Payroll Tax Cuts Threaten Social Security’s Promise

Here is our reaction to President Obama’s jobs address:

“Putting Americans back to work is critical to our economic recovery. It’s unfortunate that for most of this year Washington’s attention has been diverted to deficit reduction rather than finding ways to stimulate our still flagging economy, which will itself reduce the deficit. We applaud President Obama for refocusing our national attention to where it should be–economic recovery–while offering relief that many Americans desperately need. We agree wholeheartedly with the President, the time to act is now and we hope Congress will move quickly to make job creation priority #1. Putting Americans back to work is also critical to keeping Social Security and Medicare strong. However, this proposal to extend and expand the payroll tax cut threatens Social Security’s independence by forcing the program to compete for limited federal dollars from general revenues, and by breaking the link between contributions and benefits. As we predicted back in December, there’s no such thing as a temporary tax cut. Just months after being reassured that diverting contributions from Social Security would last for just one year, Congress is now being asked to extend and even increase this diversion of payroll taxes for another year. Doubling-down by also cutting employer contributions greatly worsens the situation, and makes it even hard to restore the Social Security system to self-financing. If this extension passes, there is no guarantee that Congress won’t be asked to extend it yet again, for a 3rd or even a 4th year or longer, and expand it even more, making it a de facto permanent part of the tax code. This is death by a thousand cuts. Social Security is paid for, earned by and promised to American workers. We call on the President and the Congress to reaffirm the fact that Social Security has been, is, and will continue to be, a self-financed insurance program; and that this temporary payroll tax cut does not constitute a precedent that would undermine this principle.” Max Richtman, NCPSSM President/CEO

Debt Super Committee Begins Work

The twelve members of Congress? so-called ?Super Committee? held their first public meeting today. It was largely a pro-forma type event with opening statements all around and the approval of the committee?s rules.The Committee will meet again next week to hear from the Congressional Budget Office and could also schedule meetings with the Chairs of two other deficit panels, Bowles/Simpson and Rivlin/Domenici to hear about their proposals. The committee co-chairmen also said they may also go behind closed doors on ?important issues?. It?s hard to imagine what wouldn?t qualify as an ?important? issue given the enormity of the panel?s mission. The National Journal reports:

Not all of the meetings and discussions of the 12-member super committee on deficit reduction will be conducted in public, the two leaders said on Thursday, despite calls from colleagues that the panel?s work all be done in open session.Co-chair Sen. Patty Murray, D-Wash., echoing fellow co-chair Rep. Jeb Hensarling, R-Texas, said, ?We looked at how House and Senate committees operate, and we worked together to make sure this committee met publicly, but also had the ability to meet just among members to discuss important issues.?The committee?s official deadline to report out recommendations for deficit reduction is Nov. 23, but Senate Minority Whip Jon Kyl, R-Ariz., said realistically the panel needs to complete its work by the end of October in order to have a final product by Thanksgiving.As the meeting was getting under way, more than a dozen protesters interrupted with chants of ?What do we want? Jobs! When do we need ?em? NOW!? The chants caused Rep. Dave Camp, R-Mich., to stop speaking, and the meeting paused briefly as staff struggled to block out the noise.

A common theme throughout today?s testimony was also ?we don?t have to start from scratch? with some urging their ?Super Committee? colleagues to pick up where other deficit reduction groups left off. Democrat Chris Van Holen even suggested reports provided by the Fiscal Commission and fiscal hawks Alice Rivlin and Pete Domenici should be a ?framework? because they provided ?a balanced approach?. Given that Bowles/Simpson proposed savings through 2/3 budget cuts and 1/3 revenue increases, that strikes us as far from the type of ?balance? expected by most Americans. Both reports also included major changes to Social Security with Rivlin/Domenici including Medicare premium and cost sharing changes that would be devastating for seniors. Balanced, really?Time will tell what Washington?s idea of shared sacrifice really means. Meanwhile, President Obama will make a desperately needed pivot to the issue of job creation in an address to the Joint Session of Congress tonight at 7:00pm.

