FDR’S GRANDSON ON WHY THE NATIONAL COMMITTEE ENDORSED JOE BIDEN

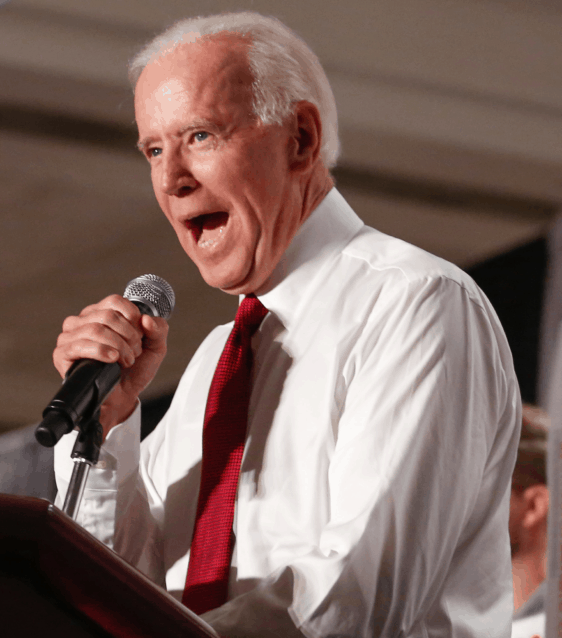

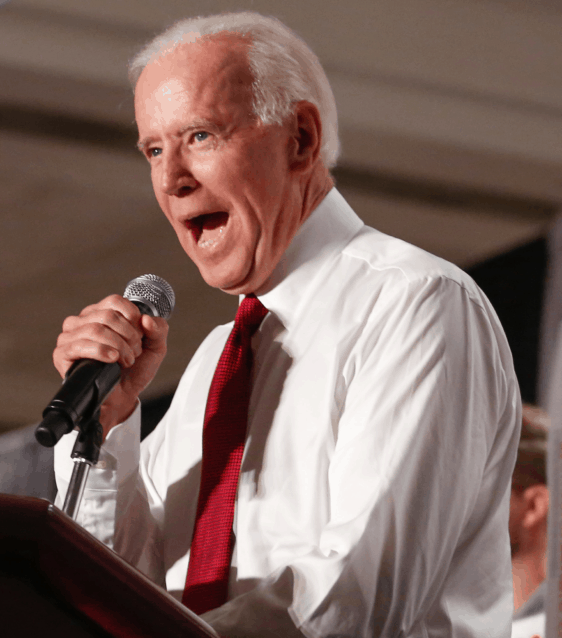

President Roosevelt’s grandson, James Roosevelt, Jr., is vice-chair of the National Committee’s advisory board

The National Committee to Preserve Social Security and Medicare announced Thursday that it is endorsing Joe Biden for president. This endorsement breaks a 38-year tradition of remaining neutral in presidential races, while focusing on Congressional elections. But the endorsement was necessary, says National Committee president and CEO Max Richtman, in light of President Trump’s promise to “terminate” the payroll taxes that fund Social Security, and other attacks on seniors’ earned benefits during the past 3 and a half years. “Americans deserve a President who will protect and strengthen the federal government’s commitment to older Americans, and that is Joe Biden,” says Richtman.

Watch Max Richtman’s video endorsing Joe Biden here.

The National Committee, an organization with roots in President Franklin Roosevelt’s New Deal, was founded by FDR’s son, Congressman James Roosevelt, Sr., in 1982 to protect Social Security and Medicare. We spoke to his son (and FDR’s grandson), James Roosevelt, Jr., vice-chair of the National Committee’s advisory board, about this historic endorsement and the reasons behind it.

Why should the National Committee break with precedent now and endorse Joe Biden for president?

