Think the Supreme Court Ruling Won’t Impact You? Think Again…

While the nation waits for the Supreme Court’s decision on the Affordable Care Act, we think it’s important that the real-world implications of this decision for millions of American seniors not get lost in the shuffle.Here is an analysis of the impact on seniors’ Medicare and Medicaid benefits if the ACA is completely overturned:If the individual mandate is declared unconstitutional and is not severed from the rest of the law the whole ACA would be struck down. All of the provisions which positively impact senior’s health would be stripped away.The Part D Donut Hole will return. Prescription drug costs will rise because discounts provided by ACA will be revoked. Beginning in 2011, brand-name drug manufacturers provided a 50% discount on brand-name and biologic drugs for Part D enrollees in the donut hole. By 2013, Medicare would have begun to provide an additional discount on brand-name and biologic drugs for enrollees in the donut hole. By 2020, Part D enrollees would have been responsible for only 25% of donut hole drug costs. All of these savings will be gone if the ACA is repealedNew Preventive Services provided with the ACA will disappear.

While the nation waits for the Supreme Court’s decision on the Affordable Care Act, we think it’s important that the real-world implications of this decision for millions of American seniors not get lost in the shuffle.Here is an analysis of the impact on seniors’ Medicare and Medicaid benefits if the ACA is completely overturned:If the individual mandate is declared unconstitutional and is not severed from the rest of the law the whole ACA would be struck down. All of the provisions which positively impact senior’s health would be stripped away.The Part D Donut Hole will return. Prescription drug costs will rise because discounts provided by ACA will be revoked. Beginning in 2011, brand-name drug manufacturers provided a 50% discount on brand-name and biologic drugs for Part D enrollees in the donut hole. By 2013, Medicare would have begun to provide an additional discount on brand-name and biologic drugs for enrollees in the donut hole. By 2020, Part D enrollees would have been responsible for only 25% of donut hole drug costs. All of these savings will be gone if the ACA is repealedNew Preventive Services provided with the ACA will disappear.

- Prior to the ACA, Medicare beneficiaries were required to pay a deductible and 20% co-pay for many preventive health services.

- The ACA eliminated cost-sharing for many preventive services and introduced an annual wellness visit for beneficiaries.

- The ACA also eliminated cost-sharing for screening services, like mammograms, Pap smears, bone mass measurements, depression screening, diabetes screening, HIV screening and obesity screenings.

Savings for Chemotherapy and Dialysis patients in Medicare Advantage plans lost

- In the past, Medicare Advantage plans have had flexibility to impose cost-sharing structures that differ from traditional Medicare. Prior to the ACA, plans increased co-insurance for some services, like chemotherapy and dialysis. Beneficiaries who were enrolled in MA plans that needed those services were left worse off than if they had the same conditions and were in traditional Medicare. Many beneficiaries enrolled in these plans did not understand the differences in cost sharing.

- The ACA attempts to remedy this by preventing Medicare Advantage plans from imposing higher cost-sharing for chemotherapy and dialysis than is permitted under Medicare Parts A and B.

- The Centers for Medicare and Medicaid Services (CMS) issued final regulations on these improvements in 2011, and many became effective January 1 of this year.

Improvements in care for individuals with chronic conditions gone

- The ACA has several provisions targeted to improving the quality of care for patients with chronic illness and reducing the costs to Medicare and Medicaid for serving those beneficiaries.

Improvements to help seniors transition from the hospital back home repealed

- The ACA established the Community-Based Care Transition Program which targets individuals who are in traditional fee-for-service Medicare and are hospitalized and at risk for readmission. The program provides grants to hospitals to work with community-based organizations to provide transitional care interventions.

- 30 community-based organizations across the country have already partnered with local hospital systems and are committed to reducing readmissions by 20% and hospital acquired conditions by 40%.

Improvements in seniors’ access to primary care physicians lost

- Through the Independence at Home demonstration, that ACA will pay physicians and nurse practitioners to provide home-based primary care to targeted chronically ill individuals for a three-year period.

- CMS recently launched this primary care initiative with 16 practices across the country.

Medicare’s Trust Fund will face insolvency 8 years (or even more) sooner than expected

- The Affordable Care Act includes many measures to control costs as well as models for reform that will increase the solvency of the Medicare. If the ACA is repealed those cost saving measures will be lost and Medicare’s solvency threatened.

The National Committee has partnered with the highly respected National Senior Citizens Law Center to provide detailed analysis of the various Affordable Care Act rulings that could come from the Supreme Court. Our full analysis will be available immediately following the Court’s ruling, expected soon.