Esther Says What You’ve Been Thinking – in New NCPSSM Social Security Video

Esther Lenett is a National Committee member who lives in Maryland. She’s 93 years old and depends on Social Security. She’s one of those wonderful people who you can count on to tell it like it is. We’re so glad she agreed to talk to us about Social Security, the new Debt Committee and Washington’s rush to play “let’s make a deal” with the future of millions of American workers.We all know people just like Esther who have an important story to tell…if only, Washington will listen.Take a minute, watch Esther’s video and share it with your friends.

Repetition of a Lie Does Not Make it True

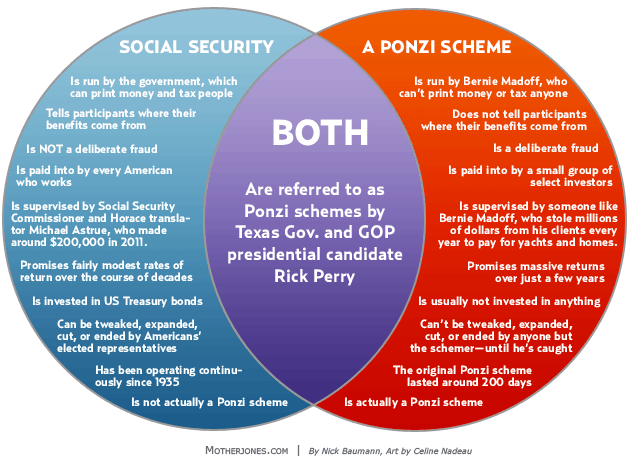

Explaining Social Security?s financing mechanisms to the average person just isn?t easy. That fact is one reason why conservatives for years have, somewhat successfully, persuaded too many to believe that Social Security is a Ponzi scheme?regardless of the facts. Kudos to Mother Jones for making yet another run at explaining why Social Security is absolutely not a Ponzi scheme. We urge our readers to print this one out, learn it, and arm yourself so that you caneducate the next person you hear who makes this ridiculous claim.We?d also suggest you make this an election day litmus test because as we?ve said again and again and MJ says so well here:?anyone who says that Social Security is a Ponzi scheme either misunderstands Social Security, misunderstands Ponzi schemes, is deliberately lying, or some combination of those ?

A Venn Diagram for Rick Perry: Social Security Is Not a Ponzi Scheme

On Saturday, Texas Gov.Rick Perry told a group of voters that Social Security is a “Ponzi scheme” and a “monstrous lie” to younger Americans. It’s not the first time the GOP presidential candidate has made such claims. The Texas governor also described SocialSecurity as a Ponzi scheme in his 2010 book, “Fed Up!,” and has argued the program is unconstitutional and could be handed over to the states.When politicians make clearly false claims, reporters have an obligation to explain to readers why those claims are false?or at least quote someone who can. I would suggest political scientist Jonathan Bernstein:Very simple: anyone who says that Social Security is a Ponzi scheme either misunderstands Social Security, misunderstands Ponzi schemes, is deliberately lying, or some combination of those… After all, a Ponzi scheme is a deliberate fraud. Saying that Social Security is financed like a Ponzi scheme is factually wrong, but saying that Social Security is a Ponzi scheme or is like a Ponzi scheme is basically a false accusation of fraud against the US government and the politicians who have supported Social Security over the years.Andrew Sullivan’s readers also have a number of good reasons why Social Security is not a Ponzi scheme. The Social Security Administration also has a good webpage explaining why SocialSecurity is not a Ponzi scheme. But I find that charts often make understanding things easier, so here’s a Venn diagram I made that explains some of the differences and similarities between Social Security and a Ponzi scheme:

More Proof We Don’t Have to Kill Medicare to Save It: Spending is Slowing

?It is an article of faith, at least among conservatives, that as long as Medicare remains a government program, outlays will rise relentlessly, year after year. Only ?the market? could possibly tame Medicare inflation, they say. The fear-mongers argue that unless we either shift costs to seniors; raise the age when they become eligible for Medicare; or turn the whole program over to private sector insurers, Medicare expenditures will bankrupt the country.Here is the truth: Both Standard & Poor?s (S&P) and the Congressional Budget Office (CBO) now have 18 months of hard data showing that Medicare spending has begun to slow dramatically. Health reform legislation has not yet begun to kick in to pare Medicare payments, but something is changing on the ground. As I pointed out in an earlier post, Medicare spending began to plunge in January of 2010. After levitating by an average of 9.7 percent a year from 2000 to 2009, CBO?s monthly budget reports show that Medicare pay-outs are now rising by less than 4 percent a year.? Maggie Mahar, Taking Note Blog, Century Foundation

Maggie Mahar has written two detailed descriptions of how and why this is happening, even before full implementation of health care reform in 2014.

?What is striking about the recent dip to 4 percent, is that this time around, there have been no major policy changes in Washington. Over the past 18 months, neither benefits nor payments to providers have been reduced in any significant way. The Affordable Care Act does call for cutting overpayments to Medicare Advantage insurers, while shaving annual increases in payments to hospitals, nursing homes and other institutional providers by 1 percent a year over ten years. But these changes have not yet taken effect.This slow-down is not a result of Congress cutting Medicare spending. Instead, as former White House health care adviser Dr. Zeke Emanuel pointed out in Part 1 of this post, providers are ?anticipating the Affordable Care Act kicking in 2014.? They can?t wait until the end of 2013, he explained: ?They have to act today. Everywhere I go,? Emanuel, told me, ?medical schools and hospitals are asking me, ?How can we cut our costs by 10 to 15 percent?? They know that they must trim their own costs if they are going to lower the bills that they send to Medicare.?” Like Orszag, Emanuel is seeing a ?shift toward value in the health sector.?

We must allow Medicare reforms that focus on improved outcomes while lowering costs and don?t target beneficiaries for severe and debilitating benefit cuts to be given a chance to work before jumping on a deficit bandwagon that directly targets America?s seniors for benefit cuts.Washington?s new ?Super Committee? appears ready to consider many of the destructive proposals pushed by fiscal hawks targeting Medicare beneficiaries to foot the bill for our debt reduction. Rather than targeting beneficiaries, these ?Super Committee? members should build on the successes already seen in health care reform.

Payroll Tax Cuts Threaten Social Security’s Promise

Here is our reaction to President Obama’s jobs address:

“Putting Americans back to work is critical to our economic recovery. It’s unfortunate that for most of this year Washington’s attention has been diverted to deficit reduction rather than finding ways to stimulate our still flagging economy, which will itself reduce the deficit. We applaud President Obama for refocusing our national attention to where it should be–economic recovery–while offering relief that many Americans desperately need. We agree wholeheartedly with the President, the time to act is now and we hope Congress will move quickly to make job creation priority #1. Putting Americans back to work is also critical to keeping Social Security and Medicare strong. However, this proposal to extend and expand the payroll tax cut threatens Social Security’s independence by forcing the program to compete for limited federal dollars from general revenues, and by breaking the link between contributions and benefits. As we predicted back in December, there’s no such thing as a temporary tax cut. Just months after being reassured that diverting contributions from Social Security would last for just one year, Congress is now being asked to extend and even increase this diversion of payroll taxes for another year. Doubling-down by also cutting employer contributions greatly worsens the situation, and makes it even hard to restore the Social Security system to self-financing. If this extension passes, there is no guarantee that Congress won’t be asked to extend it yet again, for a 3rd or even a 4th year or longer, and expand it even more, making it a de facto permanent part of the tax code. This is death by a thousand cuts. Social Security is paid for, earned by and promised to American workers. We call on the President and the Congress to reaffirm the fact that Social Security has been, is, and will continue to be, a self-financed insurance program; and that this temporary payroll tax cut does not constitute a precedent that would undermine this principle.” Max Richtman, NCPSSM President/CEO