JAMES ROOSEVELT: “Social Security is under unprecedented assault. No presidential candidate or incumbent has ever proposed cutting off Social Security’s payroll-based funding before. Joe Biden supports expanding and strengthening Social Security. Donald Trump talked about cutting off its financial lifeline. I am 100% behind the National Committee’s decision to endorse Joe Biden, the candidate who can be trusted to protect seniors’ earned benefits from any attempts to undermine or privatize them. This is an unusual situation and requires unprecedented action. Joe Biden has earned this endorsement and Donald Trump has forfeited it.”

Do Joe Biden and Kamala Harris understand the current needs of American seniors?

JAMES ROOSEVELT: “Joe Biden has a record of over four decades of being a strong supporter of Social Security and Medicare. It’s clear that he understands their importance. Kamala Harris has joined in that support in her time in the Senate. Joe Biden was a strong voice in the Senate for the needs of seniors and it’s clear that the proposals that Biden and Harris are offering demonstrate a clear understanding of American seniors’ needs.”

Do you think that seniors’ earned benefits are in danger if President Trump is re-elected?

“I am convinced that Social Security and Medicare and overall health coverage is in danger if Donald trump stays in power. We are facing with Donald Trump something that FDR couldn’t have imagined, namely, somebody who has no regard for the well-being of the American people. When FDR said ‘no damn politician’ would dare scrap Social Security, he still thought every politician would be concerned for the welfare of the American people. He never contemplated a Donald Trump.”

Is the payroll tax deferral the only reason we’re endorsing, or is it just the straw that broke the camel’s back?

JAMES ROOSEVELT: “Throughout 3.5 years in office, President Trump has taken administrative action to reduce the effectiveness of the Social Security Administration. The Trump administration has cut SSA personnel, closed offices, and appointed a commissioner who is committed to the privatization of seniors’ retirement funding. Joe Biden has a strong record of supporting seniors’ earned benefits and expanding Social Security.”

What about Medicare and Medicaid?

JAMES ROOSEVELT: “Joe Biden is a strong supporter of expanding Medicare coverage and Medicaid expansion being available in all states. Once again, Donald Trump has sought to undercut these programs. Most dramatically, Donald Trump has asked the Supreme Court to invalidate all Medicaid expansion by throwing out the Affordable Care Act. Across the board, Donald Trump has imperiled Medicare coverage. Joe Biden is supportive of Medicare and Medicaid, not just continuing but improving these programs.”

Can Joe Biden and Kamala Harris usher-in a ‘New’ New Deal if elected, in the same spirit as your grandfather’s?

JAMES ROOSEVELT: “There’s no question that Joe Biden and Kamala Harris are committed to a very progressive, New Deal-like approach for the 21stcentury. It’s needed for overall equity, including racial equity, but it’s particularly needed to meet the economic challenges that this country has faced in recent decades. The COVID-19 recession requires bold government action. Joe Biden and Kamala Harris understand that. President Trump downplays COVID-19, which has disproportionately affected seniors. It’s been devastating for seniors from a health point of view and often from a financial point of view as families lose the ability to support their older relatives.”

Read the press release about our endorsement of Joe Biden here.

