McCarthy Speakership Battle May Cost Seniors in the Long Run

Kevin McCarthy’s battle for the House speakership made for compelling political theater this week, but it could have dramatic implications for America’s seniors. According to news reports, McCarthy (R-CA) made concessions to holdout House members that would empower right-wingers in Congress who want to slash Social Security and Medicare — in order to fulfill his personal ambition to become Speaker.

CNN’s Manu Raju reported Friday afternoon that McCarthy agreed to demands from Freedom Caucus members regarding upcoming debt ceiling negotiations. In the putative deal, McCarthy reportedly has pledged not to raise the debt ceiling (so that the federal government can pay its existing obligations) without concessions on spending from Democrats and the White House on domestic programs.

If this reporting is accurate, it means that McCarthy has effectively agreed to risk a U.S. government default on its financial obligations (and the financial chaos that would ensue) in order to force cuts to Social Security, Medicare, and other safety net programs — despite the fact that these programs are incredibly popular and vital to the well-being of American seniors. (Not to mention that lifting the debt ceiling is essential for the U.S. to pay its existing bills.)

This scorched-earth strategy, which one CNN analyst characterized as “taking us to the brink of destruction,” is not what voters demanded in the 2022 elections. In fact, in denying Republicans an anticipated “Red Wave” last fall, the electorate clearly rejected MAGA extremism and MAGA-nomics.

Nevertheless, a small cadre of right-wing Freedom Caucus members are the ‘tail wagging the dog’ in McCarthy’s bid for the speakership. These extremists oppose spending on social programs no matter how important or popular those may be. (One commentator rightly branded them as “nihilists” who don’t believe in a functional federal government.)

We have seen this before. In 2011, Tea Party members instigated a battle over the debt ceiling that resulted in harmful caps on domestic spending that haunt us to this day. “I was around in 2011,” said former Obama advisor David Axelrod on CNN today, “and I remember that Republicans took us to the precipice of what would have been a catastrophe,” by risking a federal default on its financial obligations.

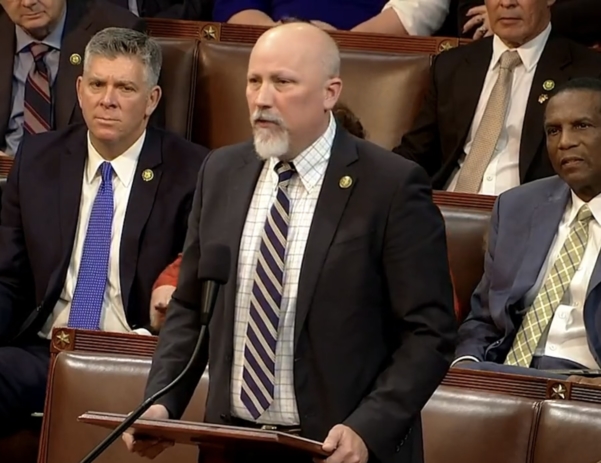

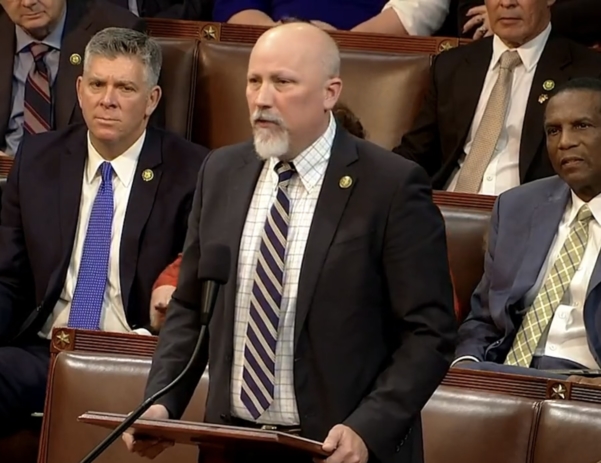

Rep. Chip Roy (R-TX) helped negotiate concessions from Kevin McCarthy

Beyond the debt ceiling maneuverings, Freedom Caucus members reportedly are wringing other concessions from McCarthy in return for their votes that also could be devastating for older Americans. These include rule changes that could make it harder to raise revenue and easier to cut spending on social programs.

The hard right would get approval power over some plum committee assignments, including a third of the members on the influential Rules Committee, which controls what legislation reaches the floor and in what form. And spending bills would have to be considered under so-called open rules, allowing any member to put to a vote an unlimited number of changes that could gut or scuttle the legislation altogether. – New York Times, 1/6/23

“That does not bode well for programs like Social Security and Medicare that are going to need an infusion of revenue,” says Maria Freese, policy advisor here at NCPSSM. “The new rules would make it easier for House Republicans to keep cutting taxes for the wealthy while gutting programs that everyday Americans depend on.”

If Kevin McCarthy does prevail (which as of Friday afternoon looks increasingly likely) and achieves his years-long dream of being House Speaker, seniors will be among those everyday Americans paying the price.

Does New Hill Spending Deal Affect Social Security & Medicare?

Congressional negotiators have avoided a government shutdown by reaching a compromise agreement on federal spending for the remainder of FY 2023. The Hill newspaper reported that lawmakers had “reached a bipartisan, bicameral framework that should allow them to finish an omnibus appropriations bill that can pass the House and Senate and be signed into law by the President.’” We spoke to NCPSSM legislative director Dan Adcock about the spending deal and whether it impacts Social Security and Medicare.

