Wall Street vs. Main Street: They Don’t Need their Social Security So Why Should You?

The Business Roundtable has presented the latest CEO/Wall Street attempt to convince Washington that slashing Social Security and Medicare benefits for the average American is the brave thing to do to cut our deficits. Their proposal is nothing more than a knock-off of the Bowles Simpson and the Ryan plan – two plans that have been soundly rejected by a majority of Americans in poll after poll and at the ballot box in November. Incredibly, this plan doubles-down and includes virtually every bad idea Washington has considered over the past decade all rolled into one proposal. In short, America’s CEO’s say raising the retirement age to 70, cutting benefits immediately for seniors, the disabled and veterans, turning Medicare into CouponCare while also raising the Medicare eligibility age, really isn’t too much to ask from millions of middle-class American families still reeling in this economy.

Now maybe if you were a millionaire or billionaire, you might think these were good ideas too. But most Americans are living well below what these CEOs earn, explaining why preserving and strengthening Social Security and Medicare benefits is so vitally important for the middle class. It’s clearly not a priority for America’s corporate class. But there’s also another explanation for this disconnect between Wall Street and Main Street. The dirty little secret the Business Roundtable doesn’t want to talk about is the vested interest that corporate and Wall Street CEO’s have in convincing Congress we can’t afford Social Security and Medicare.