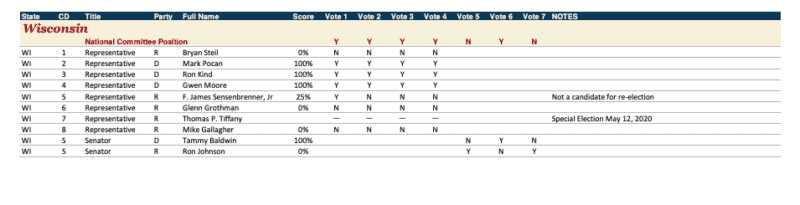

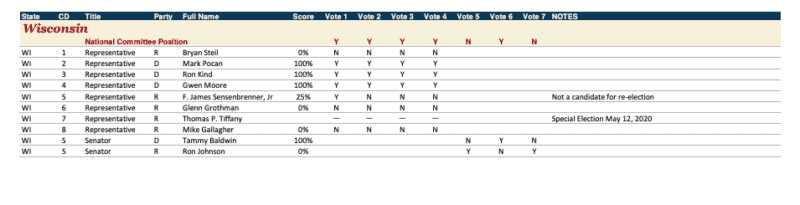

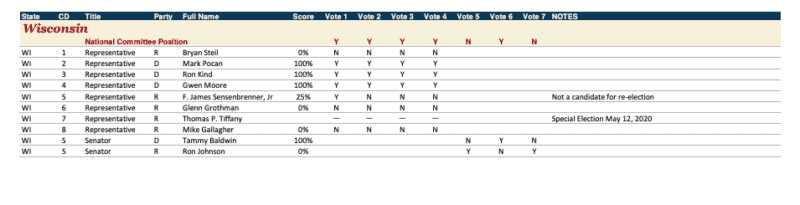

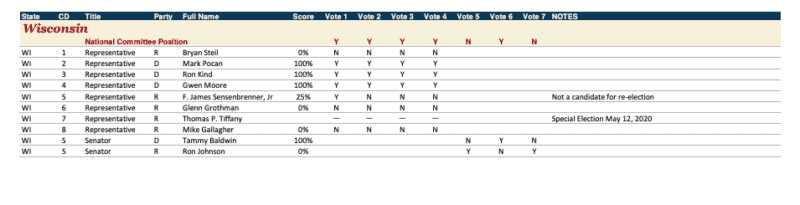

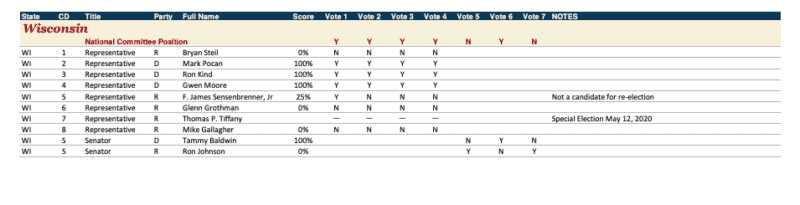

National Committee Releases Congressional Scorecard in Advance of 2020 Elections

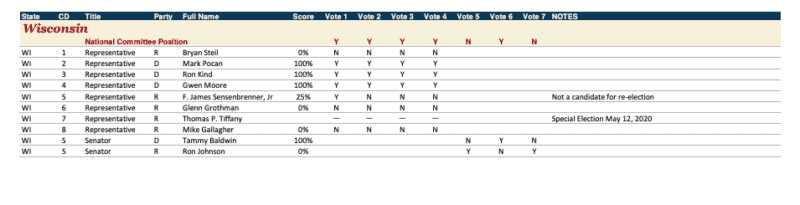

For the first time, voters across America can now access a Congressional Scorecard from the National Committee to Preserve Social Security and Medicare to view their elected representatives’ records on issues crucial to seniors before this fall’s elections. The scorecard – previously available exclusively to National Committee members – is designed to inform citizens about how their House and Senate members voted on Social Security, Medicare, and other measures impacting older Americans during the 116th Congress.

“This election, more than any other, will determine whether seniors’ earned benefits are protected and expanded or cut and privatized. Workers pay for these benefits with their hard-earned payroll contributions over the course of their lifetimes. Amid a pandemic that has taken a disproportionate toll on older Americans, it is critical that voters understand their House and Senate members’ votes on key legislation affecting seniors. Our Congressional Scorecard will help voters compare incumbents’ public statements with their actual records.” – Max Richtman, president and CEO of the National Committee to Preserve Social Security and Medicare

To view their representatives’ scores, voters can visit www.ncpssm.org/scorecard and click on their state on the interactive U.S. map. That will bring up a list of the state’s U.S. Senators and House members, along with a record of relevant votes and a percentage score from 0 to 100%. The higher a members’ score, the better his/her votes aligned with seniors’ interests. Elected representatives with a perfect 100% score voted in favor of older Americans every time. House and Senate members scoring 0% voted consistently against seniors’ interests — or may have missed the votes in our scorecard.

