Washington Makes It Clear: Medicare Will Now Be Targeted to Pay Down Deficit

“Official Washington was in celebration mode on New Year’s Day after kind of averting a completely unnecessary crisis that was entirely of its own creation.” The Borowitz Report

This was our favorite headline from the hundreds of stories flooding our email boxes during the holiday “fiscal cliff” debate. The fact that it’s satire really doesn’t diminish the underlying message. Crisis creation seems to be what Washington does best these days. Even so, there was good news in this deal for seniors including: the end of the Social Security payroll tax holiday (which should never have been implemented in the first place), a one year doc fix preventing a massive cut in doctors’ Medicare reimbursements and extension of a number of Medicare programs that would have expired December 31st.

So while America’s seniors can breathe a sigh of relief that Congress finally came to its senses and removed benefit cuts for millions of middle-class and poor Americans from the fiscal cliff deal, that relief will be short-lived. Tomorrow, with the swearing-in of a new Congress, the assault on Social Security and Medicare begins all over again.

As Michael Hiltzik at the Los Angeles Times correctly points out, this alleged quest for deficit reduction has really been about cutting Social Security and Medicare under the guise of debt reduction.

“Despite the lawmakers’ claims that the debate has been about closing the federal deficit and reducing the federal debt, none of the negotiating over the past weeks has dealt with those issues. Indeed, the tax and spending package will widen the deficit by some $4 trillion over 10 years, compared with what would happen if the tax increases and spending cuts mandated by existing law were implemented.

The House Republican caucus has consistently looked for ways to protect high-income taxpayers from a tax increase, at the expense of beneficiaries of government programs such as enrollees in Social Security and Medicare. If there’s a dominant preoccupation with cutting the deficit lurking somewhere in that mind-set, good luck finding it.”

The Huffington Post describes what’s coming next:

“The fiscal cliff has not been averted. If anything, the U.S. faces an even more ominous deadline in a few months. The debt ceiling was hit as of New Year’s Eve. The U.S. Treasury will dip into its tool bag to keep the country’s borrowing ability going, but that will last only about two months. Also in early March, the sequestration — $110 billion in across-the-board spending cuts, half in defense and half in domestic programs — springs back, unless Congress finds a way to offset it with other spending cuts. Weeks later, the law that keeps the government funded expires. It all means that, in late February and early March, Congress will face a sequestration, a government default and a government shutdown. Republicans say they’ll use the leverage created by the debt ceiling to force Obama to accept spending cuts, particularly in entitlement programs. Obama resisted that notion on Dec. 31, saying he wants more tax increases and won’t accept Republican plans to “shove” spending cuts past him. “If they think that’s going to be the formula for how we solve this thing, then they’ve got another thing coming,” he said.

However, once the fiscal cliff deal passed, the President’s message changed making it clear cuts to Medicare will be offered up to pay down the deficit:

“I agree with Democrats and Republicans that the aging population and the rising cost of health care makes Medicare the biggest contributor to our deficit. I believe we’ve got to find ways to reform that program without hurting seniors who count on it to survive. And I believe that there’s further unnecessary spending in government that we can eliminate.” President Obama statement, January 1

There are ways to make Medicare more efficient and save money, in fact, many of those ideas were already implemented in the Affordable Care Act. Going forward Congress should also consider allowing Medicare to negotiate with drug makers for lower prescription drug costs in Part D and allowing drug re-importation which would save billions in the Medicare program. Unfortunately, both of these common sense proposals are opposed by conservatives, many of the same fiscal hawks, who’d rather reduce spending by cutting benefits instead of curtailing the excessive payments to the highly profitable pharmaceutical industry.

Winning the fiscal cliff battle is clearly just the first step in ensuring America’s seniors don’t lose the war about to begin in earnest against the nation’s vital safety net programs –Medicare, Medicaid and Social Security.

Seniors Can do the Math. Chained CPI = Social Security Benefit Cuts

We want to be very, very clear about the White House’s decision to cave to GOP demands cutting billions in Social Security benefits to the poor and middle-class – it simply doesn’t have to happen. There are many other ways the White House and Congress could find that same amount of deficit savings without targeting America’s poor and middle class. Instead, Democrats and Republicans appear ready to tell retirees earning an average $14,000 Social Security benefit they’ll have to live on less so that: someone making from $500,000 to $999,999 can keep their Bush tax cuts, and Pharma can keep charging Medicare higher prices for Part D drugs, the wealthy can keep their capital gains tax loop holes, and huge corporations can continue to dodge their corporate taxes.

