket would receive only $200 in relief for the rest of 2020 while an earner in the top bracket would yield more than $4,000.

In addition to the obvious inequities, a payroll tax cut would do nothing to help the more than 30 million Americans who have lost their jobs since the pandemic began – or the many public service workers at all levels of government who do not participate in Social Security.

As in much of the media coverage of President Trump’s payroll tax cut proposals, the Reuters story does not even mention Social Security – which workers’ payroll contributions fund.

“The conservative leaning Tax Foundation has estimated that if the Trump administration held a holiday starting on April 1 that lasted through the end of the year, the government would lose out on $950 billion.” – Reuters, 5/19/20

It would be a lot more accurate to say that Social Security – and all the American families who depend on it – would lose $950 billion in much-needed revenue. (If Congress takes no action, the Social Security trust fund will become depleted by 2035.) But the Reuters story and others like it fail to make the link between payroll taxes and the program they were established to fund. Social Security is the very reason they exist.

That omission plays into the hands of President Trump, some of his advisors, and his allies in Congress who talk about payroll contributions as if they were ‘just another tax to be cut,’ rather than the lifeblood of America’s most successful social insurance program.

The Reuters article also takes for granted that Trump and Kudlow’s main motivation is “staunching economic pain caused by the coronavirus pandemic,” rather than undermining the earned benefits of retirees, people with disabilities, and their families by constricting Social Security’s revenue stream. Payroll tax cuts will not relieve working people’s economic pain; they will exacerbate it by compromising the basic financial security that Social Security provides when Americans need it most.