Rather Than Slashing Social Security How About Lifting the Cap?

The Center for Economic and Policy Research has released a new report looking at the effect of raising or lifting the payroll tax cap on Social Security contributions.Incredibly, most people still don?t realize that workers who earn more than $110,100 don?t contribute on their full income and that simply removing that tax loophole for high earners would close the vast majority of Social Security?s modest long-term funding gap. Legislation introduced by Senator Bernie Sanders (I-VT) and Rep. Peter DeFazio (D-OR) would apply the same payroll tax already paid by more than 9 out of 10 Americans to those with incomes over $250,000 a year. Making the wealthiest Americans pay the same payroll tax already assessed on those with lower incomes should be a no-brainer and it is the solution Americans prefer rather than cutting already modest Social Security benefits.Lifting the cap also recaptures income lost to Social Security because of the growing income inequality in this nation that has allowed a growing number of wealthy Americans to avoid paying their fair share. Robert Reich describes how:

Back in 1983, the ceiling was set so the Social Security payroll tax would hit 90 percent of all wages covered by Social Security. That 90 percent figure was built into the Greenspan Commission’s fixes. The Commission assumed that, as the ceiling rose with inflation, the Social Security payroll tax would continue to hit 90 percent of total income.Today, though, the Social Security payroll tax hits only about 84 percent of total income. It went from 90 percent to 84 percent because a larger and larger portion of total income has gone to the top. In 1983, the richest 1 percent of Americans got 11.6 percent of total income. Today the top 1 percent takes in more than 20 percent.If we want to go back to 90 percent, the ceiling on income subject to the Social Security tax would need to be raised to $180,000. Presto. Social Security’s long-term (beyond 26 years from now) problem would be solved.

Unfortunately, rather than embrace lifting the payroll tax cap, many Republicans and Democrats alike now seem to be rallying behind the Bowles-Simpson (BS) plan, which proposes two-thirds benefit cuts over one-third income increases.Ask your member of Congress?does he/she support cutting benefits for middle-class Americans rather than restoring contributions by the wealthy to their historic levels?

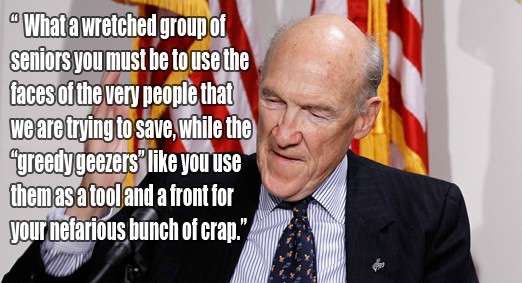

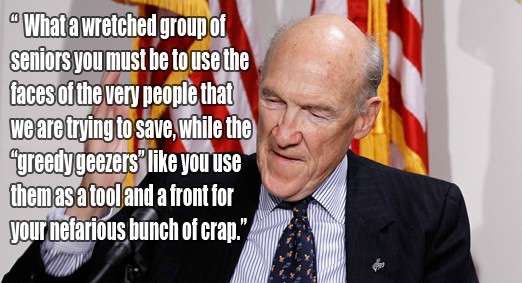

Wanted: A Political Intervention for Alan Simpson

We wrote yesterday about Fiscal Commission Co-Chairman and former Senator Alan Simpson’s latest diatribe against seniors – this time launched at the Alliance for Retired Americans in California.For anyone who’s been in Washington for awhile, these rants are really just déjà vu all over again. But even as a “charter member of the Simpson tongue-lashing club” our President/CEO, Max Richtman, found this latest attack simply too much. So he wrote Senator Simpson a letter asking him to cease and desist his hate-filled attacks on seniors:

May 24, 2012

Dear Senator Simpson,

We’ve both been in this business for a long time and we’ve certainly had our share of fundamental disagreements about America’s priorities and how to protect them. As you well know, I’m a charter member of the Simpson tongue-lashing club going back to my time as Staff Director at the Senate Aging Committee and since.

However, after reading your letter to seniors in California, who simply dared to oppose your reforms for Social Security and Medicare, I feel compelled to ask you to refocus this debate where it belongs. Call this a political intervention, if you will.

The American people deserve and expect a true dialogue in which retirees are more than “greedy geezers” and those with opposing world views aren’t treated with the total disrespect you hand out so freely. After thirty years, isn’t it long past time to elevate the conversation beyond personal and profane attacks on those you simply disagree with?