Q: What basically happened here?

Adcock: Republicans and Democrats were able to forestall a government shutdown that would have been triggered on Friday had they failed to agree on spending for the remainder of FY 2023. Late yesterday the two parties arrived at a compromise agreement on appropriations for the rest of the fiscal year, which began on October 1, 2022. The result will be an “Omnibus” spending bill because it combines all congressional appropriations into a single piece of legislation.

Q: Does this process affect Social Security and Medicare benefits?

Adcock: Not directly. Social Security and Medicare are considered “mandatory spending,” and are funded according to the laws that created them. They are not part of the annual appropriations process. What Congress is wrangling over now is called “discretionary spending,” which goes toward the day to day operation of the federal government. On the other hand, if there had been a government shutdown, Social Security Administration customer service could have been disrupted.

Q: What about funding for the Social Security Administration?

Adcock: Funding for SSA is, indeed, part of the annual appropriations process. We have urged Congress to appropriate $14.8 billion for Fiscal Year 2023, which is the level that President Biden requested in his budget. SSA badly needs these funds in order to improve customer service after more than a decade of budget cuts – and to work through the huge backlog in disability claims that built up during the pandemic.

Q: The current process is different than the debt ceiling negotiations, right?

Adcock: Yes. This week’s negotiations were about agreeing on appropriations to fund the daily operations of the government and avoid a shutdown. The debt ceiling issue is separate. Sometime during 2023 (most likely during the 3rd quarter), the federal government will have exhausted its ability to borrow money to meet its financial obligations — unless Congress raises or suspends the debt ceiling. Republicans, who will have a majority in the House in the 118th Congress, have threatened to use next year’s debt ceiling negotiations to extract cuts to Social Security and Medicare. Democrats will have to stand firm in the face of GOP pressure and refuse to consider cuts to Americans’ earned benefits.

Q: Is the spending agreement a done deal?

Adcock: The two parties have reached a tentative agreement on top-line numbers, but they still must determine the line item amounts for each federal agency and program in the actual spending bill. There’s also a lot of backroom work that goes into assembling a thousand-plus page bill like this. The congressional leadership are incentivized to finish by the end of next week so that they can head home for the holidays.

NCPSSM President Busts Social Security Myths at Sen. Harkin’s Forum

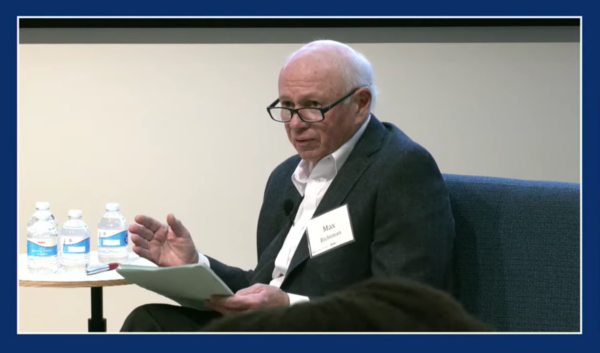

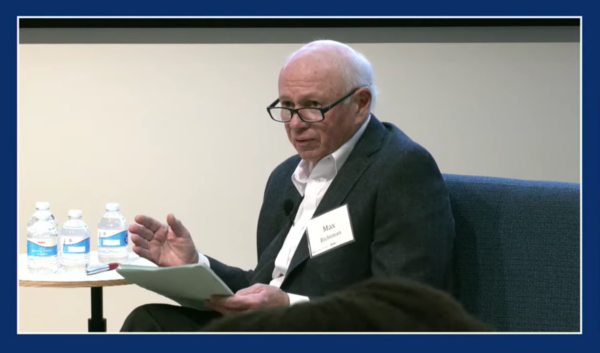

Some of the nation’s leading Social Security experts gathered in Des Moines, IA on Wednesday to discuss the future of a program buffeted by serious financial and political challenges. The forum, Roadmaps to Retirement, was presented by the Harkin Institute at Drake University and moderated by former U.S. Senator Tom Harkin (who also chairs the National Committee to Preserve Social Security and Medicare Advisory Board). NCPSSM President and CEO Max Richtman was among the experts on the panel, which also included Acting SSA Commissioner Kilolo Kijakazi and Assistant U.S. Labor Secretary Taryn Williams, among others.

During the forum, Senator Harkin asked Richtman to debunk several harmful myths which have undermined public perceptions of Social Security over the years – with many of these falsehoods perpetuated by conservative ideologues who have opposed the program from the beginning. Richtman told the audience that one of the most pernicious myths is that Social Security is “bankrupt” or “going broke”:

“While it’s true that the Social Security trust fund will become depleted in 2035 if Congress takes no preventative action, the program is not going bankrupt. Payroll taxes from workers will continue to cover 80% of benefits even if the trust fund is allowed to run dry. The only way Social Security could go “bankrupt” is if we had 100% unemployment and no one was working or paying into the program, which is unlikely to ever happen.” – Max Richtman, 12/7/22

Richtman also debunked the myth that the Social Security trust fund isn’t real — or that it consists of “worthless IOUs.” He explained that the $2.852 trillion in the trust fund is held in special interest-bearing Treasury bonds backed by “the full faith and credit of the United States of America.” He also pushed back on the notion that the government has been “stealing from Social Security” to pay for other expenses, a widespread belief which is patently untrue.