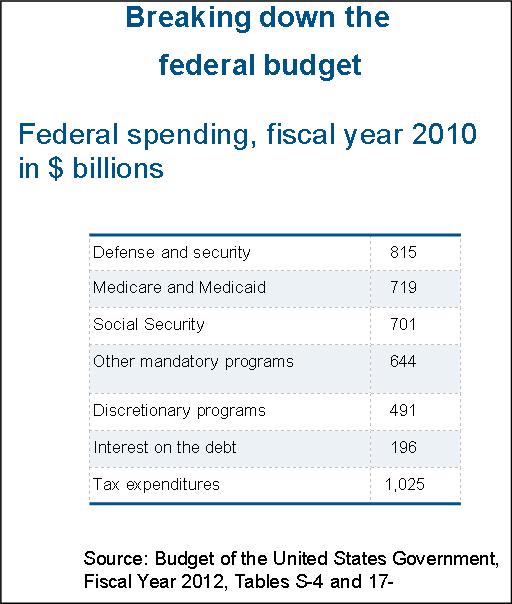

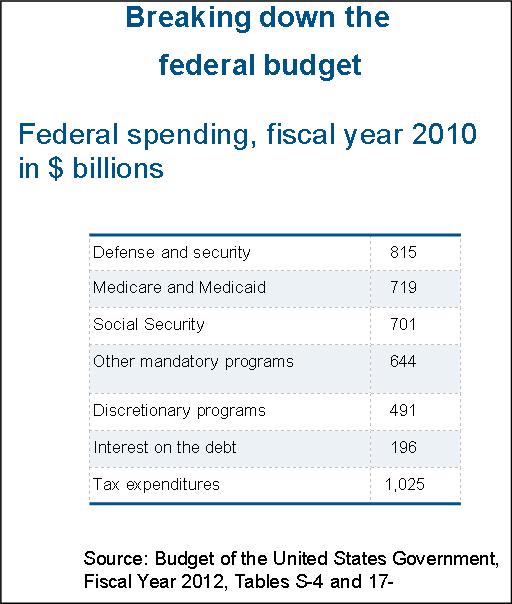

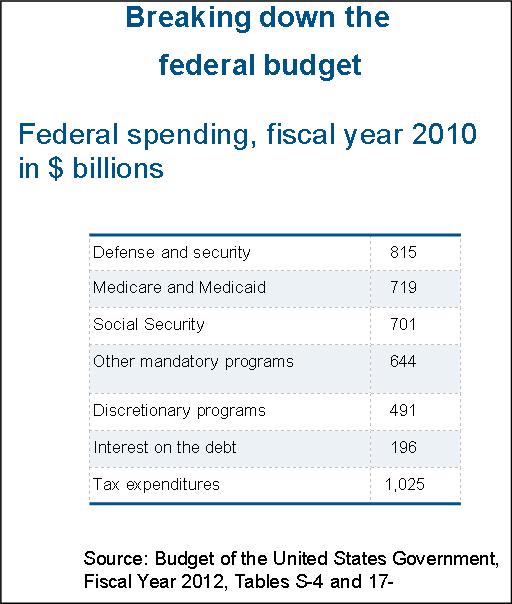

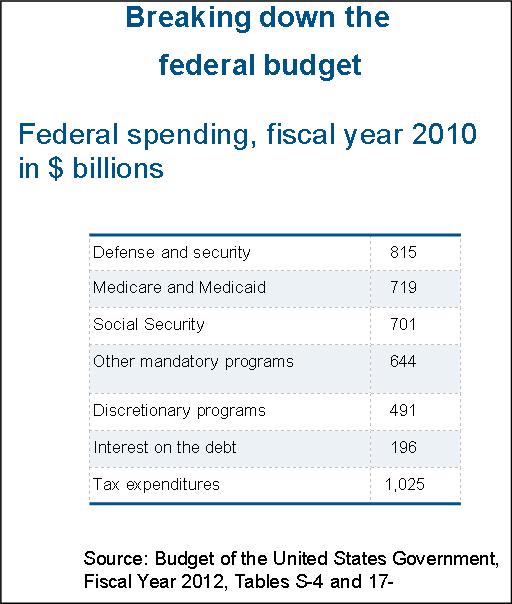

The Business Roundtable is fighting to protect more than $1 trillion dollars in tax giveaways—paid for with working American’s tax dollars. Roundtable leaders portray their plan cutting benefits to millions of American families as “practical.” What’s “practical” about spending a trillion dollars in tax expenditures to pad corporate bottom lines and executive bonus checks while telling an average senior receiving only $14,000 a year in Social Security income to live on less? While they decry the high cost of providing healthcare to seniors and veterans they conveniently ignore the fact that tax code spending is up 60% since 1986 and is a bigger part of the budget than SS, Medicare, Medicaid or national defense.

The Business Roundtable is fighting to protect more than $1 trillion dollars in tax giveaways—paid for with working American’s tax dollars. Roundtable leaders portray their plan cutting benefits to millions of American families as “practical.” What’s “practical” about spending a trillion dollars in tax expenditures to pad corporate bottom lines and executive bonus checks while telling an average senior receiving only $14,000 a year in Social Security income to live on less? While they decry the high cost of providing healthcare to seniors and veterans they conveniently ignore the fact that tax code spending is up 60% since 1986 and is a bigger part of the budget than SS, Medicare, Medicaid or national defense.

The Business Roundtable’s so-called “practical” approach also shows that “shared sacrifice” really just means middle-class families should sacrifice so corporations and wealthy CEO’s can share the gains of a trillion dollar tax giveaway. If these captains of industry are truly concerned about the future of Social Security then why not why not lift the payroll cap and subject all income such as deferred compensation to FICA? Or how about limiting just two of those massive tax breaks for the wealthy & corporations, which saves much more than raising the retirement age?

· Limit some itemized deductions for high earners ($114 billion)

· Eliminate Corporate meals and entertainment write offs ($84 billion)

These two common sense changes save $198 billion over just 5 years while raising the retirement age to 70 saves $120 billion over the next decade.

Surely, writing off expensive business dinners for multimillionaires isn’t a higher priority for our nation than providing enough income so the average senior can afford to buy groceries.

This debate really is about America’s priorities for generations of middle-class families. Unfortunately, America’s CEO’s have made their priorities perfectly clear.

The False Prophets of Dysfunction and the Social Security “Crisis”

“I’m reminded of a particularly pernicious rule of today’s politics: the self-fulfilling prophecy of dysfunction. Many of today’s conservatives run for office on a platform that government doesn’t work. And when they’re elected, they work their hardest to prove it true. They say, “we’re Greece!” when of course we’re nothing like Greece, then they threaten default to make us Greece.

This is an alarmingly simple ploy, but once you tune into it you see it everywhere. The prophets of dysfunction must convince us a spending crisis, an entitlement crisis, and debt crisis despite their factual inaccuracies. It there’s no crisis—if, as is clearly the case—our fiscal challenges can actually be met with reasonable policies involving analysis (e.g., squeezing inefficiencies out of health care delivery) and compromise (spending cuts and revenue increases), these hair-on-fire-slash-and-burners have no use.