I know this letter is likely an exercise in futility. However, I’m writing to you today with one simple request – please cease and desist with the mean-spirited, denigrating, and hate-filled personal attacks on America’s seniors. Sure, some in the press still love the profanity laden poison-pen letters and insulting sound-bites, but it only denigrates the serious policy work many honest and caring people on both sides of the debate perform each and every day, not to mention the American people who will ultimately be impacted by the reforms being debated.

No doubt you consider all of this “blather and drivel” or even your favorites “horse or bulls**t”. However, that fact has absolutely nothing to do with the serious business at hand. Please refocus your attention to what really matters – your proposed reforms and the American people who will be affected by them.

Sincerely,

Max Richtman

President/CEO

The National Committee to Preserve Social Security& Medicare

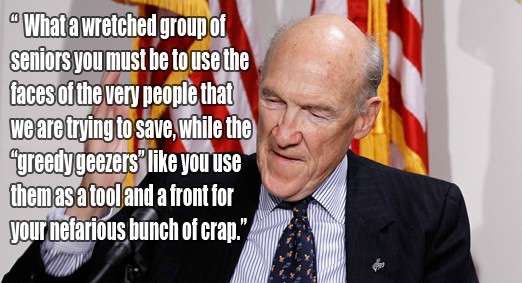

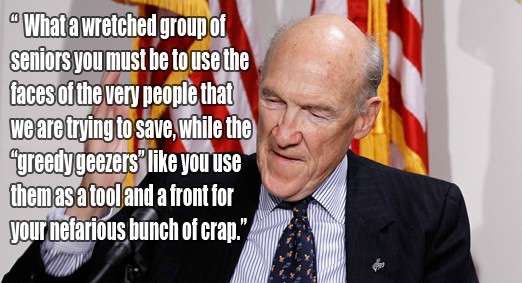

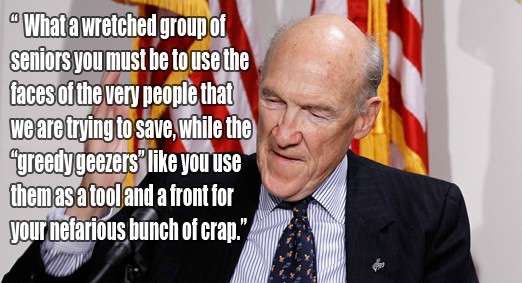

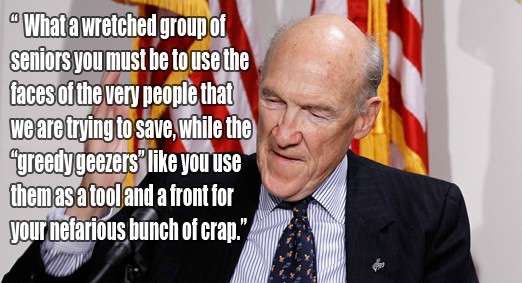

When Name-Calling and Profanity Replace the Truth about Social Security: Alan Simpson’s At it Again

To Whom It May Concern: Erskine Bowles and I thoroughly enjoyed our time on the West Coast and received an excellent reception from folks ? at least those who are using their heads and have given up using emotion, fear, guilt or racism to juice up their troops. Your little flyer entitled Bowles! Simpson! Stop using the deficit as a phony excuse to gut our Social Security!? is one of the phoniest excuses for a ‘flyer’ I have ever seen. You use the faces of young people, who are the ones who are going to get gutted while you continue to push out your blather and drivel. My suggestion to you, an honest one, read the damn report. The Moment of Truth 67 pages, and then tell me if we’re not doing the right thing with Social Security. What a wretched group of seniors you must be to use the faces of the very people that we are trying to save, while the ‘greedy geezers’ like you use them as a tool and a front for your nefarious bunch of crap. You must feel some sense of shame for shoveling out this bulls**t. Read the latest news from the Social Security Trustees. The Social Security System will not ‘hit the skids’ in 2033 instead of 2036. If you can’t understand all of this you need a pane of glass in your naval so you can see out during the day! Read the report. Get back to me. My address is below. If you don’t read the report, as Ebenezer Scrooge said in the Christmas Carol, Haunt me no longer! Best regards, Alan Simpson

