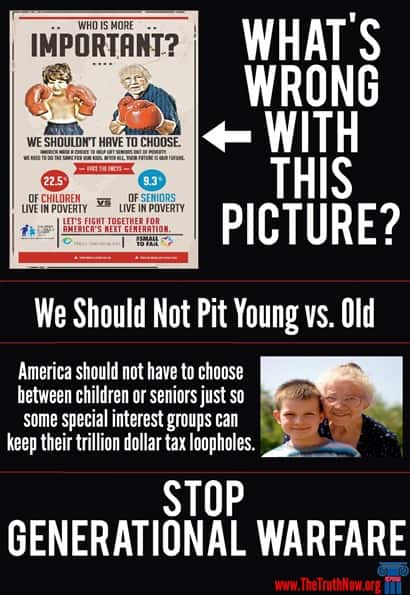

If you listen to any of the hundreds of lobbyists and PR flaks who are part of a billion dollar corporate campaign to cut Social Security and Medicare benefits, our fiscal problems have nothing to do with economic collapse, Wall Street excess, or a trillion dollars in wasteful corporate tax loopholes. America’s real problem is grandma and grandpa. According to our nation’s wealthiest CEO’s and Wall Street millionaires, led by “Fix the Debt”, the Business Roundtable and countless other Pete Peterson backed organizations, the solution to our economic woes is to convince America’s young people that Social Security won’t be around for them. Then, make them believe that the “greedy geezers” (aka their parents/grandparents), who are trying to get-by on an average $14,000 annual Social Security benefit, really don’t care about the program’s future – just their own survival. It’s classic case of dodge and deflect — divide and conquer politics. Economist, Dean Baker explains:

“Peter Peterson, the Wall Street investment banker, has been most visible in this effort, committing over $1 billion of his fortune for this purpose. Recently he enlisted a group of CEOs in his organization, Fix the Debt, which quite explicitly hopes to divert concerns over income inequality into concerns over generational inequality. It argues that programs like Social Security and Medicare, whose direct beneficiaries are disproportionately elderly, are taking resources from the young.

It is easy to show the absurdity of this position. The amount of money that the young stand to lose from the upward redistribution of income is an order of magnitude larger than whatever hit to their after-tax income they might face due to the continuing drop in the ratio of workers to retirees. Also, older people generally have families. This means that when we cut the Social Security or Medicare benefits of middle and lower income beneficiaries we are often creating a gap that will be filled from the income of their children.”

This strategy is nothing new. In fact, it follows an especially cynical proposal (even by Washington standards) created in 1983, after conservatives were unsuccessful in their attempts to convince the Social Security Commission to privatize Social Security. The Los Angeles Times’ Michael Hiltzik describes the Cato Institute’s generational warfare strategy, now in full implementation here in Washington,

“The purest articulation of intergenerational warfare as a wedge to break up Social Security’s political coalition is a 1983 paper published by the libertarian Cato Journal. It was titled “Achieving a ‘Leninist’ Strategy,” an allusion to the Bolshevik leader’s supposed ideas about dividing and weakening his political adversaries.

The paper advocated making a commitment to honor Social Security’s commitment to the retired and near-retired as a tool to “detach, or at least neutralize” them as opponents of privatization or other changes. Meanwhile, doubts among the young about the survival of the program should be exploited so they could be “organized behind the private alternative.”

So when you hear a politician promising to exempt the retired and near retired from changes to Social Security, while offering to make it more “secure” for future generations, you now know the game plan.”

The real problem is this “game plan” will be devastating for America’s young people. The wealthy corporate “generals” of this generational warfare strategy claim to be “saving” the social safety net for future generations. In truth, it’s America’s young people who will face the biggest benefit cuts if they buy into this campaign. The fact is, the Recession Generation will need Social Security and Medicare just as much, if not more than the parents and grandparents these wealthy CEO’s are trying to demonize. The Center for Retirement Research of Boston College reports:

“Adults age 25 to 34 in 2008 will see their age-70 incomes fall by 4.9 percent (or $3,000 per person) as a result of the recession. Younger workers are especially hard hit since they lose the benefits of compounding interest. Compounding becomes an especially powerful force in a 401(k) when combined with pre-tax contributions and the fact that they do not pay taxes on their annual 401(k) account earnings.”

Not only couldl this generation face lower incomes but many younger households are also carrying more student loan debt after the recession than before: 40% had such debt in 2010, up from 34% in 2007 and 26% in 2001. Our nation’s seniors know that cutting already modest benefits for future generations will leave their children and grandchildren facing a retirement that could be just as financially difficult as the economic troubles they now face in their youth. That’s why the vast majority of Americans oppose cutting benefits under the guise of deficit reduction. In fact, a recent National Academy of Social Insurance poll shows most are willing to pay more to preserve and even improve benefits. That’s certainly doesn’t fit the “greedy geezer” propaganda offered by corporate lobbyists posing as deficit hawks.

Social Security and Medicare aren’t the problems. However, rising income inequality and Washington’s economic policies which have shifted income away from middle-class families (including the young and old alike) to America’s millionaires and corporations are the problems. That’s why groups like Fix the Debt, the Business Roundtable, the Peterson Foundation and the rest of Washington’s massive corporate lobby have made such a huge investment in slick messaging campaigns to convince America’s young people to focus on their grandparents’ $14,000 Social Security benefit rather than the trillion dollars in tax breaks and loopholes enjoyed by our nation’s wealthiest.