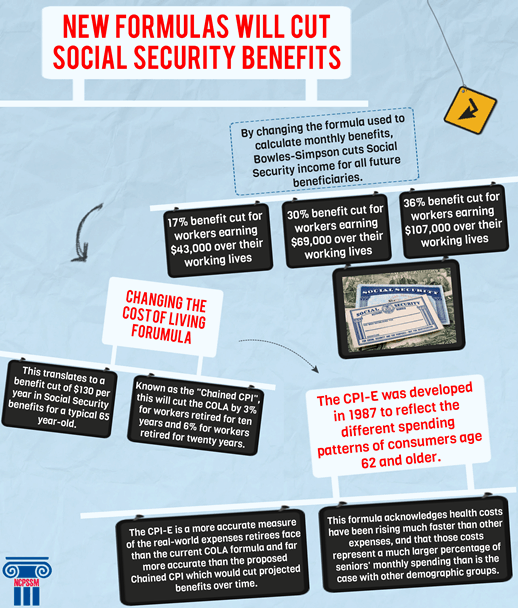

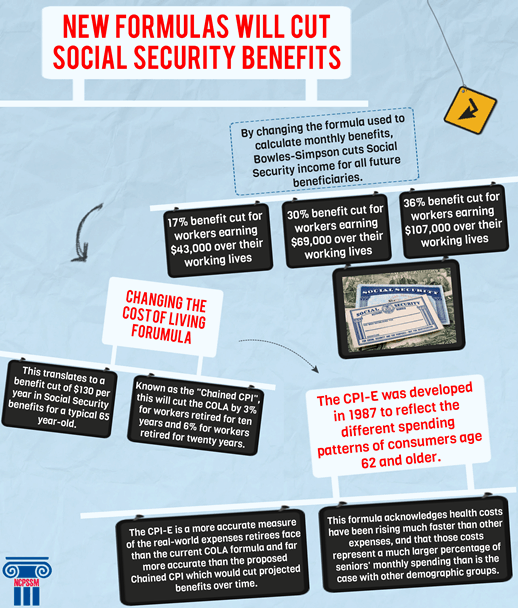

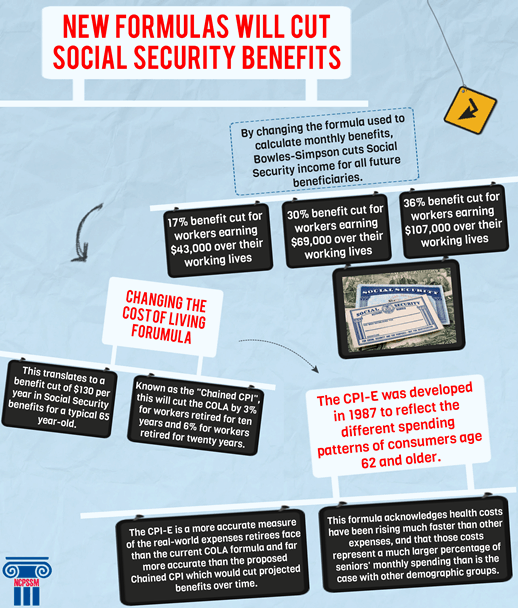

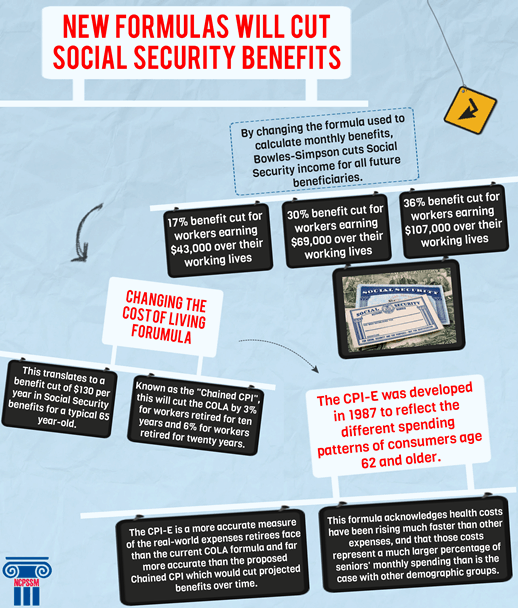

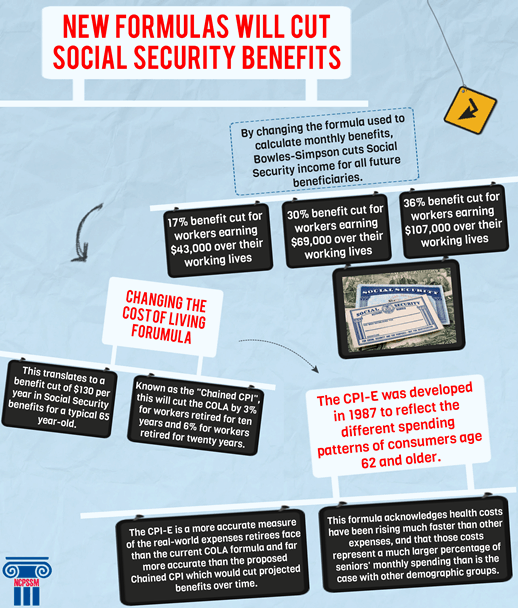

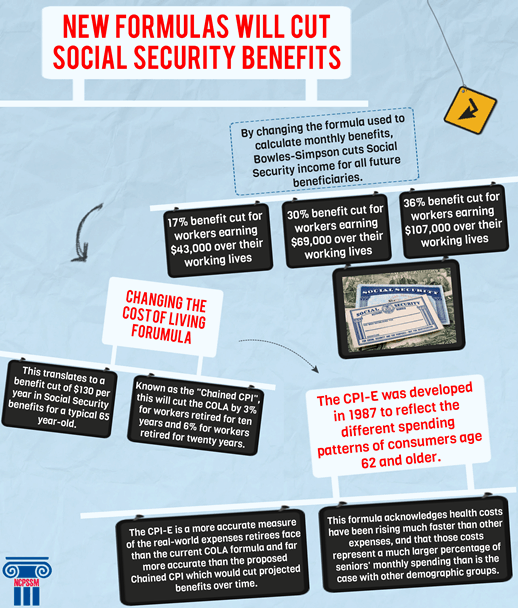

The chained CPI would mean an immediate benefit cut of $130 per year for the typical 65-year old retiree and would grow exponentially to a $1,400 cut after 30 years of retirement. Contrary to the political spin, this chained CPI proposal isn’t a “tweak” or an “adjustment,” it’s designed to cut benefits and raises taxes, largely on the poor and middle class, totaling $208 billion over ten years. $112 billion of those benefits cuts come from Social Security alone with up to $24 billion coming from VA benefits and civilian and military retirement pay cuts.

Passing the chained CPI means Washington has made a very clear choice to force those who can least afford it to pay down the deficit…even though Social Security has not contributed one dime to the problem.

Richard Eskow provides a terrific rundown of the many other deficit options available in his post on Our Future: 8 Deficit Reducers that are more Ethical – and More Effective – than the Chained CPI. Here’s just a highlight but we recommend you read the entire post:

Close multiple loopholes in the capital gains law: $174.2 billion. (1.42x)

Lawmakers could save nearly one and a half times as much money as they’ll get from stripping seniors, the disabled, veterans, and children of their benefits – 1.42 times as much, to be precise – by closing capital gains loopholes.

They include the “carried interest” loophole, which taxes hedge fund managers’ service fees at the low “investors’” rate; the ‘blended rate,’ which taxes some quick derivatives trades as if they were long-term investments; the ability to ‘gift’ capital gains to avoid taxation; a dodge for bartering capital gains; and the ability to ‘defer’ gains to future years.

A more aggressive approach – eliminating the capital gains altogether – could yield more than $900 billion in savings, but that might affect middle-class families and seniors. By using the “chained CPI,” America’s seniors, vets, and disabled are taking a hit so that hedge fund managers can keep their loopholes.

(Source: Calculations based on figures cited by the Center for Budget and Policy Priorities.)

