The Business Roundtable has presented the latest CEO/Wall Street attempt to convince Washington that slashing Social Security and Medicare benefits for the average American is the brave thing to do to cut our deficits. Their proposal is nothing more than a knock-off of the Bowles Simpson and the Ryan plan – two plans that have been soundly rejected by a majority of Americans in poll after poll and at the ballot box in November. Incredibly, this plan doubles-down and includes virtually every bad idea Washington has considered over the past decade all rolled into one proposal. In short, America’s CEO’s say raising the retirement age to 70, cutting benefits immediately for seniors, the disabled and veterans, turning Medicare into CouponCare while also raising the Medicare eligibility age, really isn’t too much to ask from millions of middle-class American families still reeling in this economy.

Now maybe if you were a millionaire or billionaire, you might think these were good ideas too. But most Americans are living well below what these CEOs earn, explaining why preserving and strengthening Social Security and Medicare benefits is so vitally important for the middle class. It’s clearly not a priority for America’s corporate class. But there’s also another explanation for this disconnect between Wall Street and Main Street. The dirty little secret the Business Roundtable doesn’t want to talk about is the vested interest that corporate and Wall Street CEO’s have in convincing Congress we can’t afford Social Security and Medicare.

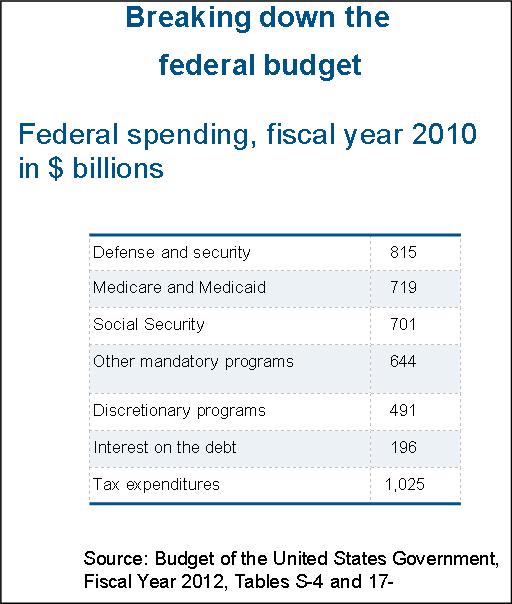

The Business Roundtable is fighting to protect more than $1 trillion dollars in tax giveaways—paid for with working American’s tax dollars. Roundtable leaders portray their plan cutting benefits to millions of American families as “practical.” What’s “practical” about spending a trillion dollars in tax expenditures to pad corporate bottom lines and executive bonus checks while telling an average senior receiving only $14,000 a year in Social Security income to live on less? While they decry the high cost of providing healthcare to seniors and veterans they conveniently ignore the fact that tax code spending is up 60% since 1986 and is a bigger part of the budget than SS, Medicare, Medicaid or national defense.

The Business Roundtable is fighting to protect more than $1 trillion dollars in tax giveaways—paid for with working American’s tax dollars. Roundtable leaders portray their plan cutting benefits to millions of American families as “practical.” What’s “practical” about spending a trillion dollars in tax expenditures to pad corporate bottom lines and executive bonus checks while telling an average senior receiving only $14,000 a year in Social Security income to live on less? While they decry the high cost of providing healthcare to seniors and veterans they conveniently ignore the fact that tax code spending is up 60% since 1986 and is a bigger part of the budget than SS, Medicare, Medicaid or national defense.

The Business Roundtable’s so-called “practical” approach also shows that “shared sacrifice” really just means middle-class families should sacrifice so corporations and wealthy CEO’s can share the gains of a trillion dollar tax giveaway. If these captains of industry are truly concerned about the future of Social Security then why not why not lift the payroll cap and subject all income such as deferred compensation to FICA? Or how about limiting just two of those massive tax breaks for the wealthy & corporations, which saves much more than raising the retirement age?

· Limit some itemized deductions for high earners ($114 billion)

· Eliminate Corporate meals and entertainment write offs ($84 billion)

These two common sense changes save $198 billion over just 5 years while raising the retirement age to 70 saves $120 billion over the next decade.

Surely, writing off expensive business dinners for multimillionaires isn’t a higher priority for our nation than providing enough income so the average senior can afford to buy groceries.

This debate really is about America’s priorities for generations of middle-class families. Unfortunately, America’s CEO’s have made their priorities perfectly clear.