An important job of progressives throughout history is the exposure of such false prophets. Of course, these prophets have huge profits riding on their ruse, so they won’t leave quietly. But we must expose them nevertheless. Our system is broken because a broken system works for the false prophets of dysfunction. It doesn’t work for the rest of us.”

Social Security Propaganda Advice for the GOP: Say Save When You Really Mean Slash

GOP Pollster and spinmeister, Frank Luntz, is convinced the Republican party doesn’t have a problem with their ideas, just in being too honest when talking about them. Luntz wrote an Oped for the Washington Post this weekend that provides an incredibly cynical glimpse into the GOP propaganda strategy on Social Security and Medicare. Basically, he says conservatives should avoid telling Americans the whole story about the various plans to cut benefits, privatize or shift costs for seniors:

“Instead of entitlement reform or controlling the growth of Medicare and Social Security, talk about how to save and strengthen these programs so they are there when voters need them. After all, they paid for them.” Frank Luntz, GOP Pollster

That’s right, they do pay for them — which is why the vast majority of Americans do not support cutting Social Security or Medicare benefits to pay down the deficit. However, rather than address this massive disconnect between how the average American would address our fiscal mess and how Republicans would, the Luntz strategy is to cloak their plans in poll-tested propaganda.

Orwellian double-speak offered by conservatives who say “save” when they mean “slash” and “preserve” when they mean “privatize” isn’t new. It was also the cornerstone of the Republican campaign against healthcare reform where the GOP continues to mislead seniors into believing the Affordable Care Act cut their Medicare benefits, even though the opposite is true.

“Do not say: ‘entitlement reform,’ ‘privatization,’ ‘every option is on the table,’ … Do say: ‘strengthen,’ ‘secure,’ ‘save,’ ‘preserve, ‘protect.’” NRCC Medicare Memo

So, House Republicans will gather at their annual retreat this week — and if they take their pollster’s advice — crafting ways to ensure they don’t tell the American people exactly what they have planned for Social Security and Medicare and the millions of families those programs serve.

Social Security Has Nothing to Do with the Deficit – Ronald Reagan

Here’s a little blast from the past for Congressional Republicans who’ve decided cutting Social Security must be a part of any deficit debate. It’s yet another reminder of how many Americans the current GOP have abandoned in it’s embrace of Tea Party politics — including the “Gipper.”

Cutting Medicare, Medicaid & Social Security in the 113th Congress

Max Richtman, NCPSSM President/CEO

Will the New Congress Save Social Security, Medicare and Medicaid or Cut Benefits? The Middle Class wants to know.

Members of the 113th Congress have now taken their oaths of office but their day of congratulatory celebrations and receptions will soon be a distant memory as a series of self-induced fiscal “crises” will demand this new Congress’ full attention. Over the next few months, Congress will face default, sequestration, and a possible government shutdown. We can be sure that the well-financed anti-entitlement lobby will not let these crises go to waste. Each one provides the perfect backdrop for their long-running campaign to cut Medicare, Medicaid, and Social Security benefits to pay down the federal deficit.

Already, Republicans in Congress are promising to — once again — hold the debt ceiling hostage to force benefit cuts in Medicare, Medicaid, and even Social Security. If they can’t get these cuts by threatening the solvency of our nation, their next opportunity will come as Congress attempts to craft a deficit reduction plan to avoid the $110 billion in automatic cuts delayed in the fiscal cliff legislation. Once again, many legislators have made it clear they expect seniors, retirees, the disabled, and the poor to pay down our deficit. They will demand drastic changes such as raising the retirement age, means testing, or changing the cost of living allowance (COLA) formula to cut benefits to millions of middle class and poor beneficiaries in Medicare, Medicaid and Social Security who are still struggling in this economy.

Democrats in Congress succeeded in keeping these devastating benefit cuts out of the short-term “fiscal cliff” deal. Unfortunately, important leverage was also lost. Washington’s well-financed anti-entitlement lobby continues to pretend that “shared sacrifice” means that if a millionaire loses a tax break (which he or she doesn’t need and America can’t afford) then the middle-class and poor must also pay more for or risk losing their health care benefits in Medicare and Medicaid. This false equivalency pretends that a tax dollar lost to a millionaire or huge corporation is the same as a benefit dollar lost to a retiree living on $14,000 a year in Social Security. This fiscal myth permeates the deficit debate and explains why members, like Senate minority leader Mitch McConnell, have no intention of addressing a full deficit package in a balanced way since the short-term fiscal cliff deal “was the last word on taxes. That debate is over.” Using this political metric, cuts to Medicare and Social Security benefits will be used to pay for the majority of a fiscal mess these programs simply did not create.