Debt Super Committee Begins Work

The twelve members of Congress? so-called ?Super Committee? held their first public meeting today. It was largely a pro-forma type event with opening statements all around and the approval of the committee?s rules.The Committee will meet again next week to hear from the Congressional Budget Office and could also schedule meetings with the Chairs of two other deficit panels, Bowles/Simpson and Rivlin/Domenici to hear about their proposals. The committee co-chairmen also said they may also go behind closed doors on ?important issues?. It?s hard to imagine what wouldn?t qualify as an ?important? issue given the enormity of the panel?s mission. The National Journal reports:

Not all of the meetings and discussions of the 12-member super committee on deficit reduction will be conducted in public, the two leaders said on Thursday, despite calls from colleagues that the panel?s work all be done in open session.Co-chair Sen. Patty Murray, D-Wash., echoing fellow co-chair Rep. Jeb Hensarling, R-Texas, said, ?We looked at how House and Senate committees operate, and we worked together to make sure this committee met publicly, but also had the ability to meet just among members to discuss important issues.?The committee?s official deadline to report out recommendations for deficit reduction is Nov. 23, but Senate Minority Whip Jon Kyl, R-Ariz., said realistically the panel needs to complete its work by the end of October in order to have a final product by Thanksgiving.As the meeting was getting under way, more than a dozen protesters interrupted with chants of ?What do we want? Jobs! When do we need ?em? NOW!? The chants caused Rep. Dave Camp, R-Mich., to stop speaking, and the meeting paused briefly as staff struggled to block out the noise.

A common theme throughout today?s testimony was also ?we don?t have to start from scratch? with some urging their ?Super Committee? colleagues to pick up where other deficit reduction groups left off. Democrat Chris Van Holen even suggested reports provided by the Fiscal Commission and fiscal hawks Alice Rivlin and Pete Domenici should be a ?framework? because they provided ?a balanced approach?. Given that Bowles/Simpson proposed savings through 2/3 budget cuts and 1/3 revenue increases, that strikes us as far from the type of ?balance? expected by most Americans. Both reports also included major changes to Social Security with Rivlin/Domenici including Medicare premium and cost sharing changes that would be devastating for seniors. Balanced, really?Time will tell what Washington?s idea of shared sacrifice really means. Meanwhile, President Obama will make a desperately needed pivot to the issue of job creation in an address to the Joint Session of Congress tonight at 7:00pm.

Esther Says What You’ve Been Thinking – in New NCPSSM Social Security Video

Esther Lenett is a National Committee member who lives in Maryland. She’s 93 years old and depends on Social Security. She’s one of those wonderful people who you can count on to tell it like it is. We’re so glad she agreed to talk to us about Social Security, the new Debt Committee and Washington’s rush to play “let’s make a deal” with the future of millions of American workers.We all know people just like Esther who have an important story to tell…if only, Washington will listen.Take a minute, watch Esther’s video and share it with your friends.

Repetition of a Lie Does Not Make it True

Explaining Social Security?s financing mechanisms to the average person just isn?t easy. That fact is one reason why conservatives for years have, somewhat successfully, persuaded too many to believe that Social Security is a Ponzi scheme?regardless of the facts. Kudos to Mother Jones for making yet another run at explaining why Social Security is absolutely not a Ponzi scheme. We urge our readers to print this one out, learn it, and arm yourself so that you caneducate the next person you hear who makes this ridiculous claim.We?d also suggest you make this an election day litmus test because as we?ve said again and again and MJ says so well here:?anyone who says that Social Security is a Ponzi scheme either misunderstands Social Security, misunderstands Ponzi schemes, is deliberately lying, or some combination of those ?