Refuse to compromise on the President’s $250,000 figure for increased taxation: $183 billion (1.5x)

The President’s initial tax plan – the one he and his party ran on, the one that voters endorsed – called for letting the Bush tax cuts expire for income above $250,000. That would bring in an estimated $366 billion in added revenue over the next ten years. Now, say reports, he and the Republicans will agree on a figure that’s “somewhere in the middle.”

If true, the deal’s deficit reduction impact will be reduced by $183 billion. That’s one and a half times as much as the “chained CPI” will take from seniors, the disabled, veterans, and their dependents. They’ll pay — so that people earning $250,000 and up don’t have to.

(Source: CBPP estimate, divided in half.)

Allow the government to negotiate with drug companies: $220 billion. (1.8x)

Current law specifically forbids the government from using its negotiating power to obtain lower rates for Medicare prescriptions – even though much of the research behind the drugs involved was performed at government expense.

If we allow the government to negotiate with drug companies, that will save an estimated $220 billion. That’s 1.8 times as much money as the “chained CPI” – and it comes from the drug companies, not vulnerable Americans.

(Source: Outterson and Kesselheim, Health Affairs.)

Eliminate corporate tax loopholes: $1.24 trillion (10x)

A 2007 Treasury Department report (prepared under President Bush) concluded that “corporate tax preferences” – that is, loopholes – resulted in lost revenue of $1,241,000,000,000 over a ten-year period.

That number looks pretty good – especially when it’s stacked up against the “chained CPI” figure of $122 billion.

If we can’t afford to honor our commitment to America’s veterans and their families, or to our seniors, or to the disabled, we sure can’t afford these corporate tax loopholes – excuse me, I meant “preferences.”

(Source: United States Department of the Treasury background paper.)

Social Security Benefits Targeted in Deficit Talks

There are media reports that President Obama has caved on GOP demands that Social Security benefits be cut as part of a deficit deal. According to the Washington Post:

Obama also gave ground on a key Republican demand — applying a less-generous measure of inflation across the federal government. That change would save about $225 billion over the next decade, with more than half the savings coming from smaller cost-of-living increases for Social Security beneficiaries.

NCPSSM President/CEO, Max Richtman, had this reaction:

“Too many Washington politicians clearly hope middle-class Americans simply won’t notice billions of dollars in Social Security benefit cuts included in proposals changing the current cost of living allowance formula to a stingier chained CPI. I promise you, seniors and their families will notice.

If news reports are correct and the White House is considering this benefit cut, then President Obama has broken faith with seniors and his commitment to keep Social Security out of the deficit debate. The chained CPI would mean an immediate benefit cut of $130 per year for the typical 65-year old retiree and would grow exponentially to a $1,400 cut after 30 years of retirement.

Contrary to the political spin, this chained CPI proposal isn’t a “tweak” or an “adjustment,” it’s designed to cut benefits and raises taxes, largely on the poor and middle class, totaling $208 billion over ten years. $112 billion of those benefits cuts come from Social Security alone with up to $24 billion coming from VA benefits and civilian and military retirement pay cuts.

Seniors will have received an average COLA of 1.3% over 4 years with no increases in two of those years. Arguing that is too generous shows how out of touch some of our political leaders have become with the real-world economic realities facing average Americans. Adopting the chained CPI is nothing more than a political slight of hand targeting our nation’s middle class and poor and should be rejected by the President.” Max Richtman, NCPSSM President/CEO

For more details on the chained CPI here’s our one-page fact sheet, infographic and a detailed description from the Center for Economic and Policy Research.

Fix the Debt says Cutting Social Security is as American as…

What do you do when the vast majority of Americans, of all ages and political stripes, disagree with you? If you’re part of the well-financed anti-Social Security, Medicare lobby, you simply spend a portion of your billion dollar investment on a massive nationwide advertising campaign designed to convince Americans that cutting middle-class benefits is as American as…let’s see…McDonald’s hamburgers.

Burson-Marsteller subsidiary Proof Integrated Communications has launched a massive campaign for the Fix the Debt organization. The campaign includes images that are parody recreations of well-known advertising slogans with taglines like “I’m fixin’ it,” “Got debt?” and “Just fix it.” Johanna Schneider, MD of Burson’s DC office, said this is the biggest public policy campaign she has seen in some time.

This new campaign is in addition to the PR blitz already underway led by PR agencies DCI Group, Glover Park Group, and Dewey Square Group, which is also paid for by the same Pete Peterson funded anti-entitlement campaign.