Even if Congress is allowed to cut Medicare and Medicaid to the bone, the real challenge to our economy — skyrocketing health care costs – remains untouched. For too long, conservatives in Congress have ignored the fact that if the U.S. paid the same costs per person for health care as other wealthy countries our nation would be looking at long-term surpluses, not deficits. If the rate of growth in overall health care is restrained so it is no longer growing faster than the rest of the economy, Medicare’s long-range financial deficit could be cut by well over one-half. In fact, we may be seeing movement in that direction as former OMB Director, Peter Orszag reports, “health-care costs have decelerated over the past few years, and Medicare costs have decelerated more than other health costs.”

There are also ways to make Medicare and Medicaid more efficient and save money without cutting benefits to vulnerable Americans. In fact, many of these reforms have been implemented in the Affordable Care Act, the same legislation which many in Congress who claim to want to “save” Medicare have worked tirelessly to destroy. Health care reform added eight years of solvency to Medicare and should be given time for full implementation. Congress should also consider allowing Medicare to negotiate with drug makers for lower prescription drug costs in Part D and allowing drug re-importation which would save billions in the Medicare program. Unfortunately, both of these common sense proposals are opposed by conservatives, and many of the same so-called fiscal hawks, who’d rather reduce spending by cutting benefits to seniors than curtailing excessive Medicare payments to the highly profitable pharmaceutical industry.

Claims that the only way to “save” Social Security is to cut benefits also ignores the fiscal facts. Social Security has not contributed one penny to the deficit and doesn’t even belong in a deficit debate. If solvency is truly the goal, then Congress needs to follow the advice of the vast majority of the American people who support lifting the payroll tax cap. Modest and manageable changes will make Social Security stronger for generations. In spite of this fact, cutting benefits by raising the retirement age, means testing, or adopting a stingier cost of living formula still remain the favored approach for Wall Street CEO’s and the many deficit-scold lobby groups flooding the halls of Congress.

Iowa Senator Tom Harkin said it best when casting his vote against the fiscal cliff deal,

“Every dollar that wealthy taxpayers do not pay under this deal, we will eventually ask Americans of modest means to forgo in Social Security, Medicare and Medicaid benefits.”

That’s billions of dollars America’s middle-class and poor families simply don’t have.

This article was orginal posted on Huffington Post.

Wall Street vs. Main Street: They Don’t Need their Social Security So Why Should You?

The Business Roundtable has presented the latest CEO/Wall Street attempt to convince Washington that slashing Social Security and Medicare benefits for the average American is the brave thing to do to cut our deficits. Their proposal is nothing more than a knock-off of the Bowles Simpson and the Ryan plan – two plans that have been soundly rejected by a majority of Americans in poll after poll and at the ballot box in November. Incredibly, this plan doubles-down and includes virtually every bad idea Washington has considered over the past decade all rolled into one proposal. In short, America’s CEO’s say raising the retirement age to 70, cutting benefits immediately for seniors, the disabled and veterans, turning Medicare into CouponCare while also raising the Medicare eligibility age, really isn’t too much to ask from millions of middle-class American families still reeling in this economy.

Now maybe if you were a millionaire or billionaire, you might think these were good ideas too. But most Americans are living well below what these CEOs earn, explaining why preserving and strengthening Social Security and Medicare benefits is so vitally important for the middle class. It’s clearly not a priority for America’s corporate class. But there’s also another explanation for this disconnect between Wall Street and Main Street. The dirty little secret the Business Roundtable doesn’t want to talk about is the vested interest that corporate and Wall Street CEO’s have in convincing Congress we can’t afford Social Security and Medicare.

The Business Roundtable’s so-called “practical” approach also shows that “shared sacrifice” really just means middle-class families should sacrifice so corporations and wealthy CEO’s can share the gains of a trillion dollar tax giveaway. If these captains of industry are truly concerned about the future of Social Security then why not why not lift the payroll cap and subject all income such as deferred compensation to FICA? Or how about limiting just two of those massive tax breaks for the wealthy & corporations, which saves much more than raising the retirement age?