On the House side, these votes included the Protecting Americans with Preexisting Conditions Act and the Elijah E. Cummings Lower Drug Costs Now Act. (H.R. 3), among others. Critical Senate votes included the Bipartisan Budget Act of 2019, which would have resulted in cuts to Social Security, Medicare, and Medicaid — and a measure disapproving of the president’s order allowing states to offer junk health insurance plans under the Affordable Care Act.

“The urgency of this election compelled us to release incumbents’ scores publicly so that all voters have the fullest possible picture of where their elected representatives in Congress stand. Armed with this information, we believe Americans will see which candidates truly support the social safety net programs that seniors depend on now more than ever during the COVID pandemic – and vote accordingly.” – Max Richtman

Eliminating Payroll Taxes Would Exhaust Social Security Trust Funds

We have warned in this space and others that President Trump’s payroll tax cuts are dangerous to Social Security. The program’s chief actuary has just confirmed that. In a new analysis, Stephen Goss warns that if payroll taxes were “eliminated” (as President Trump has promised to do if re-elected), the Social Security retirement trust fund would run dry in 2023. (The Social Security Disability Insurance trust fund would be depleted even sooner – in the middle of next year.)

President Trump signed an executive order on August 8, deferring the payment of workers’ payroll taxes until 2021. At that time, he vowed to terminate payroll taxes in his second term.

“If victorious on November 3rd, I plan to forgive these taxes and make permanent cuts to the payroll tax… I’m going to make them all permanent.” – President Trump

As the chief actuary’s analysis confirms, permanently eliminating the payroll taxes that Social Security depends on for its funding would destroy the program, which protects nearly 70 million Americans from income loss in retirement and upon disability or death of a family provider. (Social Security celebrated its 85th anniversary on August 14th.)

Goss prepared his analysis in response to a request from four U.S. Senators: Sen. Chris Van Hollen (D-MD), Sen. Bernie Sanders (I-VT), Sen. Ron Wyden (D-OR), and Senate Minority Leader Chuck Schumer (D-NY). Van Hollen reacted swiftly to the chief actuary’s projections.

“This analysis makes clear – this is another thinly veiled attempt to gut Social Security and go after the American people’s hard-earned benefits… We can’t let Trump get away with this and will do everything in our power to prevent this disastrous policy from ever going into effect.” – Sen. Chris Van Hollen (D-MD), 8/25/20

President Trump has suggested that funds from payroll tax contributions could be replaced by general federal revenue. That would fundamentally alter the ‘earned benefit’ nature of Social Security. “Social Security is not a handout. It’s not an entitlement,” National Committee government relations director Dan Adcock told CNBC. “That’s why even under those circumstances we are so strongly opposed to payroll tax cuts.”

The August 8th executive order was an attempt by President Trump to circumvent Congress, where the payroll tax was wildly unpopular with Democrats and some Republicans, too. And for good reason: not only do payroll tax cuts interfere with Social Security’s funding stream, they provide minimal economic stimulus, heavily favor employers and high-income earners, and do nothing for Americans currently out of work. Furthermore, the President’s executive order has sown confusion among employers.

“It’s been two weeks since Trump issued his directive deferring the deadline to pay worker’s portions of Social Security taxes from Sept. 1 to the end of the year. But employers, which are responsible for submitting those payments to the Internal Revenue Service, are waiting to hear from the agency on how any tax bill would be handled when it comes due later.” – Bloomberg, 8/25/20

The fact that the President or his advisors would even entertain the idea of deferring or terminating Social Security’s dedicated funding stream, especially now when the Social Security program is delivering critically needed economic stability during the COVID pandemic, demonstrates how much the Trump administration doesn’t know – or doesn’t care – about Social Security.