“Unfortunately, some of these myths have taken hold in the public’s mind. Many younger adults have bought into them and are cynical about the future of Social Security. Some young people believe that they are more likely to see Bigfoot or a U.F.O. than a Social Security check when they retire.” – Max Richtman, 12/7/22

Senator Harkin pointed out that, contrary to many younger adults’ perceptions, Social Security not only will be there for them when they retire, but the program provides insurance against disability and the loss of a family breadwinner to millions of young adults right now. In fact, workers have life insurance protection from Social Security worth over $725,000. Meanwhile, for a young disabled worker with a spouse and two children, the disability coverage they get through Social Security Disability Insurance (SSDI) is valued at over $580,000.

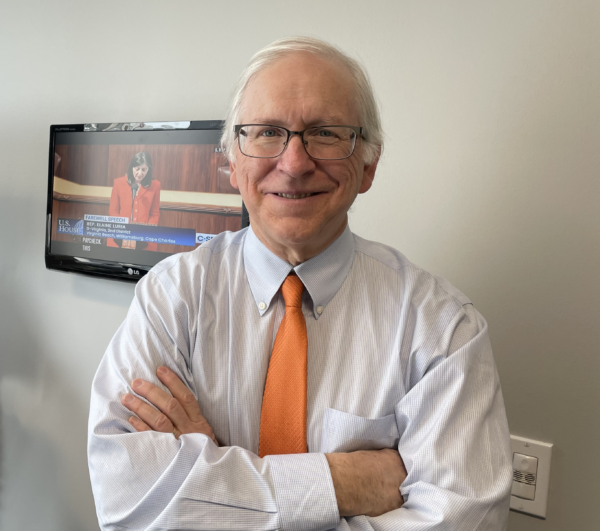

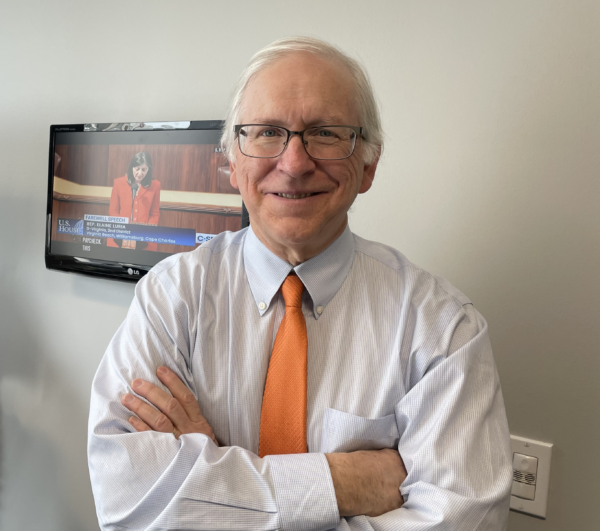

NCPSSM President Max Richtman: “The only way Social Security could go “bankrupt” is if we had 100% unemployment.”

Richtman and Senator Harkin agreed that more outreach to younger adults about Social Security is needed in order to maintain support for the program moving forward. “Hopefully there will be more education for young people as to how it works,” said Harkin. But the genesis of the forum was the Harkin Institute’s concern about financial security for current as well as future retirees. Experts have noted that the ‘three-legged stool’ of retirement security (retirement savings, employer provided pensions, and Social Security) is no longer strong enough for many workers to retire securely — mainly because it’s harder for working people to save for retirement and employers have largely stopped offering pensions.