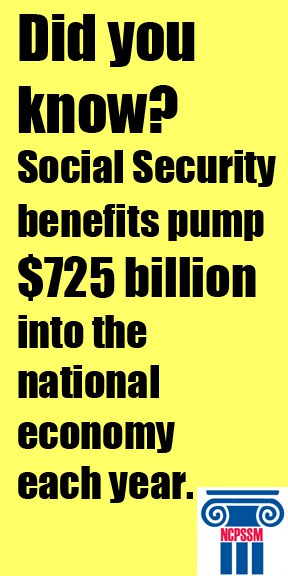

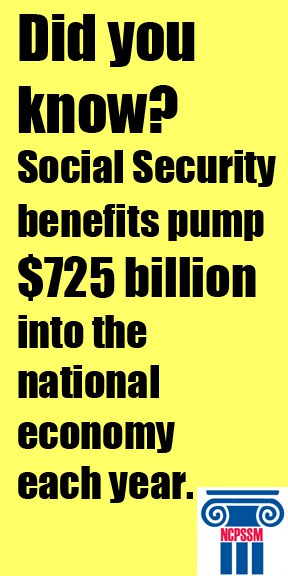

Social Security Supports Your Local Economy

Think the Supreme Court Ruling Won’t Impact You? Think Again…

- Prior to the ACA, Medicare beneficiaries were required to pay a deductible and 20% co-pay for many preventive health services.

- The ACA eliminated cost-sharing for many preventive services and introduced an annual wellness visit for beneficiaries.

- The ACA also eliminated cost-sharing for screening services, like mammograms, Pap smears, bone mass measurements, depression screening, diabetes screening, HIV screening and obesity screenings.

Savings for Chemotherapy and Dialysis patients in Medicare Advantage plans lost

- In the past, Medicare Advantage plans have had flexibility to impose cost-sharing structures that differ from traditional Medicare. Prior to the ACA, plans increased co-insurance for some services, like chemotherapy and dialysis. Beneficiaries who were enrolled in MA plans that needed those services were left worse off than if they had the same conditions and were in traditional Medicare. Many beneficiaries enrolled in these plans did not understand the differences in cost sharing.

- The ACA attempts to remedy this by preventing Medicare Advantage plans from imposing higher cost-sharing for chemotherapy and dialysis than is permitted under Medicare Parts A and B.

- The Centers for Medicare and Medicaid Services (CMS) issued final regulations on these improvements in 2011, and many became effective January 1 of this year.

Improvements in care for individuals with chronic conditions gone

- The ACA has several provisions targeted to improving the quality of care for patients with chronic illness and reducing the costs to Medicare and Medicaid for serving those beneficiaries.

Improvements to help seniors transition from the hospital back home repealed

- The ACA established the Community-Based Care Transition Program which targets individuals who are in traditional fee-for-service Medicare and are hospitalized and at risk for readmission. The program provides grants to hospitals to work with community-based organizations to provide transitional care interventions.

- 30 community-based organizations across the country have already partnered with local hospital systems and are committed to reducing readmissions by 20% and hospital acquired conditions by 40%.

Improvements in seniors’ access to primary care physicians lost

- Through the Independence at Home demonstration, that ACA will pay physicians and nurse practitioners to provide home-based primary care to targeted chronically ill individuals for a three-year period.

- CMS recently launched this primary care initiative with 16 practices across the country.

Medicare’s Trust Fund will face insolvency 8 years (or even more) sooner than expected

- The Affordable Care Act includes many measures to control costs as well as models for reform that will increase the solvency of the Medicare. If the ACA is repealed those cost saving measures will be lost and Medicare’s solvency threatened.

The National Committee has partnered with the highly respected National Senior Citizens Law Center to provide detailed analysis of the various Affordable Care Act rulings that could come from the Supreme Court. Our full analysis will be available immediately following the Court’s ruling, expected soon.

Rather Than Slashing Social Security How About Lifting the Cap?

The Center for Economic and Policy Research has released a new report looking at the effect of raising or lifting the payroll tax cap on Social Security contributions.Incredibly, most people still don?t realize that workers who earn more than $110,100 don?t contribute on their full income and that simply removing that tax loophole for high earners would close the vast majority of Social Security?s modest long-term funding gap. Legislation introduced by Senator Bernie Sanders (I-VT) and Rep. Peter DeFazio (D-OR) would apply the same payroll tax already paid by more than 9 out of 10 Americans to those with incomes over $250,000 a year. Making the wealthiest Americans pay the same payroll tax already assessed on those with lower incomes should be a no-brainer and it is the solution Americans prefer rather than cutting already modest Social Security benefits.Lifting the cap also recaptures income lost to Social Security because of the growing income inequality in this nation that has allowed a growing number of wealthy Americans to avoid paying their fair share. Robert Reich describes how:

Back in 1983, the ceiling was set so the Social Security payroll tax would hit 90 percent of all wages covered by Social Security. That 90 percent figure was built into the Greenspan Commission’s fixes. The Commission assumed that, as the ceiling rose with inflation, the Social Security payroll tax would continue to hit 90 percent of total income.Today, though, the Social Security payroll tax hits only about 84 percent of total income. It went from 90 percent to 84 percent because a larger and larger portion of total income has gone to the top. In 1983, the richest 1 percent of Americans got 11.6 percent of total income. Today the top 1 percent takes in more than 20 percent.If we want to go back to 90 percent, the ceiling on income subject to the Social Security tax would need to be raised to $180,000. Presto. Social Security’s long-term (beyond 26 years from now) problem would be solved.

Unfortunately, rather than embrace lifting the payroll tax cap, many Republicans and Democrats alike now seem to be rallying behind the Bowles-Simpson (BS) plan, which proposes two-thirds benefit cuts over one-third income increases.Ask your member of Congress?does he/she support cutting benefits for middle-class Americans rather than restoring contributions by the wealthy to their historic levels?

Wanted: A Political Intervention for Alan Simpson

We wrote yesterday about Fiscal Commission Co-Chairman and former Senator Alan Simpson’s latest diatribe against seniors – this time launched at the Alliance for Retired Americans in California.For anyone who’s been in Washington for awhile, these rants are really just déjà vu all over again. But even as a “charter member of the Simpson tongue-lashing club” our President/CEO, Max Richtman, found this latest attack simply too much. So he wrote Senator Simpson a letter asking him to cease and desist his hate-filled attacks on seniors:

May 24, 2012

Dear Senator Simpson,

We’ve both been in this business for a long time and we’ve certainly had our share of fundamental disagreements about America’s priorities and how to protect them. As you well know, I’m a charter member of the Simpson tongue-lashing club going back to my time as Staff Director at the Senate Aging Committee and since.

However, after reading your letter to seniors in California, who simply dared to oppose your reforms for Social Security and Medicare, I feel compelled to ask you to refocus this debate where it belongs. Call this a political intervention, if you will.

The American people deserve and expect a true dialogue in which retirees are more than “greedy geezers” and those with opposing world views aren’t treated with the total disrespect you hand out so freely. After thirty years, isn’t it long past time to elevate the conversation beyond personal and profane attacks on those you simply disagree with?

I know this letter is likely an exercise in futility. However, I’m writing to you today with one simple request – please cease and desist with the mean-spirited, denigrating, and hate-filled personal attacks on America’s seniors. Sure, some in the press still love the profanity laden poison-pen letters and insulting sound-bites, but it only denigrates the serious policy work many honest and caring people on both sides of the debate perform each and every day, not to mention the American people who will ultimately be impacted by the reforms being debated.

No doubt you consider all of this “blather and drivel” or even your favorites “horse or bulls**t”. However, that fact has absolutely nothing to do with the serious business at hand. Please refocus your attention to what really matters – your proposed reforms and the American people who will be affected by them.

Sincerely,

Max Richtman

President/CEO

The National Committee to Preserve Social Security& Medicare

When Name-Calling and Profanity Replace the Truth about Social Security: Alan Simpson’s At it Again

To Whom It May Concern: Erskine Bowles and I thoroughly enjoyed our time on the West Coast and received an excellent reception from folks ? at least those who are using their heads and have given up using emotion, fear, guilt or racism to juice up their troops. Your little flyer entitled Bowles! Simpson! Stop using the deficit as a phony excuse to gut our Social Security!? is one of the phoniest excuses for a ‘flyer’ I have ever seen. You use the faces of young people, who are the ones who are going to get gutted while you continue to push out your blather and drivel. My suggestion to you, an honest one, read the damn report. The Moment of Truth 67 pages, and then tell me if we’re not doing the right thing with Social Security. What a wretched group of seniors you must be to use the faces of the very people that we are trying to save, while the ‘greedy geezers’ like you use them as a tool and a front for your nefarious bunch of crap. You must feel some sense of shame for shoveling out this bulls**t. Read the latest news from the Social Security Trustees. The Social Security System will not ‘hit the skids’ in 2033 instead of 2036. If you can’t understand all of this you need a pane of glass in your naval so you can see out during the day! Read the report. Get back to me. My address is below. If you don’t read the report, as Ebenezer Scrooge said in the Christmas Carol, Haunt me no longer! Best regards, Alan Simpson

Social Security Supports Your Local Economy