Trump Payroll Tax Cut is First Shot in War Against Social Security

Whether or not President Trump understands the dangerous implications of “terminating payroll taxes,” his executive order on Saturday and accompanying remarks should alarm all Americans. The President’s exercising unilateral authority (of dubious legality) to cut the payroll taxes which fund Social Security proves that opponents of workers’ earned benefits have his ear. Earlier this month, conservative commentator and longtime antagonist of Social Security Stephen Moore implored the President to bypass Congress and order the I.R.S. to impose a “payroll tax holiday.” That’s exactly what the President’s executive order does. And that’s exactly what many on the right want: a back-door method to destroy Social Security under the guise of a “tax cut.”

“Beyond the attack on crucial earned benefits, this action does nothing to help unemployed and retired Americans survive this unprecedented crisis. Instead, the President is focused on undermining their financial security… This decree is a poorly disguised first step in an effort to fully dismantle this vital program by executive fiat.” – Rep. Richard Neal, Chairman of House Ways & Means Committee, 8/9/20

Simply put, the President’s action is a blatant betrayal of his promises “not to touch” Social Security. Rescinding workers’ payroll contributions – even temporarily – is harmful to Social Security, since the program’s funding depends on those taxes. But the President’s pronouncement that if re-elected he would “terminate FICA taxes” is even more chilling. No supporter of Social Security would permanently “terminate” the taxes that it relies on for funding, especially at a time when the program faces financial challenges that require more revenue, not less. Surrounding himself with “entitlement reformers” who want to cut, privatize, and obliterate the program – and then acting on their advice – is a strange way of honoring those promises.

His opponent, Joe Biden, wasted no time calling the President’s action what it is – “the first shot in a reckless war on Social Security.”

“He is putting Social Security at grave risk at a time when seniors are suffering the overwhelming impact of a pandemic he failed to control. Our seniors are under enough stress without Trump putting their hard-earned benefits in doubt.” – Joe Biden, 8/8/20

Trump’s executive order is also an election-year ploy to offer financially struggling Americans fake relief during the COVID pandemic. Democrats and many Republicans in Congress opposed a payroll tax cut because it is an ineffective means of stimulus (and risky for Social Security), so the President simply did an end-run around them that may not even be legal. House Democratic leader Nancy Pelosi called the order “absurdly unconstitutional” and Republican Senator Ben Sasse labeled it “unconstitutional slop.”

So here we have an executive order that is an insidious attack on Social Security and likely unconstitutional, but also will not deliver the economic stimulus that the president promises, as senior contributor Rob Berger points out in Forbes.

“Experts seem to universally agree that a payroll tax holiday isn’t the type of relief we need. For starters, it does nothing for the unemployed. It only helps those with a job. It also doesn’t help those out of the workforce, such as retirees or stay-at-home parents. And the benefit is spread out over four months, rather than given to those in need of immediate relief.” – Rob Berger, Forbes, 8/9/20

Like many of his other executive orders and actions as President in general, Trump’s payroll tax cut is another con. He postures as a populist while doing the bidding of the corporate class, which has opposed Social Security from the very beginning. Any president who promises to “terminate” the funding source for America’s most popular and successful social insurance program if re-elected… deserves not to be.

FDR’S GRANDSON ON WHY THE NATIONAL COMMITTEE ENDORSED JOE BIDEN

President Roosevelt’s grandson, James Roosevelt, Jr., is vice-chair of the National Committee’s advisory board

The National Committee to Preserve Social Security and Medicare announced Thursday that it is endorsing Joe Biden for president. This endorsement breaks a 38-year tradition of remaining neutral in presidential races, while focusing on Congressional elections. But the endorsement was necessary, says National Committee president and CEO Max Richtman, in light of President Trump’s promise to “terminate” the payroll taxes that fund Social Security, and other attacks on seniors’ earned benefits during the past 3 and a half years. “Americans deserve a President who will protect and strengthen the federal government’s commitment to older Americans, and that is Joe Biden,” says Richtman.

Watch Max Richtman’s video endorsing Joe Biden here.