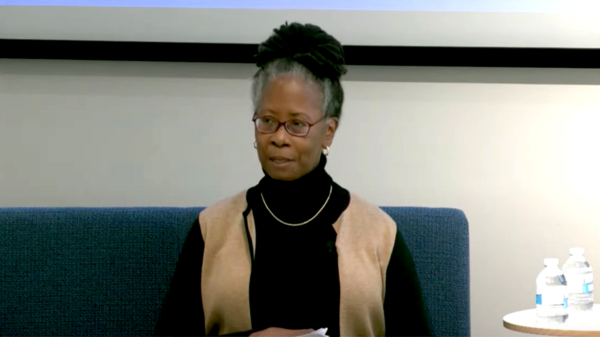

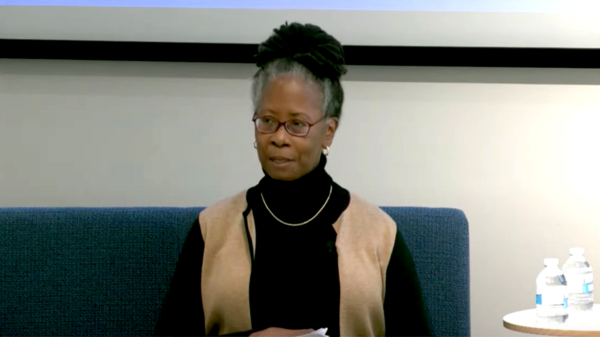

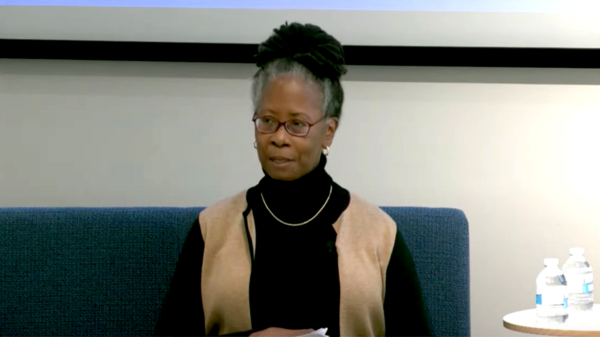

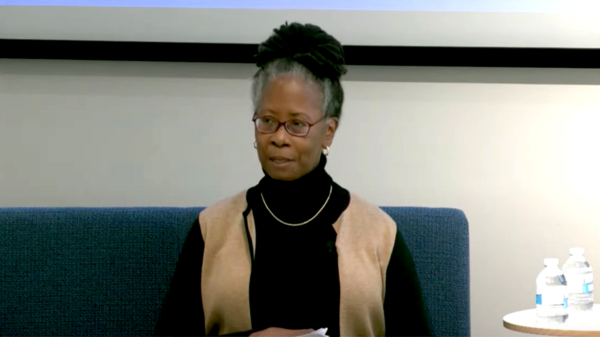

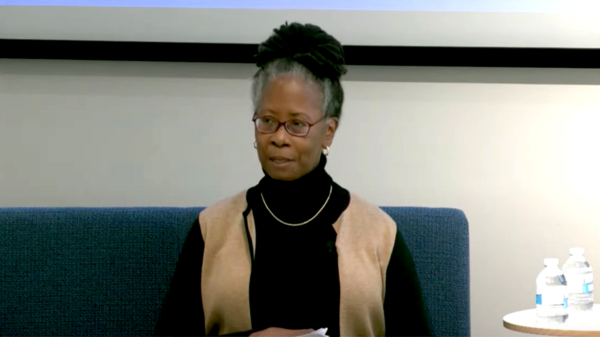

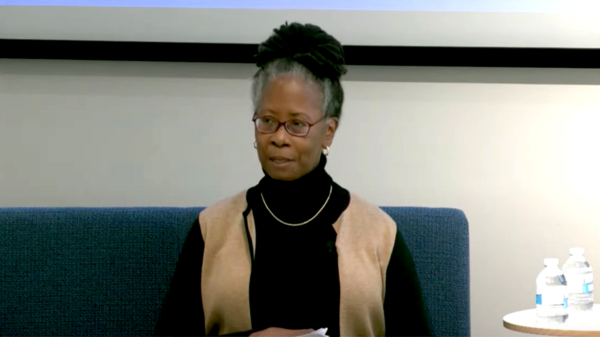

This new reality, says Harkin, makes it even more important to preserve and strengthen Social Security, noting that 40% of Americans aged 65 and over rely on the program for at least half of their total income. Social Security Acting Commissioner Kijakazi pointed out that even higher percentages of women and communities of color depend on Social Security as their main income source. “Social Security was supposed to be a ‘floor’ for retirement income. But it was never intended to be the sole source of retirement income,” says Kijakazi.

Acting Social Security Commissioner Kilolo Kijakazi

Harkin and Richtman called on Congress to strengthen the program and expand benefits to reflect the realities of retiring in America in the 20th century. They both favor adjusting the payroll wage cap (which will be about $160,000 in 2023) so that high earners begin paying their fair share into the system. This measure, which is included in Rep. John Larson’s Social Security 2100 act, would boost the solvency of the trust fund beyond the 2035 depletion date. These proposals are overwhelmingly popular among the public. Senator Harkin cited a survey by the National Academy of Social Insurance (NASI), indicating that 83% of Americans agree it is critical to preserve Social Security benefits for future generations, even if it means increasing taxes paid by wealthier earners.

Acting Commissioner Kijakazi called on lawmakers to shore up Social Security sooner than later. “Congress does need to act to ensure we will be able to pay all benefits beyond 2035,” she said. “And we believe congress will act to take the steps needed to maintain the long-term solvency of the program.”

The Warnock-Walker Runoff Isn’t Just About the Size of the Democrats’ Senate Majority

(photo from www.warnockforgeorgia.com)

While it’s true that a runoff win by Senator Raphael Warnock would give the Democrats a 51-50 majority, there is more at stake for voters – especially seniors. They need Senator Warnock to remain in the Senate to fight for their vital Social Security and Medicare benefits – and to continue advocating for lower prescription drug prices. That’s why the National Committee to Preserve Social Security and Medicare has endorsed Rev. Warnock for re-election as a “champion for seniors.”

He proved this during his first two years in office. Senator Warnock introduced legislation to cap seniors’ out-of-pocket drugs costs at $2,000 per year and limit insulin costs to $35 a month. Both provisions became part of the Inflation Reduction Act, which became law in late summer. He has been a fierce advocate for expanding Medicaid in Georgia, one of the holdout states that has refused to implement coverage for lower-income workers. Expanding Medicaid improves health outcomes for everyone – especially communities of color.

Mindful of the need to boost seniors’ benefits and put Social Security on a sound financial path, Senator Warnock cosponsored the Social Security Expansion Act. During the fall campaign, he pledged to fight GOP efforts to privatize seniors’ earned benefits. Senator Warnock is – and will continue to be – a key defender of Social Security and Medicare.

Perhaps at no other time since the Great Depression have seniors’ earned benefits been so crucial. The pandemic took a heavy toll on seniors – both physically and financially. Before and during this crisis, Social Security and Medicare have functioned as social insurance lifelines, which is, of course, their original purpose.