· Limit some itemized deductions for high earners ($114 billion)

· Eliminate Corporate meals and entertainment write offs ($84 billion)

These two common sense changes save $198 billion over just 5 years while raising the retirement age to 70 saves $120 billion over the next decade.

Surely, writing off expensive business dinners for multimillionaires isn’t a higher priority for our nation than providing enough income so the average senior can afford to buy groceries.

This debate really is about America’s priorities for generations of middle-class families. Unfortunately, America’s CEO’s have made their priorities perfectly clear.

The False Prophets of Dysfunction and the Social Security “Crisis”

“I’m reminded of a particularly pernicious rule of today’s politics: the self-fulfilling prophecy of dysfunction. Many of today’s conservatives run for office on a platform that government doesn’t work. And when they’re elected, they work their hardest to prove it true. They say, “we’re Greece!” when of course we’re nothing like Greece, then they threaten default to make us Greece.

This is an alarmingly simple ploy, but once you tune into it you see it everywhere. The prophets of dysfunction must convince us a spending crisis, an entitlement crisis, and debt crisis despite their factual inaccuracies. It there’s no crisis—if, as is clearly the case—our fiscal challenges can actually be met with reasonable policies involving analysis (e.g., squeezing inefficiencies out of health care delivery) and compromise (spending cuts and revenue increases), these hair-on-fire-slash-and-burners have no use.

An important job of progressives throughout history is the exposure of such false prophets. Of course, these prophets have huge profits riding on their ruse, so they won’t leave quietly. But we must expose them nevertheless. Our system is broken because a broken system works for the false prophets of dysfunction. It doesn’t work for the rest of us.”

Social Security Propaganda Advice for the GOP: Say Save When You Really Mean Slash

GOP Pollster and spinmeister, Frank Luntz, is convinced the Republican party doesn’t have a problem with their ideas, just in being too honest when talking about them. Luntz wrote an Oped for the Washington Post this weekend that provides an incredibly cynical glimpse into the GOP propaganda strategy on Social Security and Medicare. Basically, he says conservatives should avoid telling Americans the whole story about the various plans to cut benefits, privatize or shift costs for seniors:

“Instead of entitlement reform or controlling the growth of Medicare and Social Security, talk about how to save and strengthen these programs so they are there when voters need them. After all, they paid for them.” Frank Luntz, GOP Pollster

That’s right, they do pay for them — which is why the vast majority of Americans do not support cutting Social Security or Medicare benefits to pay down the deficit. However, rather than address this massive disconnect between how the average American would address our fiscal mess and how Republicans would, the Luntz strategy is to cloak their plans in poll-tested propaganda.

Orwellian double-speak offered by conservatives who say “save” when they mean “slash” and “preserve” when they mean “privatize” isn’t new. It was also the cornerstone of the Republican campaign against healthcare reform where the GOP continues to mislead seniors into believing the Affordable Care Act cut their Medicare benefits, even though the opposite is true.

“Do not say: ‘entitlement reform,’ ‘privatization,’ ‘every option is on the table,’ … Do say: ‘strengthen,’ ‘secure,’ ‘save,’ ‘preserve, ‘protect.’” NRCC Medicare Memo

So, House Republicans will gather at their annual retreat this week — and if they take their pollster’s advice — crafting ways to ensure they don’t tell the American people exactly what they have planned for Social Security and Medicare and the millions of families those programs serve.

Social Security Has Nothing to Do with the Deficit – Ronald Reagan

Here’s a little blast from the past for Congressional Republicans who’ve decided cutting Social Security must be a part of any deficit debate. It’s yet another reminder of how many Americans the current GOP have abandoned in it’s embrace of Tea Party politics — including the “Gipper.”

Cutting Medicare, Medicaid & Social Security in the 113th Congress

Max Richtman, NCPSSM President/CEO

Will the New Congress Save Social Security, Medicare and Medicaid or Cut Benefits? The Middle Class wants to know.