The National Committee, an organization with roots in President Franklin Roosevelt’s New Deal, was founded by FDR’s son, Congressman James Roosevelt, Sr., in 1982 to protect Social Security and Medicare. We spoke to his son (and FDR’s grandson), James Roosevelt, Jr., vice-chair of the National Committee’s advisory board, about this historic endorsement and the reasons behind it.

Why should the National Committee break with precedent now and endorse Joe Biden for president?

JAMES ROOSEVELT: “Social Security is under unprecedented assault. No presidential candidate or incumbent has ever proposed cutting off Social Security’s payroll-based funding before. Joe Biden supports expanding and strengthening Social Security. Donald Trump talked about cutting off its financial lifeline. I am 100% behind the National Committee’s decision to endorse Joe Biden, the candidate who can be trusted to protect seniors’ earned benefits from any attempts to undermine or privatize them. This is an unusual situation and requires unprecedented action. Joe Biden has earned this endorsement and Donald Trump has forfeited it.”

Do Joe Biden and Kamala Harris understand the current needs of American seniors?

JAMES ROOSEVELT: “Joe Biden has a record of over four decades of being a strong supporter of Social Security and Medicare. It’s clear that he understands their importance. Kamala Harris has joined in that support in her time in the Senate. Joe Biden was a strong voice in the Senate for the needs of seniors and it’s clear that the proposals that Biden and Harris are offering demonstrate a clear understanding of American seniors’ needs.”

Do you think that seniors’ earned benefits are in danger if President Trump is re-elected?

“I am convinced that Social Security and Medicare and overall health coverage is in danger if Donald trump stays in power. We are facing with Donald Trump something that FDR couldn’t have imagined, namely, somebody who has no regard for the well-being of the American people. When FDR said ‘no damn politician’ would dare scrap Social Security, he still thought every politician would be concerned for the welfare of the American people. He never contemplated a Donald Trump.”

Is the payroll tax deferral the only reason we’re endorsing, or is it just the straw that broke the camel’s back?

JAMES ROOSEVELT: “Throughout 3.5 years in office, President Trump has taken administrative action to reduce the effectiveness of the Social Security Administration. The Trump administration has cut SSA personnel, closed offices, and appointed a commissioner who is committed to the privatization of seniors’ retirement funding. Joe Biden has a strong record of supporting seniors’ earned benefits and expanding Social Security.”

What about Medicare and Medicaid?

JAMES ROOSEVELT: “Joe Biden is a strong supporter of expanding Medicare coverage and Medicaid expansion being available in all states. Once again, Donald Trump has sought to undercut these programs. Most dramatically, Donald Trump has asked the Supreme Court to invalidate all Medicaid expansion by throwing out the Affordable Care Act. Across the board, Donald Trump has imperiled Medicare coverage. Joe Biden is supportive of Medicare and Medicaid, not just continuing but improving these programs.”

Can Joe Biden and Kamala Harris usher-in a ‘New’ New Deal if elected, in the same spirit as your grandfather’s?

JAMES ROOSEVELT: “There’s no question that Joe Biden and Kamala Harris are committed to a very progressive, New Deal-like approach for the 21stcentury. It’s needed for overall equity, including racial equity, but it’s particularly needed to meet the economic challenges that this country has faced in recent decades. The COVID-19 recession requires bold government action. Joe Biden and Kamala Harris understand that. President Trump downplays COVID-19, which has disproportionately affected seniors. It’s been devastating for seniors from a health point of view and often from a financial point of view as families lose the ability to support their older relatives.”

Read the press release about our endorsement of Joe Biden here.

National Committee Releases Congressional Scorecard in Advance of 2020 Elections

For the first time, voters across America can now access a Congressional Scorecard from the National Committee to Preserve Social Security and Medicare to view their elected representatives’ records on issues crucial to seniors before this fall’s elections. The scorecard – previously available exclusively to National Committee members – is designed to inform citizens about how their House and Senate members voted on Social Security, Medicare, and other measures impacting older Americans during the 116th Congress.