Without Social Security, the poverty rate in Georgia would be a whopping 44%. For Black and Latino seniors – who are especially reliant on Social Security for income – the poverty rate would approach or exceed 50% without their earned benefits.

Despite the crucial role that Medicare and Social Security play in seniors’ lives, Republicans insist that both programs must be “reformed” – which really means cut and privatized. High-profile members of Herschel Walker’s party, including Sen. Rick Scott (R-FL) and Sen. Ron Johnson (R-WI) have proposed subjecting seniors’ earned benefits to an up or down vote every five years and placing both programs at the mercy of annual budget battles. Herschel Walker campaigned with Sen. Scott in October and would be a rubber stamp for any GOP plans to undermine Social Security and Medicare.

Sen. Rick Scott (L) and Herschel Walker (R)

Republicans have been crystal clear about their intentions. The House Republican Study Committee’s 2022 budget blueprint called for raising the retirement age to 70 (a huge benefit cut), reducing COLAs, and cutting benefits for “high earners,” an odd characterization since the cuts eventually could extend to workers earning $40,000 per year.

Seniors have suffered enough during the pandemic and post-pandemic economy. With inflation running over 7% this year and health care costs soaring, they depend on their Social Security and Medicare benefits now more than ever. Older Georgians need Democrats in Congress to continue fighting for lower prescription drug prices and better access to affordable health care. Voters should reject the pernicious policies of Hershel Walker’s party, which seems to care more about their wealthy and powerful patrons than working people – and re-elect Senator Raphael Warnock.

Bloomberg Analysis Frames Social Security and Medicare as Debt Reduction Issues. That’s Misleading.

Fiscal conservatives continue to promote the narrative that Social Security and Medicare must be “reformed” to reduce the federal debt, which basically means cutting seniors’ earned benefits. The latest foray in this propaganda campaign came in the form of an ‘analysis’ piece from Bloomberg’s Karl W. Smith, published last week in the Washington Post.

“The financial stakes are high. Rapidly rising interest rates means now is the time to act, before the burden of servicing the debt to fund these programs becomes a major barrier to deficit reduction.” – Karl W. Smith, Bloomberg/Washington Post, 11/21/22

The focus on deficits and debt reduction is misleading. Social Security and Medicare Part A are self-funded by workers’ payroll contributions and do not contribute to the debt. In fact, the biggest driver of the federal debt is ‘tax expenditures,’ with the 2017 Trump/GOP tax cuts as a prime example.

But conservatives claiming to be concerned about the debt never object to tax cuts for the wealthy and profitable corporations. Yet, they frame Social Security and Medicare as contributors to the debt and deficit instead of what they are: programs that provide financial and health security for tens of millions of older Americans.

The go-to solution, for Smith and others, is benefit cuts:

“The GOP wants to mitigate these costs by, among other things, raising the eligibility age for Medicare to match the Social Security retirement age, which is 67 for those born after 1960. In addition, Republicans would reduce Social Security benefits for those whose income was on the high end over their lifetimes and raise premiums for Medicare beneficiaries with higher incomes.” – Karl W. Smith, Bloomberg/Washington Post, 11/21/22

Raising the eligibility age for Medicare would leave tens of millions of seniors without insurance. (Republicans have also proposed changing the Social Security full retirement age from 67 to 70.) These are benefit reductions, plain and simple. Meanwhile, means testing Social Security in the way that Smith suggests would change the fundamental nature of the program, which has been working just fine for more than 80 years as a compact between workers and the federal government. In fact, a recent means testing proposal would have reduced Social Security benefits for people with average annual earnings of only $49,000.

It’s true that Social Security and Medicare face financing challenges that Congress must address. The Social Security Trustees project that, absent congressional action, the old age and disability trust fund will become depleted in 2035, with the Medicare Part A trust fund at risk of running out in 2028. Democrats have proposed (and in the case of Medicare, enacted) legislation to bring more revenue into both programs. But most Republicans refuse to consider revenue-based solutions, preferring to cut benefits. (Key members of the GOP proposed several drastic measures that would undermine Social Security and Medicare during the mid-term campaign season.)

Exhortations to cut benefits are part of a well-funded, right-leaning ideological movement to oppose government social programs, no matter how successful or popular. Not surprisingly, the author of the Bloomberg/Post analysis is previous Vice President of the Tax Foundation, whose “major funders include the conservative Koch Family Foundation and the foundation of the late Richard Scaife, a billionaire known as ‘the funding father of the right,’” according to Mother Jones.

Smith observes that “Republicans hoped that Americans would deliver a clear repudiation of President Biden’s economic policies when they went to the polls (in November).” But those hopes were dashed. Instead, voters in many states and districts rejected Republican, supply-side economics. Members of Congress would be wiser to listen to the voters – who support Social Security and Medicare by large, bipartisan majorities – than to columnists who preach austerity for the programs that protect our most vulnerable citizens.

McCarthy Speakership Battle May Cost Seniors in the Long Run

Kevin McCarthy’s battle for the House speakership made for compelling political theater this week, but it could have dramatic implications for America’s seniors. According to news reports, McCarthy (R-CA) made concessions to holdout House members that would empower right-wingers in Congress who want to slash Social Security and Medicare — in order to fulfill his personal ambition to become Speaker.