How ironic that as Alan Simpson continues to attack seniors’ groups like ours for daring to represent their membership (and at $12 per year membership you can be sure we don’t have a billion dollars to spend) his big business and Wall Street funded “Fix the Debt” campaign is preparing an all-out advertising onslaught geared to buy the debate and silence the middle-class Americans who will actually pay the price for their failed fiscal policies. Representing seniors — BAD, representing big business — No problem!

The American people simply don’t believe cutting Social Security benefits for a senior living on an average $14,000 while lowering tax rates for corporations and the wealthy is fiscally responsible. They don’t believe the nation’s disabled, veterans, survivors and their families should pay the price for a deficit Social Security didn’t create.

However, as we’ve already seen, this Wall Street backed propaganda campaign has succeeded in convincing many on Capitol Hill that if millionaires lose even a penny of their tax cuts then the middle-class and poor must pay an even bigger price.

The question is will this massive ad blitz fool the American people into accepting massive benefit cuts with their fries?

Raising the Medicare Age is one of Washington’s Worst Ideas — Ever

And that’s saying something!

The weekend was buzzing with hints that President Obama might be open to trade a slightly higher tax rate for the wealthy for raising Medicare’s eligibility age. The New York Times’ Paul Krugman had the best summation of just how bad an idea this truly is:

First, raising the Medicare age is terrible policy. It would be terrible policy even if the Affordable Care Act were going to be there in full force for 65 and 66 year olds, because it would cost the public $2 for every dollar in federal funds saved. And in case you haven’t noticed, Republican governors are still fighting the ACA tooth and nail; if they block the Medicaid expansion, as some will, lower-income seniors will just be pitched into the abyss.

The Kaiser Family Foundation did a detailed analysis of the impact of raising the age of Medicare eligibility, taking into account the implementation of health care reform.

Seven million people age 65 or 66. 42 percent would turn to employer-sponsored plans for health insurance, either as active workers or retirees, 38 percent would enroll in the Exchange, and 20 percent would become covered under Medicare.

Two-thirds of adults ages 65 and 66 affected by the proposal are projected to pay more out-of- pocket, on average, in premiums and cost sharing under their new source of coverage than they would have paid under Medicare.

Premiums in the Exchange would rise for adults under age 65 by three percent (an additional ($141 per enrollee in 2014), on average, due to the shift of older adults from Medicare into the pool of lives covered by the Exchange.

Medicare Part B premiums would increase by three percent in 2014, as the deferred enrollment of relatively healthy, lower-cost beneficiaries would raise the average cost across remaining beneficiaries.

In addition, costs to employers are projected to increase by $4.5 billion in 2014 and costs to states are expected to increase by $0.7 billion.

Raising the age of eligibility to 67 in 2014 is projected to result in an estimated net increase of $3.7 billion in out-of-pocket costs for those ages 65 and 66 who would otherwise have been covered by Medicare.

In sum, raising Medicare’s eligibility age costs $2 for every $1 saved. Seniors, including those already in Medicare and those 65 & 66 years old who’d no longer qualify, would pay more. Businesses would pay more and states would pay more.

Sound like a good deal to you?

Washington Makes It Clear: Medicare Will Now Be Targeted to Pay Down Deficit

“Official Washington was in celebration mode on New Year’s Day after kind of averting a completely unnecessary crisis that was entirely of its own creation.” The Borowitz Report

This was our favorite headline from the hundreds of stories flooding our email boxes during the holiday “fiscal cliff” debate. The fact that it’s satire really doesn’t diminish the underlying message. Crisis creation seems to be what Washington does best these days. Even so, there was good news in this deal for seniors including: the end of the Social Security payroll tax holiday (which should never have been implemented in the first place), a one year doc fix preventing a massive cut in doctors’ Medicare reimbursements and extension of a number of Medicare programs that would have expired December 31st.

So while America’s seniors can breathe a sigh of relief that Congress finally came to its senses and removed benefit cuts for millions of middle-class and poor Americans from the fiscal cliff deal, that relief will be short-lived. Tomorrow, with the swearing-in of a new Congress, the assault on Social Security and Medicare begins all over again.

As Michael Hiltzik at the Los Angeles Times correctly points out, this alleged quest for deficit reduction has really been about cutting Social Security and Medicare under the guise of debt reduction.