“This election, more than any other, will determine whether seniors’ earned benefits are protected and expanded or cut and privatized. Workers pay for these benefits with their hard-earned payroll contributions over the course of their lifetimes. Amid a pandemic that has taken a disproportionate toll on older Americans, it is critical that voters understand their House and Senate members’ votes on key legislation affecting seniors. Our Congressional Scorecard will help voters compare incumbents’ public statements with their actual records.” – Max Richtman, president and CEO of the National Committee to Preserve Social Security and Medicare

To view their representatives’ scores, voters can visit www.ncpssm.org/scorecard and click on their state on the interactive U.S. map. That will bring up a list of the state’s U.S. Senators and House members, along with a record of relevant votes and a percentage score from 0 to 100%. The higher a members’ score, the better his/her votes aligned with seniors’ interests. Elected representatives with a perfect 100% score voted in favor of older Americans every time. House and Senate members scoring 0% voted consistently against seniors’ interests — or may have missed the votes in our scorecard.

On the House side, these votes included the Protecting Americans with Preexisting Conditions Act and the Elijah E. Cummings Lower Drug Costs Now Act. (H.R. 3), among others. Critical Senate votes included the Bipartisan Budget Act of 2019, which would have resulted in cuts to Social Security, Medicare, and Medicaid — and a measure disapproving of the president’s order allowing states to offer junk health insurance plans under the Affordable Care Act.

“The urgency of this election compelled us to release incumbents’ scores publicly so that all voters have the fullest possible picture of where their elected representatives in Congress stand. Armed with this information, we believe Americans will see which candidates truly support the social safety net programs that seniors depend on now more than ever during the COVID pandemic – and vote accordingly.” – Max Richtman

Eliminating Payroll Taxes Would Exhaust Social Security Trust Funds

We have warned in this space and others that President Trump’s payroll tax cuts are dangerous to Social Security. The program’s chief actuary has just confirmed that. In a new analysis, Stephen Goss warns that if payroll taxes were “eliminated” (as President Trump has promised to do if re-elected), the Social Security retirement trust fund would run dry in 2023. (The Social Security Disability Insurance trust fund would be depleted even sooner – in the middle of next year.)

President Trump signed an executive order on August 8, deferring the payment of workers’ payroll taxes until 2021. At that time, he vowed to terminate payroll taxes in his second term.

“If victorious on November 3rd, I plan to forgive these taxes and make permanent cuts to the payroll tax… I’m going to make them all permanent.” – President Trump

As the chief actuary’s analysis confirms, permanently eliminating the payroll taxes that Social Security depends on for its funding would destroy the program, which protects nearly 70 million Americans from income loss in retirement and upon disability or death of a family provider. (Social Security celebrated its 85th anniversary on August 14th.)

Goss prepared his analysis in response to a request from four U.S. Senators: Sen. Chris Van Hollen (D-MD), Sen. Bernie Sanders (I-VT), Sen. Ron Wyden (D-OR), and Senate Minority Leader Chuck Schumer (D-NY). Van Hollen reacted swiftly to the chief actuary’s projections.

“This analysis makes clear – this is another thinly veiled attempt to gut Social Security and go after the American people’s hard-earned benefits… We can’t let Trump get away with this and will do everything in our power to prevent this disastrous policy from ever going into effect.” – Sen. Chris Van Hollen (D-MD), 8/25/20

President Trump has suggested that funds from payroll tax contributions could be replaced by general federal revenue. That would fundamentally alter the ‘earned benefit’ nature of Social Security. “Social Security is not a handout. It’s not an entitlement,” National Committee government relations director Dan Adcock told CNBC. “That’s why even under those circumstances we are so strongly opposed to payroll tax cuts.”

The August 8th executive order was an attempt by President Trump to circumvent Congress, where the payroll tax was wildly unpopular with Democrats and some Republicans, too. And for good reason: not only do payroll tax cuts interfere with Social Security’s funding stream, they provide minimal economic stimulus, heavily favor employers and high-income earners, and do nothing for Americans currently out of work. Furthermore, the President’s executive order has sown confusion among employers.