CNN’s Manu Raju reported Friday afternoon that McCarthy agreed to demands from Freedom Caucus members regarding upcoming debt ceiling negotiations. In the putative deal, McCarthy reportedly has pledged not to raise the debt ceiling (so that the federal government can pay its existing obligations) without concessions on spending from Democrats and the White House on domestic programs.

If this reporting is accurate, it means that McCarthy has effectively agreed to risk a U.S. government default on its financial obligations (and the financial chaos that would ensue) in order to force cuts to Social Security, Medicare, and other safety net programs — despite the fact that these programs are incredibly popular and vital to the well-being of American seniors. (Not to mention that lifting the debt ceiling is essential for the U.S. to pay its existing bills.)

This scorched-earth strategy, which one CNN analyst characterized as “taking us to the brink of destruction,” is not what voters demanded in the 2022 elections. In fact, in denying Republicans an anticipated “Red Wave” last fall, the electorate clearly rejected MAGA extremism and MAGA-nomics.

Nevertheless, a small cadre of right-wing Freedom Caucus members are the ‘tail wagging the dog’ in McCarthy’s bid for the speakership. These extremists oppose spending on social programs no matter how important or popular those may be. (One commentator rightly branded them as “nihilists” who don’t believe in a functional federal government.)

We have seen this before. In 2011, Tea Party members instigated a battle over the debt ceiling that resulted in harmful caps on domestic spending that haunt us to this day. “I was around in 2011,” said former Obama advisor David Axelrod on CNN today, “and I remember that Republicans took us to the precipice of what would have been a catastrophe,” by risking a federal default on its financial obligations.

Rep. Chip Roy (R-TX) helped negotiate concessions from Kevin McCarthy

Beyond the debt ceiling maneuverings, Freedom Caucus members reportedly are wringing other concessions from McCarthy in return for their votes that also could be devastating for older Americans. These include rule changes that could make it harder to raise revenue and easier to cut spending on social programs.

The hard right would get approval power over some plum committee assignments, including a third of the members on the influential Rules Committee, which controls what legislation reaches the floor and in what form. And spending bills would have to be considered under so-called open rules, allowing any member to put to a vote an unlimited number of changes that could gut or scuttle the legislation altogether. – New York Times, 1/6/23

“That does not bode well for programs like Social Security and Medicare that are going to need an infusion of revenue,” says Maria Freese, policy advisor here at NCPSSM. “The new rules would make it easier for House Republicans to keep cutting taxes for the wealthy while gutting programs that everyday Americans depend on.”

If Kevin McCarthy does prevail (which as of Friday afternoon looks increasingly likely) and achieves his years-long dream of being House Speaker, seniors will be among those everyday Americans paying the price.

Does New Hill Spending Deal Affect Social Security & Medicare?

Congressional negotiators have avoided a government shutdown by reaching a compromise agreement on federal spending for the remainder of FY 2023. The Hill newspaper reported that lawmakers had “reached a bipartisan, bicameral framework that should allow them to finish an omnibus appropriations bill that can pass the House and Senate and be signed into law by the President.’” We spoke to NCPSSM legislative director Dan Adcock about the spending deal and whether it impacts Social Security and Medicare.

Q: What basically happened here?

Adcock: Republicans and Democrats were able to forestall a government shutdown that would have been triggered on Friday had they failed to agree on spending for the remainder of FY 2023. Late yesterday the two parties arrived at a compromise agreement on appropriations for the rest of the fiscal year, which began on October 1, 2022. The result will be an “Omnibus” spending bill because it combines all congressional appropriations into a single piece of legislation.

Q: Does this process affect Social Security and Medicare benefits?

Adcock: Not directly. Social Security and Medicare are considered “mandatory spending,” and are funded according to the laws that created them. They are not part of the annual appropriations process. What Congress is wrangling over now is called “discretionary spending,” which goes toward the day to day operation of the federal government. On the other hand, if there had been a government shutdown, Social Security Administration customer service could have been disrupted.

Q: What about funding for the Social Security Administration?

Adcock: Funding for SSA is, indeed, part of the annual appropriations process. We have urged Congress to appropriate $14.8 billion for Fiscal Year 2023, which is the level that President Biden requested in his budget. SSA badly needs these funds in order to improve customer service after more than a decade of budget cuts – and to work through the huge backlog in disability claims that built up during the pandemic.

Q: The current process is different than the debt ceiling negotiations, right?

Adcock: Yes. This week’s negotiations were about agreeing on appropriations to fund the daily operations of the government and avoid a shutdown. The debt ceiling issue is separate. Sometime during 2023 (most likely during the 3rd quarter), the federal government will have exhausted its ability to borrow money to meet its financial obligations — unless Congress raises or suspends the debt ceiling. Republicans, who will have a majority in the House in the 118th Congress, have threatened to use next year’s debt ceiling negotiations to extract cuts to Social Security and Medicare. Democrats will have to stand firm in the face of GOP pressure and refuse to consider cuts to Americans’ earned benefits.

Q: Is the spending agreement a done deal?

Adcock: The two parties have reached a tentative agreement on top-line numbers, but they still must determine the line item amounts for each federal agency and program in the actual spending bill. There’s also a lot of backroom work that goes into assembling a thousand-plus page bill like this. The congressional leadership are incentivized to finish by the end of next week so that they can head home for the holidays.