“Despite the lawmakers’ claims that the debate has been about closing the federal deficit and reducing the federal debt, none of the negotiating over the past weeks has dealt with those issues. Indeed, the tax and spending package will widen the deficit by some $4 trillion over 10 years, compared with what would happen if the tax increases and spending cuts mandated by existing law were implemented.

The House Republican caucus has consistently looked for ways to protect high-income taxpayers from a tax increase, at the expense of beneficiaries of government programs such as enrollees in Social Security and Medicare. If there’s a dominant preoccupation with cutting the deficit lurking somewhere in that mind-set, good luck finding it.”

The Huffington Post describes what’s coming next:

“The fiscal cliff has not been averted. If anything, the U.S. faces an even more ominous deadline in a few months. The debt ceiling was hit as of New Year’s Eve. The U.S. Treasury will dip into its tool bag to keep the country’s borrowing ability going, but that will last only about two months. Also in early March, the sequestration — $110 billion in across-the-board spending cuts, half in defense and half in domestic programs — springs back, unless Congress finds a way to offset it with other spending cuts. Weeks later, the law that keeps the government funded expires. It all means that, in late February and early March, Congress will face a sequestration, a government default and a government shutdown. Republicans say they’ll use the leverage created by the debt ceiling to force Obama to accept spending cuts, particularly in entitlement programs. Obama resisted that notion on Dec. 31, saying he wants more tax increases and won’t accept Republican plans to “shove” spending cuts past him. “If they think that’s going to be the formula for how we solve this thing, then they’ve got another thing coming,” he said.

However, once the fiscal cliff deal passed, the President’s message changed making it clear cuts to Medicare will be offered up to pay down the deficit:

“I agree with Democrats and Republicans that the aging population and the rising cost of health care makes Medicare the biggest contributor to our deficit. I believe we’ve got to find ways to reform that program without hurting seniors who count on it to survive. And I believe that there’s further unnecessary spending in government that we can eliminate.” President Obama statement, January 1

There are ways to make Medicare more efficient and save money, in fact, many of those ideas were already implemented in the Affordable Care Act. Going forward Congress should also consider allowing Medicare to negotiate with drug makers for lower prescription drug costs in Part D and allowing drug re-importation which would save billions in the Medicare program. Unfortunately, both of these common sense proposals are opposed by conservatives, many of the same fiscal hawks, who’d rather reduce spending by cutting benefits instead of curtailing the excessive payments to the highly profitable pharmaceutical industry.

Winning the fiscal cliff battle is clearly just the first step in ensuring America’s seniors don’t lose the war about to begin in earnest against the nation’s vital safety net programs –Medicare, Medicaid and Social Security.

Seniors Can do the Math. Chained CPI = Social Security Benefit Cuts

We want to be very, very clear about the White House’s decision to cave to GOP demands cutting billions in Social Security benefits to the poor and middle-class – it simply doesn’t have to happen. There are many other ways the White House and Congress could find that same amount of deficit savings without targeting America’s poor and middle class. Instead, Democrats and Republicans appear ready to tell retirees earning an average $14,000 Social Security benefit they’ll have to live on less so that: someone making from $500,000 to $999,999 can keep their Bush tax cuts, and Pharma can keep charging Medicare higher prices for Part D drugs, the wealthy can keep their capital gains tax loop holes, and huge corporations can continue to dodge their corporate taxes.

The chained CPI would mean an immediate benefit cut of $130 per year for the typical 65-year old retiree and would grow exponentially to a $1,400 cut after 30 years of retirement. Contrary to the political spin, this chained CPI proposal isn’t a “tweak” or an “adjustment,” it’s designed to cut benefits and raises taxes, largely on the poor and middle class, totaling $208 billion over ten years. $112 billion of those benefits cuts come from Social Security alone with up to $24 billion coming from VA benefits and civilian and military retirement pay cuts.

Passing the chained CPI means Washington has made a very clear choice to force those who can least afford it to pay down the deficit…even though Social Security has not contributed one dime to the problem.