“It’s been two weeks since Trump issued his directive deferring the deadline to pay worker’s portions of Social Security taxes from Sept. 1 to the end of the year. But employers, which are responsible for submitting those payments to the Internal Revenue Service, are waiting to hear from the agency on how any tax bill would be handled when it comes due later.” – Bloomberg, 8/25/20

The fact that the President or his advisors would even entertain the idea of deferring or terminating Social Security’s dedicated funding stream, especially now when the Social Security program is delivering critically needed economic stability during the COVID pandemic, demonstrates how much the Trump administration doesn’t know – or doesn’t care – about Social Security.

Trump Payroll Tax Cut is First Shot in War Against Social Security

Whether or not President Trump understands the dangerous implications of “terminating payroll taxes,” his executive order on Saturday and accompanying remarks should alarm all Americans. The President’s exercising unilateral authority (of dubious legality) to cut the payroll taxes which fund Social Security proves that opponents of workers’ earned benefits have his ear. Earlier this month, conservative commentator and longtime antagonist of Social Security Stephen Moore implored the President to bypass Congress and order the I.R.S. to impose a “payroll tax holiday.” That’s exactly what the President’s executive order does. And that’s exactly what many on the right want: a back-door method to destroy Social Security under the guise of a “tax cut.”

“Beyond the attack on crucial earned benefits, this action does nothing to help unemployed and retired Americans survive this unprecedented crisis. Instead, the President is focused on undermining their financial security… This decree is a poorly disguised first step in an effort to fully dismantle this vital program by executive fiat.” – Rep. Richard Neal, Chairman of House Ways & Means Committee, 8/9/20

Simply put, the President’s action is a blatant betrayal of his promises “not to touch” Social Security. Rescinding workers’ payroll contributions – even temporarily – is harmful to Social Security, since the program’s funding depends on those taxes. But the President’s pronouncement that if re-elected he would “terminate FICA taxes” is even more chilling. No supporter of Social Security would permanently “terminate” the taxes that it relies on for funding, especially at a time when the program faces financial challenges that require more revenue, not less. Surrounding himself with “entitlement reformers” who want to cut, privatize, and obliterate the program – and then acting on their advice – is a strange way of honoring those promises.

His opponent, Joe Biden, wasted no time calling the President’s action what it is – “the first shot in a reckless war on Social Security.”

“He is putting Social Security at grave risk at a time when seniors are suffering the overwhelming impact of a pandemic he failed to control. Our seniors are under enough stress without Trump putting their hard-earned benefits in doubt.” – Joe Biden, 8/8/20

Trump’s executive order is also an election-year ploy to offer financially struggling Americans fake relief during the COVID pandemic. Democrats and many Republicans in Congress opposed a payroll tax cut because it is an ineffective means of stimulus (and risky for Social Security), so the President simply did an end-run around them that may not even be legal. House Democratic leader Nancy Pelosi called the order “absurdly unconstitutional” and Republican Senator Ben Sasse labeled it “unconstitutional slop.”

So here we have an executive order that is an insidious attack on Social Security and likely unconstitutional, but also will not deliver the economic stimulus that the president promises, as senior contributor Rob Berger points out in Forbes.

“Experts seem to universally agree that a payroll tax holiday isn’t the type of relief we need. For starters, it does nothing for the unemployed. It only helps those with a job. It also doesn’t help those out of the workforce, such as retirees or stay-at-home parents. And the benefit is spread out over four months, rather than given to those in need of immediate relief.” – Rob Berger, Forbes, 8/9/20

Like many of his other executive orders and actions as President in general, Trump’s payroll tax cut is another con. He postures as a populist while doing the bidding of the corporate class, which has opposed Social Security from the very beginning. Any president who promises to “terminate” the funding source for America’s most popular and successful social insurance program if re-elected… deserves not to be.