NCPSSM President Busts Social Security Myths at Sen. Harkin’s Forum

Some of the nation’s leading Social Security experts gathered in Des Moines, IA on Wednesday to discuss the future of a program buffeted by serious financial and political challenges. The forum, Roadmaps to Retirement, was presented by the Harkin Institute at Drake University and moderated by former U.S. Senator Tom Harkin (who also chairs the National Committee to Preserve Social Security and Medicare Advisory Board). NCPSSM President and CEO Max Richtman was among the experts on the panel, which also included Acting SSA Commissioner Kilolo Kijakazi and Assistant U.S. Labor Secretary Taryn Williams, among others.

During the forum, Senator Harkin asked Richtman to debunk several harmful myths which have undermined public perceptions of Social Security over the years – with many of these falsehoods perpetuated by conservative ideologues who have opposed the program from the beginning. Richtman told the audience that one of the most pernicious myths is that Social Security is “bankrupt” or “going broke”:

“While it’s true that the Social Security trust fund will become depleted in 2035 if Congress takes no preventative action, the program is not going bankrupt. Payroll taxes from workers will continue to cover 80% of benefits even if the trust fund is allowed to run dry. The only way Social Security could go “bankrupt” is if we had 100% unemployment and no one was working or paying into the program, which is unlikely to ever happen.” – Max Richtman, 12/7/22

Richtman also debunked the myth that the Social Security trust fund isn’t real — or that it consists of “worthless IOUs.” He explained that the $2.852 trillion in the trust fund is held in special interest-bearing Treasury bonds backed by “the full faith and credit of the United States of America.” He also pushed back on the notion that the government has been “stealing from Social Security” to pay for other expenses, a widespread belief which is patently untrue.

“Unfortunately, some of these myths have taken hold in the public’s mind. Many younger adults have bought into them and are cynical about the future of Social Security. Some young people believe that they are more likely to see Bigfoot or a U.F.O. than a Social Security check when they retire.” – Max Richtman, 12/7/22

Senator Harkin pointed out that, contrary to many younger adults’ perceptions, Social Security not only will be there for them when they retire, but the program provides insurance against disability and the loss of a family breadwinner to millions of young adults right now. In fact, workers have life insurance protection from Social Security worth over $725,000. Meanwhile, for a young disabled worker with a spouse and two children, the disability coverage they get through Social Security Disability Insurance (SSDI) is valued at over $580,000.

NCPSSM President Max Richtman: “The only way Social Security could go “bankrupt” is if we had 100% unemployment.”

Richtman and Senator Harkin agreed that more outreach to younger adults about Social Security is needed in order to maintain support for the program moving forward. “Hopefully there will be more education for young people as to how it works,” said Harkin. But the genesis of the forum was the Harkin Institute’s concern about financial security for current as well as future retirees. Experts have noted that the ‘three-legged stool’ of retirement security (retirement savings, employer provided pensions, and Social Security) is no longer strong enough for many workers to retire securely — mainly because it’s harder for working people to save for retirement and employers have largely stopped offering pensions.

This new reality, says Harkin, makes it even more important to preserve and strengthen Social Security, noting that 40% of Americans aged 65 and over rely on the program for at least half of their total income. Social Security Acting Commissioner Kijakazi pointed out that even higher percentages of women and communities of color depend on Social Security as their main income source. “Social Security was supposed to be a ‘floor’ for retirement income. But it was never intended to be the sole source of retirement income,” says Kijakazi.

Acting Social Security Commissioner Kilolo Kijakazi

Harkin and Richtman called on Congress to strengthen the program and expand benefits to reflect the realities of retiring in America in the 20th century. They both favor adjusting the payroll wage cap (which will be about $160,000 in 2023) so that high earners begin paying their fair share into the system. This measure, which is included in Rep. John Larson’s Social Security 2100 act, would boost the solvency of the trust fund beyond the 2035 depletion date. These proposals are overwhelmingly popular among the public. Senator Harkin cited a survey by the National Academy of Social Insurance (NASI), indicating that 83% of Americans agree it is critical to preserve Social Security benefits for future generations, even if it means increasing taxes paid by wealthier earners.

Acting Commissioner Kijakazi called on lawmakers to shore up Social Security sooner than later. “Congress does need to act to ensure we will be able to pay all benefits beyond 2035,” she said. “And we believe congress will act to take the steps needed to maintain the long-term solvency of the program.”

The Warnock-Walker Runoff Isn’t Just About the Size of the Democrats’ Senate Majority

(photo from www.warnockforgeorgia.com)

While it’s true that a runoff win by Senator Raphael Warnock would give the Democrats a 51-50 majority, there is more at stake for voters – especially seniors. They need Senator Warnock to remain in the Senate to fight for their vital Social Security and Medicare benefits – and to continue advocating for lower prescription drug prices. That’s why the National Committee to Preserve Social Security and Medicare has endorsed Rev. Warnock for re-election as a “champion for seniors.”

He proved this during his first two years in office. Senator Warnock introduced legislation to cap seniors’ out-of-pocket drugs costs at $2,000 per year and limit insulin costs to $35 a month. Both provisions became part of the Inflation Reduction Act, which became law in late summer. He has been a fierce advocate for expanding Medicaid in Georgia, one of the holdout states that has refused to implement coverage for lower-income workers. Expanding Medicaid improves health outcomes for everyone – especially communities of color.