Richard Eskow provides a terrific rundown of the many other deficit options available in his post on Our Future: 8 Deficit Reducers that are more Ethical – and More Effective – than the Chained CPI. Here’s just a highlight but we recommend you read the entire post:

Close multiple loopholes in the capital gains law: $174.2 billion. (1.42x)

Lawmakers could save nearly one and a half times as much money as they’ll get from stripping seniors, the disabled, veterans, and children of their benefits – 1.42 times as much, to be precise – by closing capital gains loopholes.

They include the “carried interest” loophole, which taxes hedge fund managers’ service fees at the low “investors’” rate; the ‘blended rate,’ which taxes some quick derivatives trades as if they were long-term investments; the ability to ‘gift’ capital gains to avoid taxation; a dodge for bartering capital gains; and the ability to ‘defer’ gains to future years.

A more aggressive approach – eliminating the capital gains altogether – could yield more than $900 billion in savings, but that might affect middle-class families and seniors. By using the “chained CPI,” America’s seniors, vets, and disabled are taking a hit so that hedge fund managers can keep their loopholes.

(Source: Calculations based on figures cited by the Center for Budget and Policy Priorities.)

Refuse to compromise on the President’s $250,000 figure for increased taxation: $183 billion (1.5x)

The President’s initial tax plan – the one he and his party ran on, the one that voters endorsed – called for letting the Bush tax cuts expire for income above $250,000. That would bring in an estimated $366 billion in added revenue over the next ten years. Now, say reports, he and the Republicans will agree on a figure that’s “somewhere in the middle.”

If true, the deal’s deficit reduction impact will be reduced by $183 billion. That’s one and a half times as much as the “chained CPI” will take from seniors, the disabled, veterans, and their dependents. They’ll pay — so that people earning $250,000 and up don’t have to.

(Source: CBPP estimate, divided in half.)

Allow the government to negotiate with drug companies: $220 billion. (1.8x)

Current law specifically forbids the government from using its negotiating power to obtain lower rates for Medicare prescriptions – even though much of the research behind the drugs involved was performed at government expense.

If we allow the government to negotiate with drug companies, that will save an estimated $220 billion. That’s 1.8 times as much money as the “chained CPI” – and it comes from the drug companies, not vulnerable Americans.

(Source: Outterson and Kesselheim, Health Affairs.)

Eliminate corporate tax loopholes: $1.24 trillion (10x)

A 2007 Treasury Department report (prepared under President Bush) concluded that “corporate tax preferences” – that is, loopholes – resulted in lost revenue of $1,241,000,000,000 over a ten-year period.

That number looks pretty good – especially when it’s stacked up against the “chained CPI” figure of $122 billion.

If we can’t afford to honor our commitment to America’s veterans and their families, or to our seniors, or to the disabled, we sure can’t afford these corporate tax loopholes – excuse me, I meant “preferences.”

(Source: United States Department of the Treasury background paper.)

Social Security Benefits Targeted in Deficit Talks

There are media reports that President Obama has caved on GOP demands that Social Security benefits be cut as part of a deficit deal. According to the Washington Post:

Obama also gave ground on a key Republican demand — applying a less-generous measure of inflation across the federal government. That change would save about $225 billion over the next decade, with more than half the savings coming from smaller cost-of-living increases for Social Security beneficiaries.

NCPSSM President/CEO, Max Richtman, had this reaction:

“Too many Washington politicians clearly hope middle-class Americans simply won’t notice billions of dollars in Social Security benefit cuts included in proposals changing the current cost of living allowance formula to a stingier chained CPI. I promise you, seniors and their families will notice.

If news reports are correct and the White House is considering this benefit cut, then President Obama has broken faith with seniors and his commitment to keep Social Security out of the deficit debate. The chained CPI would mean an immediate benefit cut of $130 per year for the typical 65-year old retiree and would grow exponentially to a $1,400 cut after 30 years of retirement.

Contrary to the political spin, this chained CPI proposal isn’t a “tweak” or an “adjustment,” it’s designed to cut benefits and raises taxes, largely on the poor and middle class, totaling $208 billion over ten years. $112 billion of those benefits cuts come from Social Security alone with up to $24 billion coming from VA benefits and civilian and military retirement pay cuts.

Seniors will have received an average COLA of 1.3% over 4 years with no increases in two of those years. Arguing that is too generous shows how out of touch some of our political leaders have become with the real-world economic realities facing average Americans. Adopting the chained CPI is nothing more than a political slight of hand targeting our nation’s middle class and poor and should be rejected by the President.” Max Richtman, NCPSSM President/CEO

For more details on the chained CPI here’s our one-page fact sheet, infographic and a detailed description from the Center for Economic and Policy Research.