Members of the 113th Congress have now taken their oaths of office but their day of congratulatory celebrations and receptions will soon be a distant memory as a series of self-induced fiscal “crises” will demand this new Congress’ full attention. Over the next few months, Congress will face default, sequestration, and a possible government shutdown. We can be sure that the well-financed anti-entitlement lobby will not let these crises go to waste. Each one provides the perfect backdrop for their long-running campaign to cut Medicare, Medicaid, and Social Security benefits to pay down the federal deficit.

Already, Republicans in Congress are promising to — once again — hold the debt ceiling hostage to force benefit cuts in Medicare, Medicaid, and even Social Security. If they can’t get these cuts by threatening the solvency of our nation, their next opportunity will come as Congress attempts to craft a deficit reduction plan to avoid the $110 billion in automatic cuts delayed in the fiscal cliff legislation. Once again, many legislators have made it clear they expect seniors, retirees, the disabled, and the poor to pay down our deficit. They will demand drastic changes such as raising the retirement age, means testing, or changing the cost of living allowance (COLA) formula to cut benefits to millions of middle class and poor beneficiaries in Medicare, Medicaid and Social Security who are still struggling in this economy.

Democrats in Congress succeeded in keeping these devastating benefit cuts out of the short-term “fiscal cliff” deal. Unfortunately, important leverage was also lost. Washington’s well-financed anti-entitlement lobby continues to pretend that “shared sacrifice” means that if a millionaire loses a tax break (which he or she doesn’t need and America can’t afford) then the middle-class and poor must also pay more for or risk losing their health care benefits in Medicare and Medicaid. This false equivalency pretends that a tax dollar lost to a millionaire or huge corporation is the same as a benefit dollar lost to a retiree living on $14,000 a year in Social Security. This fiscal myth permeates the deficit debate and explains why members, like Senate minority leader Mitch McConnell, have no intention of addressing a full deficit package in a balanced way since the short-term fiscal cliff deal “was the last word on taxes. That debate is over.” Using this political metric, cuts to Medicare and Social Security benefits will be used to pay for the majority of a fiscal mess these programs simply did not create.

Even if Congress is allowed to cut Medicare and Medicaid to the bone, the real challenge to our economy — skyrocketing health care costs – remains untouched. For too long, conservatives in Congress have ignored the fact that if the U.S. paid the same costs per person for health care as other wealthy countries our nation would be looking at long-term surpluses, not deficits. If the rate of growth in overall health care is restrained so it is no longer growing faster than the rest of the economy, Medicare’s long-range financial deficit could be cut by well over one-half. In fact, we may be seeing movement in that direction as former OMB Director, Peter Orszag reports, “health-care costs have decelerated over the past few years, and Medicare costs have decelerated more than other health costs.”

There are also ways to make Medicare and Medicaid more efficient and save money without cutting benefits to vulnerable Americans. In fact, many of these reforms have been implemented in the Affordable Care Act, the same legislation which many in Congress who claim to want to “save” Medicare have worked tirelessly to destroy. Health care reform added eight years of solvency to Medicare and should be given time for full implementation. Congress should also consider allowing Medicare to negotiate with drug makers for lower prescription drug costs in Part D and allowing drug re-importation which would save billions in the Medicare program. Unfortunately, both of these common sense proposals are opposed by conservatives, and many of the same so-called fiscal hawks, who’d rather reduce spending by cutting benefits to seniors than curtailing excessive Medicare payments to the highly profitable pharmaceutical industry.

Claims that the only way to “save” Social Security is to cut benefits also ignores the fiscal facts. Social Security has not contributed one penny to the deficit and doesn’t even belong in a deficit debate. If solvency is truly the goal, then Congress needs to follow the advice of the vast majority of the American people who support lifting the payroll tax cap. Modest and manageable changes will make Social Security stronger for generations. In spite of this fact, cutting benefits by raising the retirement age, means testing, or adopting a stingier cost of living formula still remain the favored approach for Wall Street CEO’s and the many deficit-scold lobby groups flooding the halls of Congress.

Iowa Senator Tom Harkin said it best when casting his vote against the fiscal cliff deal,

“Every dollar that wealthy taxpayers do not pay under this deal, we will eventually ask Americans of modest means to forgo in Social Security, Medicare and Medicaid benefits.”

That’s billions of dollars America’s middle-class and poor families simply don’t have.

This article was orginal posted on Huffington Post.