Mindful of the need to boost seniors’ benefits and put Social Security on a sound financial path, Senator Warnock cosponsored the Social Security Expansion Act. During the fall campaign, he pledged to fight GOP efforts to privatize seniors’ earned benefits. Senator Warnock is – and will continue to be – a key defender of Social Security and Medicare.

Perhaps at no other time since the Great Depression have seniors’ earned benefits been so crucial. The pandemic took a heavy toll on seniors – both physically and financially. Before and during this crisis, Social Security and Medicare have functioned as social insurance lifelines, which is, of course, their original purpose.

Without Social Security, the poverty rate in Georgia would be a whopping 44%. For Black and Latino seniors – who are especially reliant on Social Security for income – the poverty rate would approach or exceed 50% without their earned benefits.

Despite the crucial role that Medicare and Social Security play in seniors’ lives, Republicans insist that both programs must be “reformed” – which really means cut and privatized. High-profile members of Herschel Walker’s party, including Sen. Rick Scott (R-FL) and Sen. Ron Johnson (R-WI) have proposed subjecting seniors’ earned benefits to an up or down vote every five years and placing both programs at the mercy of annual budget battles. Herschel Walker campaigned with Sen. Scott in October and would be a rubber stamp for any GOP plans to undermine Social Security and Medicare.

Sen. Rick Scott (L) and Herschel Walker (R)

Republicans have been crystal clear about their intentions. The House Republican Study Committee’s 2022 budget blueprint called for raising the retirement age to 70 (a huge benefit cut), reducing COLAs, and cutting benefits for “high earners,” an odd characterization since the cuts eventually could extend to workers earning $40,000 per year.

Seniors have suffered enough during the pandemic and post-pandemic economy. With inflation running over 7% this year and health care costs soaring, they depend on their Social Security and Medicare benefits now more than ever. Older Georgians need Democrats in Congress to continue fighting for lower prescription drug prices and better access to affordable health care. Voters should reject the pernicious policies of Hershel Walker’s party, which seems to care more about their wealthy and powerful patrons than working people – and re-elect Senator Raphael Warnock.

Bloomberg Analysis Frames Social Security and Medicare as Debt Reduction Issues. That’s Misleading.

Fiscal conservatives continue to promote the narrative that Social Security and Medicare must be “reformed” to reduce the federal debt, which basically means cutting seniors’ earned benefits. The latest foray in this propaganda campaign came in the form of an ‘analysis’ piece from Bloomberg’s Karl W. Smith, published last week in the Washington Post.

“The financial stakes are high. Rapidly rising interest rates means now is the time to act, before the burden of servicing the debt to fund these programs becomes a major barrier to deficit reduction.” – Karl W. Smith, Bloomberg/Washington Post, 11/21/22

The focus on deficits and debt reduction is misleading. Social Security and Medicare Part A are self-funded by workers’ payroll contributions and do not contribute to the debt. In fact, the biggest driver of the federal debt is ‘tax expenditures,’ with the 2017 Trump/GOP tax cuts as a prime example.

But conservatives claiming to be concerned about the debt never object to tax cuts for the wealthy and profitable corporations. Yet, they frame Social Security and Medicare as contributors to the debt and deficit instead of what they are: programs that provide financial and health security for tens of millions of older Americans.

The go-to solution, for Smith and others, is benefit cuts:

“The GOP wants to mitigate these costs by, among other things, raising the eligibility age for Medicare to match the Social Security retirement age, which is 67 for those born after 1960. In addition, Republicans would reduce Social Security benefits for those whose income was on the high end over their lifetimes and raise premiums for Medicare beneficiaries with higher incomes.” – Karl W. Smith, Bloomberg/Washington Post, 11/21/22

Raising the eligibility age for Medicare would leave tens of millions of seniors without insurance. (Republicans have also proposed changing the Social Security full retirement age from 67 to 70.) These are benefit reductions, plain and simple. Meanwhile, means testing Social Security in the way that Smith suggests would change the fundamental nature of the program, which has been working just fine for more than 80 years as a compact between workers and the federal government. In fact, a recent means testing proposal would have reduced Social Security benefits for people with average annual earnings of only $49,000.

It’s true that Social Security and Medicare face financing challenges that Congress must address. The Social Security Trustees project that, absent congressional action, the old age and disability trust fund will become depleted in 2035, with the Medicare Part A trust fund at risk of running out in 2028. Democrats have proposed (and in the case of Medicare, enacted) legislation to bring more revenue into both programs. But most Republicans refuse to consider revenue-based solutions, preferring to cut benefits. (Key members of the GOP proposed several drastic measures that would undermine Social Security and Medicare during the mid-term campaign season.)

Exhortations to cut benefits are part of a well-funded, right-leaning ideological movement to oppose government social programs, no matter how successful or popular. Not surprisingly, the author of the Bloomberg/Post analysis is previous Vice President of the Tax Foundation, whose “major funders include the conservative Koch Family Foundation and the foundation of the late Richard Scaife, a billionaire known as ‘the funding father of the right,’” according to Mother Jones.

Smith observes that “Republicans hoped that Americans would deliver a clear repudiation of President Biden’s economic policies when they went to the polls (in November).” But those hopes were dashed. Instead, voters in many states and districts rejected Republican, supply-side economics. Members of Congress would be wiser to listen to the voters – who support Social Security and Medicare by large, bipartisan majorities – than to columnists who preach austerity for the programs that protect our most vulnerable citizens.