Fix the Debt says Cutting Social Security is as American as…

What do you do when the vast majority of Americans, of all ages and political stripes, disagree with you? If you’re part of the well-financed anti-Social Security, Medicare lobby, you simply spend a portion of your billion dollar investment on a massive nationwide advertising campaign designed to convince Americans that cutting middle-class benefits is as American as…let’s see…McDonald’s hamburgers.

Burson-Marsteller subsidiary Proof Integrated Communications has launched a massive campaign for the Fix the Debt organization. The campaign includes images that are parody recreations of well-known advertising slogans with taglines like “I’m fixin’ it,” “Got debt?” and “Just fix it.” Johanna Schneider, MD of Burson’s DC office, said this is the biggest public policy campaign she has seen in some time.

This new campaign is in addition to the PR blitz already underway led by PR agencies DCI Group, Glover Park Group, and Dewey Square Group, which is also paid for by the same Pete Peterson funded anti-entitlement campaign.

How ironic that as Alan Simpson continues to attack seniors’ groups like ours for daring to represent their membership (and at $12 per year membership you can be sure we don’t have a billion dollars to spend) his big business and Wall Street funded “Fix the Debt” campaign is preparing an all-out advertising onslaught geared to buy the debate and silence the middle-class Americans who will actually pay the price for their failed fiscal policies. Representing seniors — BAD, representing big business — No problem!

The American people simply don’t believe cutting Social Security benefits for a senior living on an average $14,000 while lowering tax rates for corporations and the wealthy is fiscally responsible. They don’t believe the nation’s disabled, veterans, survivors and their families should pay the price for a deficit Social Security didn’t create.

However, as we’ve already seen, this Wall Street backed propaganda campaign has succeeded in convincing many on Capitol Hill that if millionaires lose even a penny of their tax cuts then the middle-class and poor must pay an even bigger price.

The question is will this massive ad blitz fool the American people into accepting massive benefit cuts with their fries?

Raising the Medicare Age is one of Washington’s Worst Ideas — Ever

And that’s saying something!

The weekend was buzzing with hints that President Obama might be open to trade a slightly higher tax rate for the wealthy for raising Medicare’s eligibility age. The New York Times’ Paul Krugman had the best summation of just how bad an idea this truly is:

First, raising the Medicare age is terrible policy. It would be terrible policy even if the Affordable Care Act were going to be there in full force for 65 and 66 year olds, because it would cost the public $2 for every dollar in federal funds saved. And in case you haven’t noticed, Republican governors are still fighting the ACA tooth and nail; if they block the Medicaid expansion, as some will, lower-income seniors will just be pitched into the abyss.

The Kaiser Family Foundation did a detailed analysis of the impact of raising the age of Medicare eligibility, taking into account the implementation of health care reform.

Seven million people age 65 or 66. 42 percent would turn to employer-sponsored plans for health insurance, either as active workers or retirees, 38 percent would enroll in the Exchange, and 20 percent would become covered under Medicare.

Two-thirds of adults ages 65 and 66 affected by the proposal are projected to pay more out-of- pocket, on average, in premiums and cost sharing under their new source of coverage than they would have paid under Medicare.

Premiums in the Exchange would rise for adults under age 65 by three percent (an additional ($141 per enrollee in 2014), on average, due to the shift of older adults from Medicare into the pool of lives covered by the Exchange.

Medicare Part B premiums would increase by three percent in 2014, as the deferred enrollment of relatively healthy, lower-cost beneficiaries would raise the average cost across remaining beneficiaries.

In addition, costs to employers are projected to increase by $4.5 billion in 2014 and costs to states are expected to increase by $0.7 billion.

Raising the age of eligibility to 67 in 2014 is projected to result in an estimated net increase of $3.7 billion in out-of-pocket costs for those ages 65 and 66 who would otherwise have been covered by Medicare.

In sum, raising Medicare’s eligibility age costs $2 for every $1 saved. Seniors, including those already in Medicare and those 65 & 66 years old who’d no longer qualify, would pay more. Businesses would pay more and states would pay more.

Sound like a good deal to you?