A Venn Diagram for Rick Perry: Social Security Is Not a Ponzi Scheme

On Saturday, Texas Gov.Rick Perry told a group of voters that Social Security is a “Ponzi scheme” and a “monstrous lie” to younger Americans. It’s not the first time the GOP presidential candidate has made such claims. The Texas governor also described SocialSecurity as a Ponzi scheme in his 2010 book, “Fed Up!,” and has argued the program is unconstitutional and could be handed over to the states.When politicians make clearly false claims, reporters have an obligation to explain to readers why those claims are false?or at least quote someone who can. I would suggest political scientist Jonathan Bernstein:Very simple: anyone who says that Social Security is a Ponzi scheme either misunderstands Social Security, misunderstands Ponzi schemes, is deliberately lying, or some combination of those… After all, a Ponzi scheme is a deliberate fraud. Saying that Social Security is financed like a Ponzi scheme is factually wrong, but saying that Social Security is a Ponzi scheme or is like a Ponzi scheme is basically a false accusation of fraud against the US government and the politicians who have supported Social Security over the years.Andrew Sullivan’s readers also have a number of good reasons why Social Security is not a Ponzi scheme. The Social Security Administration also has a good webpage explaining why SocialSecurity is not a Ponzi scheme. But I find that charts often make understanding things easier, so here’s a Venn diagram I made that explains some of the differences and similarities between Social Security and a Ponzi scheme:

More Proof We Don’t Have to Kill Medicare to Save It: Spending is Slowing

?It is an article of faith, at least among conservatives, that as long as Medicare remains a government program, outlays will rise relentlessly, year after year. Only ?the market? could possibly tame Medicare inflation, they say. The fear-mongers argue that unless we either shift costs to seniors; raise the age when they become eligible for Medicare; or turn the whole program over to private sector insurers, Medicare expenditures will bankrupt the country.Here is the truth: Both Standard & Poor?s (S&P) and the Congressional Budget Office (CBO) now have 18 months of hard data showing that Medicare spending has begun to slow dramatically. Health reform legislation has not yet begun to kick in to pare Medicare payments, but something is changing on the ground. As I pointed out in an earlier post, Medicare spending began to plunge in January of 2010. After levitating by an average of 9.7 percent a year from 2000 to 2009, CBO?s monthly budget reports show that Medicare pay-outs are now rising by less than 4 percent a year.? Maggie Mahar, Taking Note Blog, Century Foundation

Maggie Mahar has written two detailed descriptions of how and why this is happening, even before full implementation of health care reform in 2014.

?What is striking about the recent dip to 4 percent, is that this time around, there have been no major policy changes in Washington. Over the past 18 months, neither benefits nor payments to providers have been reduced in any significant way. The Affordable Care Act does call for cutting overpayments to Medicare Advantage insurers, while shaving annual increases in payments to hospitals, nursing homes and other institutional providers by 1 percent a year over ten years. But these changes have not yet taken effect.This slow-down is not a result of Congress cutting Medicare spending. Instead, as former White House health care adviser Dr. Zeke Emanuel pointed out in Part 1 of this post, providers are ?anticipating the Affordable Care Act kicking in 2014.? They can?t wait until the end of 2013, he explained: ?They have to act today. Everywhere I go,? Emanuel, told me, ?medical schools and hospitals are asking me, ?How can we cut our costs by 10 to 15 percent?? They know that they must trim their own costs if they are going to lower the bills that they send to Medicare.?” Like Orszag, Emanuel is seeing a ?shift toward value in the health sector.?

We must allow Medicare reforms that focus on improved outcomes while lowering costs and don?t target beneficiaries for severe and debilitating benefit cuts to be given a chance to work before jumping on a deficit bandwagon that directly targets America?s seniors for benefit cuts.Washington?s new ?Super Committee? appears ready to consider many of the destructive proposals pushed by fiscal hawks targeting Medicare beneficiaries to foot the bill for our debt reduction. Rather than targeting beneficiaries, these ?Super Committee? members should build on the successes already seen in health care reform.